Compound users now supplying over $1 billion in ETH assets; COMP a top-25 altcoin

Compound users now supplying over $1 billion in ETH assets; COMP a top-25 altcoin Compound users now supplying over $1 billion in ETH assets; COMP a top-25 altcoin

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Compound’s meteoric rise in the crypto-space is coupled with the rise of DeFi tokens and retail traders chasing the next moonshot.

COMP, Compound’s native token, rose over 600 percent from a listing price of $61 to over $350 on June 21, before steadily falling to its current $195 level.

At press time, COMP is a top-25 altcoin, while the value of total assets locked in Compound exceeds $1.5 billion across supply and burrow pools.

Compound locks $1 billion

Compound touts itself as a decentralized lending pool and automated market maker, which in layman’s terms, means one can put up their crypto holdings for other traders to burrow and make money off — paying the lender a fee in return.

This is similar to how banks operate. Yearly interest—oft in the range of 2-5 percent—is generated when an account holder’s money to shipped off in the banks’ name to loan seekers. The fees they pay are then siphoned to holder accounts, with banks taking a cut.

While Compound is not a bank, provides a decentralized platform for lending and borrowing crypto assets. The interest rates are variable and fluctuate based on the supply and demand of the individual assets.

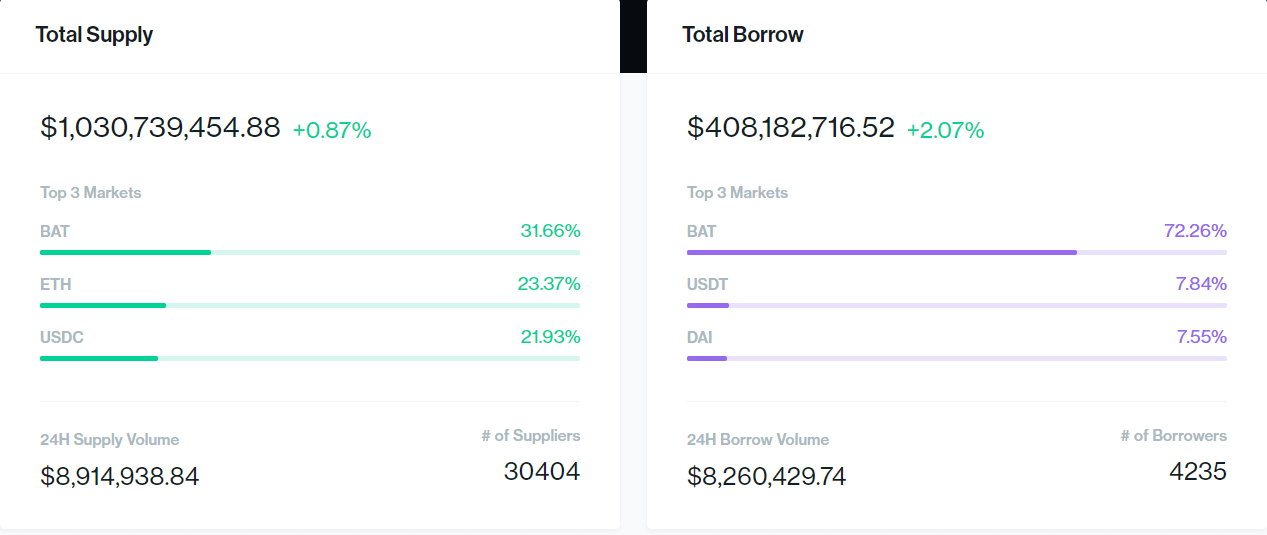

And the community seems to have taken a liking. Total assets locked on Compound crossed over $1 billion last week and has gained another 30 million since. The snapshot below shows:

Of that pool, Brave’s BAT token emerges as the top-choice pool token. Gross supply is over $326 million, with suppliers earning 14 percent and borrowers paying 33 percent APR.

However, there are concerns about how BAT holdings and distributions are calculated. As CryptoSlate reported yesterday, a Compound pool voted for a new distribution system as concerns of illiquid and propped-up holdings rose, meaning BAT might not hold its position for long.

COMP token surges, but there are concerns

Each day, over 2,880 COMP are distributed to users of the protocol; the distribution is allocated to each market (ETH, USDC, DAI), proportional to the interest being accrued in that market, notes Compound.

The token is traded mainly on DEXs like UniSwap, but last week saw mega-listings on Coinbase and FTX. The latter could have catalyzed COMP’s surge to $350.

Yesterday, Korea’s OKEx listed the COMP token — possibly opening the gates for the second round of retail interest as the country’s rides on the DeFi mania.

Meanwhile, not all are convinced with how Compound, and the broader DeFi market, is shaping up. This cohort includes Ethereum co-founder Vitalik Buterin, who has chimed in the crypto community’s fascination with “yield farming” in recent times:

Honestly I think we emphasize flashy defi things that give you fancy high interest rates way too much. Interest rates significantly higher than what you can get in traditional finance are inherently either temporary arbitrage opportunities or come with unstated risks attached.

— vitalik.eth (@VitalikButerin) June 20, 2020

Compound Market Data

At the time of press 11:33 pm UTC on Jul. 2, 2020, Compound is ranked #27 by market cap and the price is down 8.65% over the past 24 hours. Compound has a market capitalization of $475.63 million with a 24-hour trading volume of $238.8 million. Learn more about Compound ›

Crypto Market Summary

At the time of press 11:33 pm UTC on Jul. 2, 2020, the total crypto market is valued at at $260.93 billion with a 24-hour volume of $58.6 billion. Bitcoin dominance is currently at 64.34%. Learn more about the crypto market ›