Coinbase CEO sells shares prior to SEC warning

Coinbase CEO sells shares prior to SEC warning Coinbase CEO sells shares prior to SEC warning

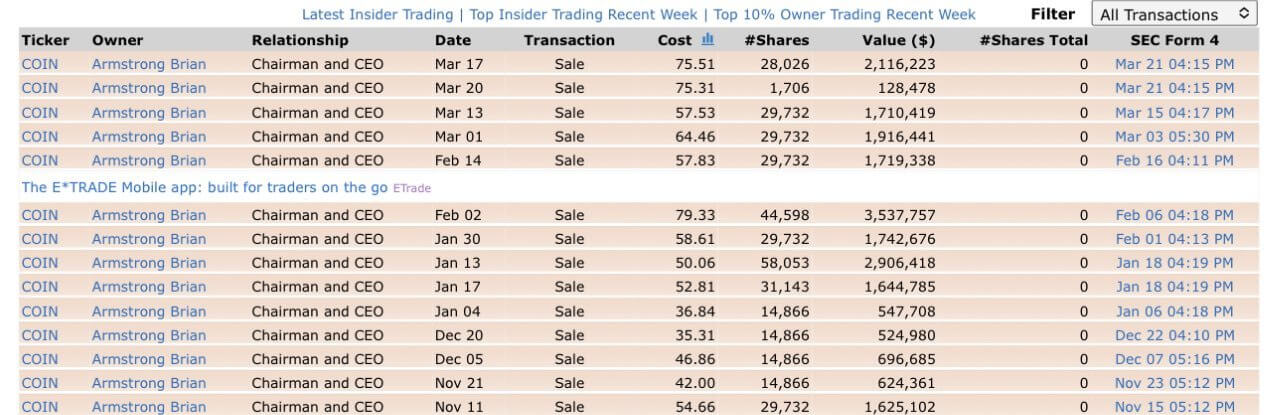

Brian Armstrong issued three transactions to sell Coinbase shares on March 15 and 21, according to recent data.

TechCrunch / CC BY 2.0 / Wikimedia. Remixed by CryptoSlate

Coinbase CEO Brian Armstrong sold Coinbase shares prior to receiving a warning from the Securities and Exchange Commission (SEC), according to data shared on Twitter by crypto sleuth, @theirish_man.

Armstong has been selling his shares since November 2022, but the three sales transactions recorded days before the SEC warning caused Coinbase shares to drop by 10% have raised concerns within the community.

The sales

The data shows that Armstrong facilitated four sales transactions since the beginning of March – on Mar. 3, Mar. 15, and two on Mar. 21. He sold a total of 89,196 Coinbase shares — which add up to $5,871,561 in value. Almost half of this amount was sold within the 24 hours before the SEC warning.

Most recent sales were recorded on Mar. 21. Armstrong issued two transactions to sell from the prices of $75.31 and $75.51, respectively. The SEC warning was publicized on Mar. 22, which dropped share prices by over 10%. At the time of writing, Coinbase share price sits at $77.14 — making a 8.16% fall in price in the last 24 hours.

According to the numbers, Armstrong has been selling Coinbase shares almost regularly since November 2022. He issued two sale transactions per month in November 2022, December 2022, and January. In February and March, he increased the amount sold by giving three transactions per month.

The SEC warning

The SEC issued a Wells notice to Coinbase on Mar. 22. The Wells notice means that the SEC has made a preliminary determination to recommend an enforcement action against the exchange. The filing specifies that the upcoming enforcement action will likely concern parts of Coinbase’s main trading platform and its other services — such as Coinbase Prime and Coinbase Wallet.

Upon first response, Coinbase said it is confident in its services and it “welcomes a legal process,” indicating that it will fight with the SEC. The crypto community also revealed its stance by rallying behind Coinbase. Executives of the crypto sphere started to question if the SEC’s warning was a deliberate attempt to stifle the market.