Coinbase Announces Cryptocurrency Index Fund

Coinbase Announces Cryptocurrency Index Fund Coinbase Announces Cryptocurrency Index Fund

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

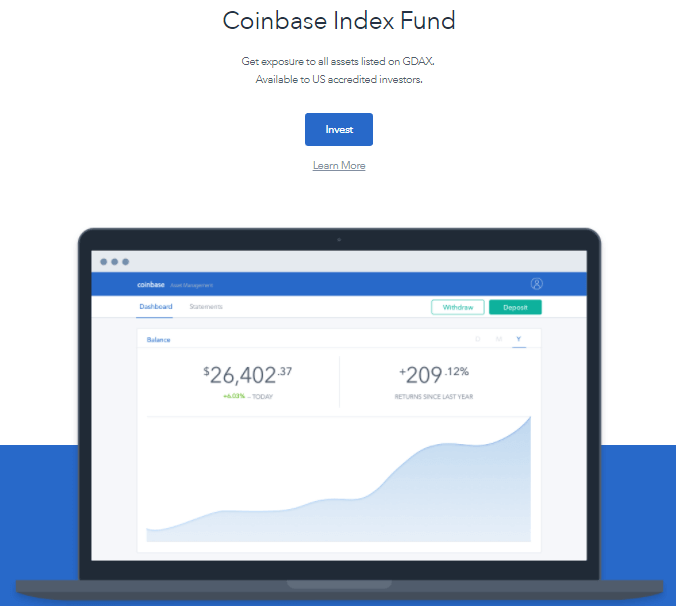

Leading cryptocurrency brokerage Coinbase has recently announced the launch of a new passively managed cryptocurrency index fund. The new investment vehicle will expose investors to the four cryptocurrencies traded on Coinbase’s GDAX exchange and marks the platform’s first push into asset management services.

The new asset management service was announced via Twitter and Medium earlier today and offers investors the opportunity to access diversified exposure to an entire asset class as opposed to individual assets.

Our plan for Asset Management:

Step 1: offer Coinbase Index Fund to US-resident, accredited investors

Step 2: make available to all investors

We’re working on launching more funds which cover a broader range of digital assets. Stay tuned.

— Coinbase (@coinbase) March 6, 2018

Reuben Bramanathan, a product manager as Coinbase, explained via Medium that the launch of the fund is intended to provide both new and institutional investors with the ability to invest in the potential of blockchain-based digital assets as a whole:

“We are noticing people coming to the space for the first time, being excited about cryptocurrencies, but not knowing where to start, so we’re excited to give people the ability to get broad exposure to the entire asset class rather than having to select individual investments.”

Index Fund Composition

The new Coinbase index fund will be overseen by a newly-minted subsidiary called Coinbase Asset Management and will be available to US-based accredited investors only. The fund will possess a minimum investment of $10,000 USD and charge a 2% annual management fee with no additional performance fees.

At launch, the fund will include the four cryptocurrencies that are currently traded on GDAX — Bitcoin, Bitcoin Cash, Litecoin, and Ethereum, weighted by market cap. The composition of the index fund upon launch should resemble the current market capitalization of each respective currency:

- Bitcoin: 62%

- Ethereum: 27%

- Bitcoin Cash: 7%

- Litecoin: 4%

If a new cryptocurrency is listed on the GDAX exchange it will be automatically listed in the index fund, which will be rebalanced on an annual basis. Investors will be able to invest in the fund once monthly, with a quarterly redemption window that required 30 days notice. Investments can be made in USD, BTC, ETH, BCH, or LTC.

The criteria required in order to invest in the Coinbase cryptocurrency index fund sets a high bar for potential investors, however — index fund investors must meet US SEC requirements as an “accredited investor.” Investors must:

- Have earned income that exceeded $200,000 (or $300,000 together with a spouse) over the last two years, and reasonably expect the same for the current year

- Possess a net worth over $1 million, either alone or together with a spouse

Coinbase has also announced the development of an array of alternative funds that will be available to all investors, covering a broader range of cryptocurrencies with less stringent investor requirements.

Coinbase is Opening Up Index Funds to Retail Investors

The new index fund possesses stringent qualification requirements in order to remain compliant, as catering to less established or experienced investors often comes with more complex regulatory challenges. In an interview with Bloomberg, Bramanathan stated that the index fund is the first step in a process that will eventuate in the release of a retail index fund:

“When people think about a retail index fund, they’re talking about an ETF, and that’s obviously a long process to launch. Our objective here is to get to a position where we do launch a fund that’s available to retail, but given the regulatory hurdles, we wanted to offer something to institutional and accredited to begin with.

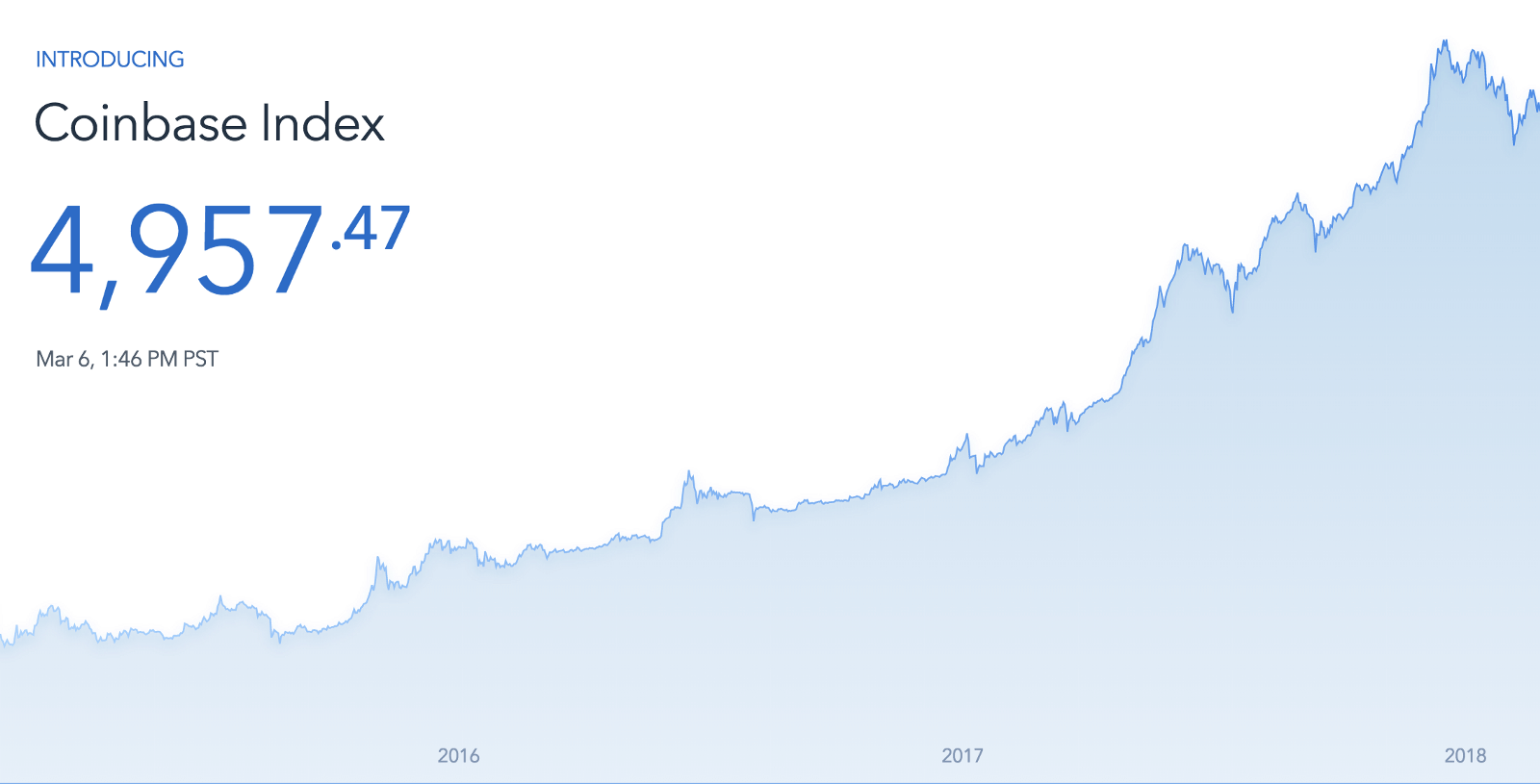

In addition to the new index fund, Coinbase has also announced the launch of the Coinbase Index, which tracks the performance of all of the digital assets listed on GDAX. The index will be subject to quarterly review by the newly-formed Coinbase Index Committee and will be reconstituted each time that a new asset is listed on GDAX.

Coinbase isn’t the first platform to launch a passive cryptocurrency index fund and follows in the footsteps of services such as Bitwise Investment’s HODL 10 Index. Coinbase’s dominant position in the cryptocurrency market, however, places it in a unique position to attract a new wave of institutional investors and novice traders with its new index fund.

The Coinbase index fund will launch over the next few months, but is available to accredited investors for pre-registration now.