CryptoSlate wMarket Update: Litecoin re-enters top 10 amid wider market weakness

CryptoSlate wMarket Update: Litecoin re-enters top 10 amid wider market weakness CryptoSlate wMarket Update: Litecoin re-enters top 10 amid wider market weakness

The wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

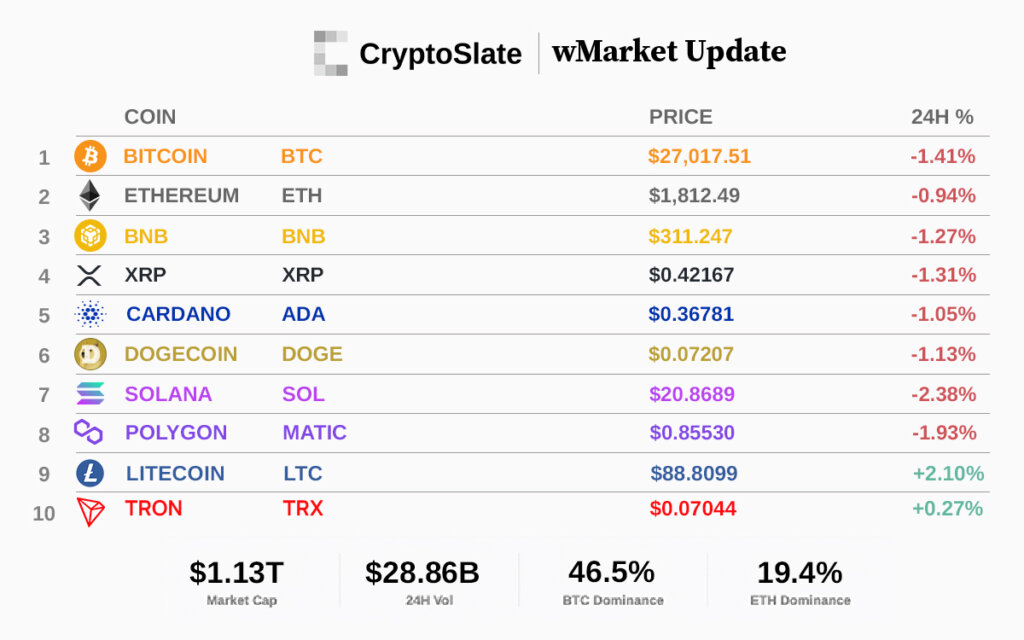

The cryptocurrency market saw net outflows of $17.6 billion over the last 24 hours and currently stands at $1.13 trillion — down 1.5% from $1.14 trillion.

During the reporting period, the Bitcoin (BTC) and Ethereum (ETH) market caps fell 1.4% and 1% to $523.55 billion and $218.09 billion, respectively.

Most of the top 10 crypto assets posted losses over the last 24 hours except TRON, up 0.3%, and Litecoin, gaining 2.1% to re-enter the top 10, ousting Polkadot. The biggest losers were Solana and Polygon, down 2.4% and 1.9%, respectively.

The market cap of Tether (USDT) grew to $82.84 billion. In contrast, USD Coin (USDC) and Binance USD (BUSD) fell to $29.80 billion and $5.56 billion, respectively.

Bitcoin

In the last 24 hours, Bitcoin fell 1.4% to trade at $27,018 as of 07:00 ET. Its market dominance stayed flat at 46.5%.

During the reporting period, BTC hit a peak price of $27,660 before trending down to find support at $26,860 by Monday evening (ET). A muted recovery topped at $27,250, leading to a further spill.

Ethereum

In the last 24 hours, Ethereum decreased 1% to trade at $1,812 as of 07:00 ET. Its market dominance fell to 19.4% from 19.7%.

Over the reporting period, ETH’s price followed BTC, reaching a $1,846 top shortly after midday Monday (ET) before bears dipped as low as $1,796. The subsequent recovery lost steam at $1,828, leading to further selling.

Top 5 Gainers

MiL.k

MLK is the day’s biggest gainer, growing 14.4% over the last 24 hours to $0.38392 as of press time. The project has yet to tweet since April 18. Its market cap stood at $108.66 million.

DAO Maker

DAO jumped 11.9% to $1.57356 over the last 24 hours. The project recently unveiled Tenet – an upcoming layer 1 chain. Its market cap stood at $226.5 million.

HEX

HEX grew 9.7% over the last 24 hours to $0.03487 as of press time. The PulseChain mainnet launched on May 13. The current activity is focused on bridging assets to the new chain. Its market cap stood at $6.05 billion.

Conflux Network

CFX rose 9% to $0.31291 as of press time. The token was a top gainer yesterday off recent interest in Conflux incubated project – Flux Fire. It was announced today that Mold Finance would migrate to the Conflux ecosystem. Its market cap stood at $900.91 million.

Ontology

ONT gained 7.7% to trade at $0.21919 at the time of writing. Node API firm GetBlock has partnered with Ontology. Its market cap stood at $191.84 million.

Top 5 Losers

Open Campus

EDU is the day’s biggest loser falling 10.1% to $1.18428 at the time of writing. The project announced a $10 million global educators fund for content creation grants. The token was yesterday’s top gainer. Its market cap stood at $171.86 million.

Telcoin

TEL dropped 9% to trade at $0.00172. The mobile payment platform said USDC deposits and EUR withdrawals are now available. Its market cap stood at $115.41 million.

OriginTrail

TRAC plunged 8.4% to trade at $0.26243 as of press time. The team hosted a special tech AMA on May 15. Its market cap stood at $103.29 million.

XinFin

XDC lost 6.9% to $0.03138 over the reporting period. Its market cap stood at $434.19 million.

UMA

UMA fell 6.5% to $2.20875 over the reporting period. UMA’s optimistic oracle was deployed on Coinbase’s layer 2 project Base. Its market cap stood at $157.49 million.

Disclaimer: CryptoSlate has received a grant from the Polkadot Foundation to produce content about the Polkadot ecosystem. While the Foundation supports our coverage, we maintain full editorial independence and control over the content we publish.

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  MiL.k

MiL.k  DAO Maker

DAO Maker  HEX

HEX  Conflux Network

Conflux Network  Ontology

Ontology  Open Campus

Open Campus  Telcoin

Telcoin  OriginTrail

OriginTrail  XDC Network

XDC Network  UMA

UMA