Crypto’s utility driving adoption in Sub-saharan Africa – Chainalysis

Crypto’s utility driving adoption in Sub-saharan Africa – Chainalysis Crypto’s utility driving adoption in Sub-saharan Africa – Chainalysis

Sub-saharan Africa has the lowest crypto transfer volume but it has the highest number of small retail payments and use of P2P exchanges.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Sub-saharan Africa recorded $100.6 billion worth of crypto transactions on-chain between July 2021 and June 2022, according to a Chainalysis report.

While it represented a growth of 16% year-over-year, it accounted for only 2% of global crypto transactions — the lowest in the world.

However, the latest Chainalysis report indicates that the region has some of the most well-developed crypto markets, with:

“Deep penetration and integration of cryptocurrency into everyday financial activity.”

Leader in small retail crypto transactions

In Sub-saharan Africa, retail crypto transfers account for 95% of all crypto-related transactions in the region, according to the report.

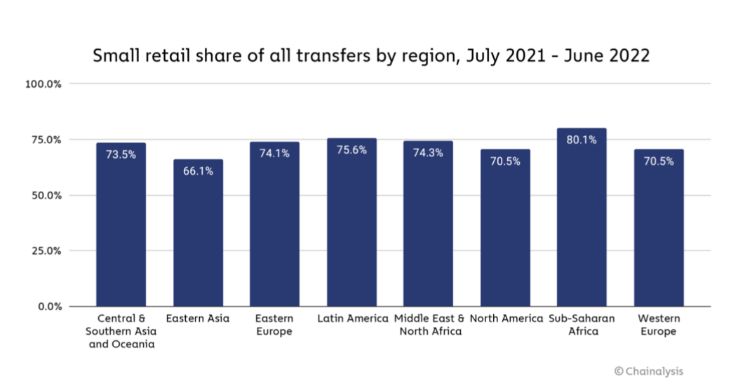

Small retail transfers of less than $1,000 made up for 80% of crypto transactions between July 2021 and June 2022, more than any other region in the world. Comparatively, the share of small retail crypto transfers in North America stood at 70.5% during the same period.

Nigerian blockchain consultancy and product studio Convexity founder Adedeji Owonibi told Chainalysis that Sub-saharan Africa does not have institutional crypto investors. Instead, the region’s crypto market is driven by retail usage, where daily traders try to earn a living amid high unemployment rates. He added:

“It [crypto] is a way to feed their family and solve their daily financial needs.”

Therefore, the adoption of cryptocurrencies is being driven by necessity in Sub-saharan Africa. This is why the number of small retail transactions in the region grew when the bear market started in May 2022, according to Chainalysis data.

The report further stated that the fluctuating value of fiat currencies of some countries in the region — such as Kenya and Nigeria — provide further incentive to trade cryptocurrencies, especially stablecoins. Many investors in the region have turned to stablecoins to maintain their savings amid the volatility of local currencies.

Peer-to-peer trading is the key

According to the Chainalysis report, P2P exchanges account for 6% of all crypto transactions in the region.

Anti-crypto regulations, like Nigeria banning banks from interacting with crypto businesses in 2021, have caused more and more people to turn to P2P trades.

Furthermore, P2P trading is not only limited to P2P exchanges in the region like Paxful, whose customers grew 55% year-over-year in Nigeria.

According to the report, crypto traders in the region also carry out private trades via groups on social media platforms like WhatsApp and Telegram.

Crypto for remittances and international business payments

The Sub-saharan region has thousands of payment systems with no interoperability or communication with each other.

Sending a payment to a country in the region can be extremely expensive compared to crypto.

Businesses in the region with international suppliers also use crypto to make payments.