CryptoSlate Daily wMarket Update: Market sell-off sees Bitcoin sink to $22,000

CryptoSlate Daily wMarket Update: Market sell-off sees Bitcoin sink to $22,000 CryptoSlate Daily wMarket Update: Market sell-off sees Bitcoin sink to $22,000

The wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

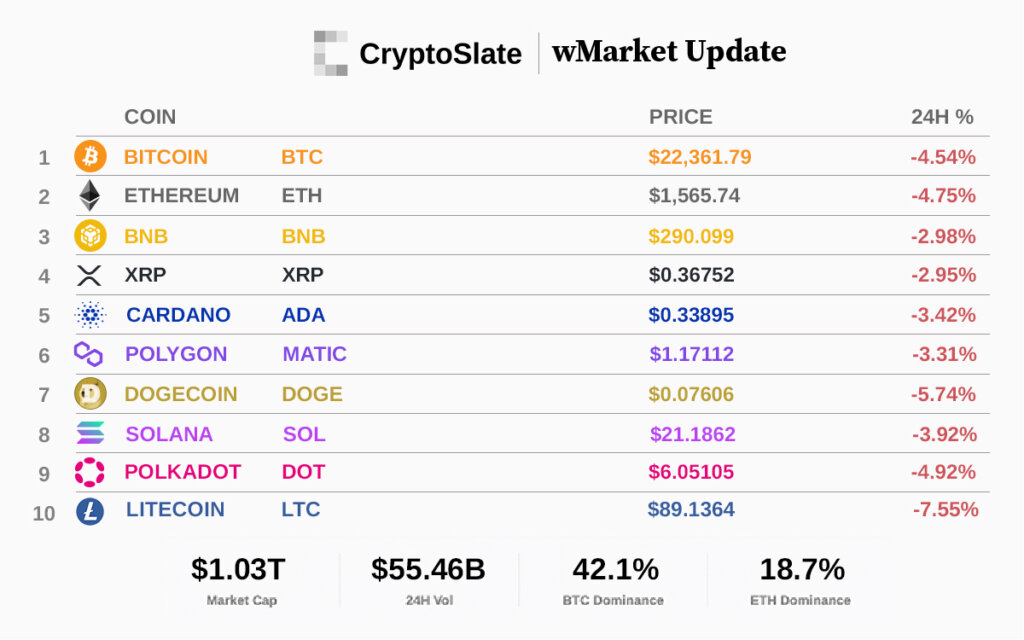

The cryptocurrency market cap saw net outflows of $40.2 billion over the last 24 hours and currently stands at $1.03 trillion — down 3.7% from $1.07 trillion.

Over the reporting period, Bitcoin and Ethereum’s market cap fell 4.5% and 4.8% to $431.98 billion and $191.66 billion, respectively.

The top 10 crypto assets recorded losses since the last report, with Litecoin losing 7.6% in value, followed by Dogecoin, down 5.7%. XRP fared best, falling 3%.

In the last 24 hours, the market caps of Tether (USDT) and USD Coin (USDC) increased to $71.12 billion and $43.14 billion, respectively. Meanwhile, Binance USD (BUSD) fell 4.7% to $9.61 billion.

Bitcoin

In the last 24 hours, Bitcoin decreased 4.5% to trade at $22,362 as of 07:00 ET. Its market dominance was 42.1%.

Over the reporting period, BTC topped out at $23,569. A sharp spill occurred on Thursday evening that found support at $21,998. The leading cryptocurrency has since been ranging between $22,137 and $22,476.

Ethereum

Over the last 24 hours, Ethereum fell 4.8% to trade at $1,566 as of 07:00 ET. Its market dominance was 18.7%.

ETH’s price performance mirrored BTC, peaking at $1,658 before experiencing a significant sell-off that bottomed at $1,550. A weak bounce topped out at $1,577, leading to a flat trading pattern.

Top 5 Gainers

RSK Infrastructure Framework

RIF is the day’s biggest gainer, rising 13.4% over the reporting period to $0.19715 as of press time. The project recently announced accelerating DeFi adoption on Bitcoin in conjunction with Rootstock. Its market cap stood at $186.64 million.

ssv.network

SSV increased 10.7% in the last 24 hours to trade at $43.9275 as of press time. The staking infrastructure protocol was in attendance at DenverETH. Its market cap stood at $439.28 million.

DAO Maker

DAO is up 8% to trade at $1.60079 as of press time. Its market cap stood at $230.42 million.

yearn.finance

YFI gained 7.7% in the last 24 hours to trade at $10,833.22. The project recently teased an ETH liquid staking product. Its market cap stood at $396.9 million.

EOS

EOS jumped 7.9% to $1.26659 as of press time. The EOS Foundation announced several developments, including improvements to governance and plans to evolve into an autonomous network. Its market cap stood at $1.37 billion.

Top 5 Losers

dXdY

DYDX is the day’s biggest loser, falling 13.9% to trade at $2.65566 at the time of writing. Its market cap stood at $414.96 million.

BinaryX

BNX lost 12.3% to $0.88506 as of press time. The project recently implemented a token swap and revaluation plan. Its market cap stood at $255.89 million.

FTX Token

FTX dumped 12.2% to $1.27624 in the last 24 hours. CEO John Ray disclosed an $8.9 billion hole in meeting customer liabilities. Its market cap stood at $419.75 million.

Synapse

SYN shed 12.2% in the last 24 hours to trade at $1.10117. Its market cap stood at $153.91 million.

Terra Classic

LUNC fell 12.1% to $0.00015 over the reporting period. Binance recently announced it would burn 50% of its LUNC spot and margin trading fees instead of 100%. Its market cap stood at $898.42 million.

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  RSK Infrastructure Framework

RSK Infrastructure Framework  ssv.network

ssv.network  DAO Maker

DAO Maker  yearn.finance

yearn.finance  EOS

EOS  dYdX (Native)

dYdX (Native)  BinaryX

BinaryX  Terra Classic

Terra Classic  FTX Token

FTX Token  Synapse

Synapse