Central banks pumping billions in liquidity actually benefits Bitcoin, here’s why

Central banks pumping billions in liquidity actually benefits Bitcoin, here’s why Central banks pumping billions in liquidity actually benefits Bitcoin, here’s why

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Central banks all across Europe and Asia are busy injecting billions of dollars in liquidity to keep the stock market afloat. As Bitcoin is described as a safe-haven asset by many, it is adding to the momentum of the dominant cryptocurrency.

Is Bitcoin actually a risk-on asset?

Coincidentally, several major bear cycles of Bitcoin like December 2018 when the price of BTC plunged to $3,150 occurred amidst heightened geopolitical risks and global economic slowdown.

In 2018, when the trade dispute between the U.S. and China reached its peak, the Bitcoin price fell to the $3,000s after a 50 percent drop within a span of two weeks. At the time, the stock market saw record-high net outflows.

There is no clear correlation to support the argument that Bitcoin is neither a risk-on or risk-off asset. In the past three years, Bitcoin has tended to demonstrate a correlation with gold. But, in the last 12 months, it has moved in the opposite direction to gold in both lower and higher time frames.

Leading digital asset trust company BitGo co-founder Ben Davenport said that at this point, it is hard to categorize Bitcoin as a risk-on or risk-off asset.

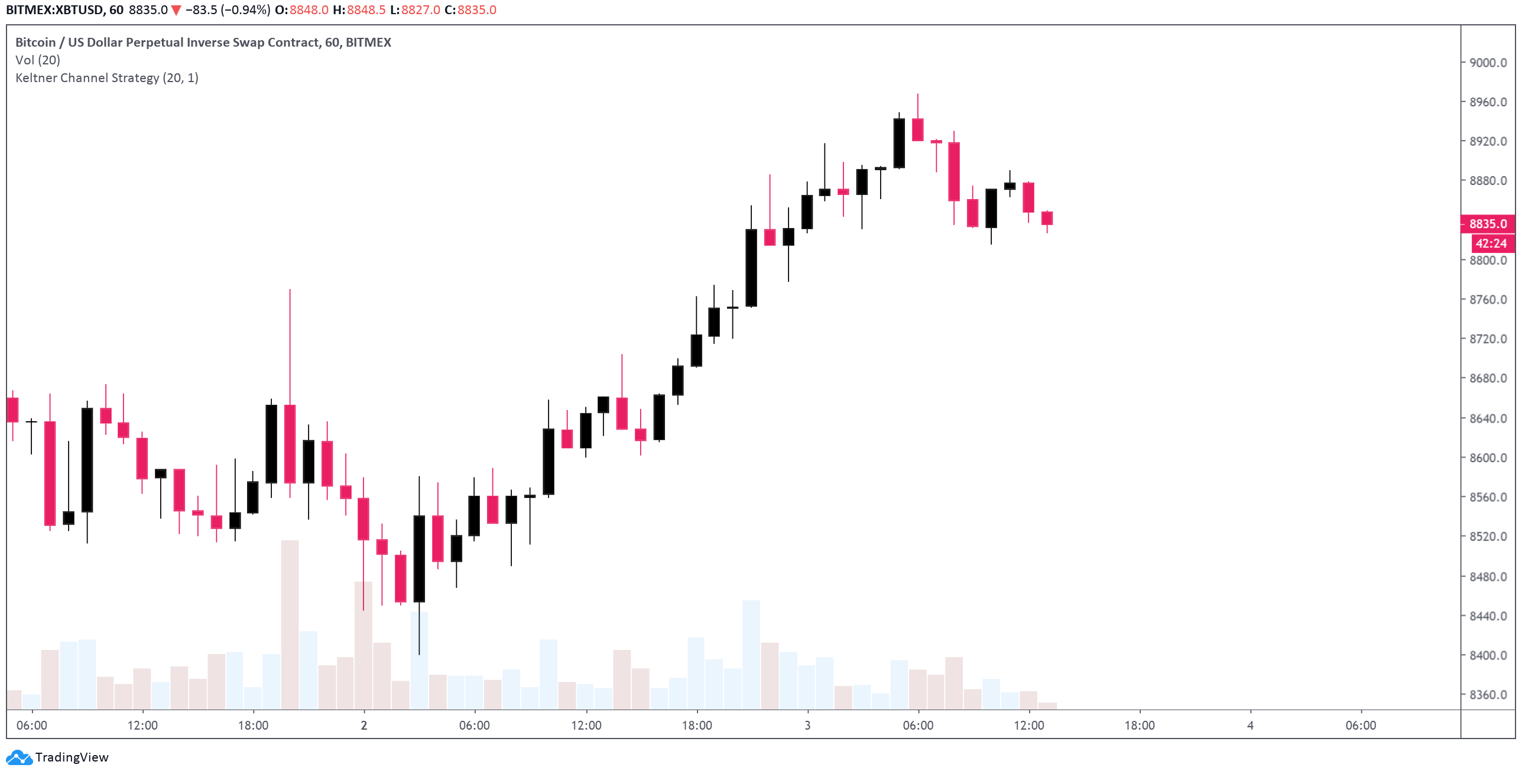

He said that the Bitcoin price is predominantly swayed by the margin trading market through platforms such as BitMEX and Binance Futures, by the hands of whales.

Davenport noted:

“Bitcoin is neither a risk-on nor a risk-off asset at this point. It still marches to the best of its own drum. The actions of whales and leveraged traders are far more meaningful than any macro concerns.”

The lack of correlation between Bitcoin and the broader financial market decreases the potential impact of macro events on the price of the cryptocurrency. But, when the general market sentiment and productivity is on the rise as a result of rising liquidity, the inflow into high-risk assets is more likely to increase than not.

Central banks that have previously refused to release stimuli to ensure the sustainability of long-term economic growth have started to bring out strong stimulus packages to boost the global economy.

The coronavirus outbreak, which is at risk of causing a true global pandemic, invoked a level of fear in the financial market that has not been seen in the past decade.

If that fear is matched with some of the biggest stimulus packages in recent years, it could recover the appetite of investors towards higher-risk asset classes that include single stocks, and also Bitcoin.

Will BTC ever be like gold?

For Bitcoin to reach some level of an inverse correlation with the stock market and the financial sector like gold, it will have to see a much bigger market cap than now.

Currently, Bitcoin is valued at a mere $161 billion, less than three percent of gold. Consequently, cryptocurrencies are still viewed as an emerging asset class with limited support from financial institutions.

It could take several more years for Bitcoin to reach a larger market cap, stability in its price, and a more robust infrastructure to back it to potentially act as a safe haven asset.