![BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2020/03/bitcoin-wick.jpg&w=70&h=37&q=75) BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED]

BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED] BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED]

![BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED]](https://cryptoslate.com/wp-content/uploads/2020/03/bitcoin-wick-768x403.jpg)

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

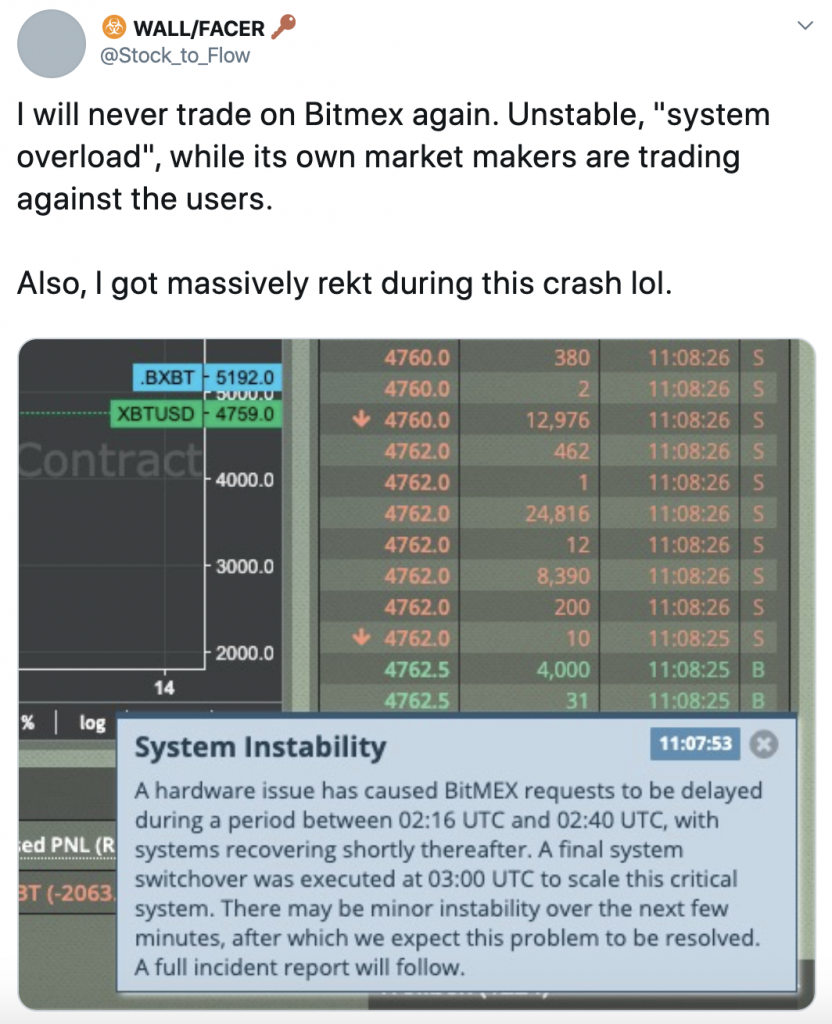

The price of Bitcoin dived $400 below the BTC spot price on BitMEX’s Bitcoin perpetual swap contract as the platform reportedly halted trading on account of “system instability.”

Traders widely reported experiencing a system crash on BitMEX between 02:16 and 03:00 UTC Friday morning, as XBTUSD crashed to $3,600, $400 below the Bitcoin spot price.

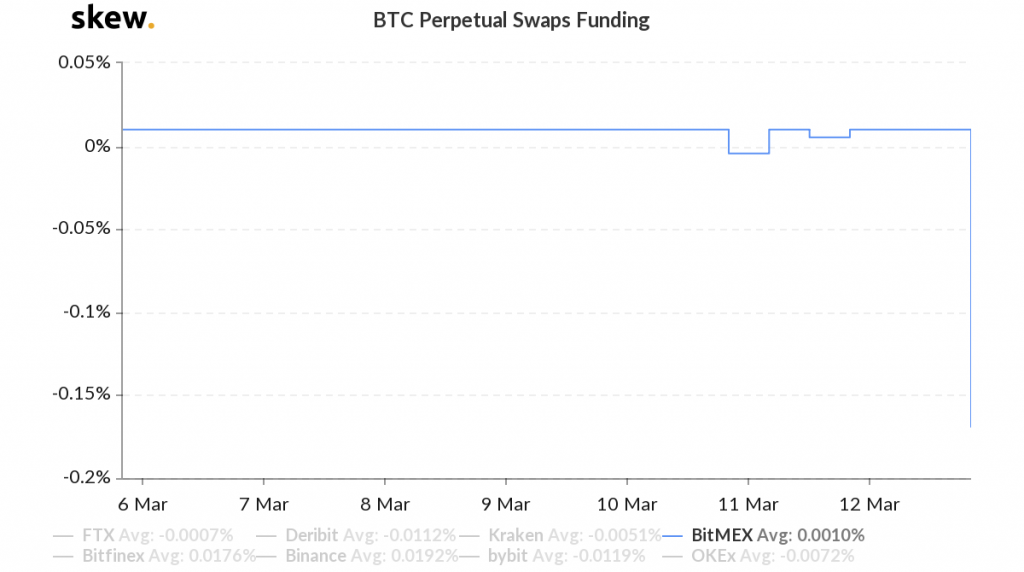

The huge divergence came following a ferocious market-wide sell-off that saw Bitcoin shed nearly 40 percent against the dollar, and the BitMEX funding rate crater to its lowest level in years.

At 5am UTC, BitMEX released a statement on Twitter describing the outage as a “hardware issue” causing “requests to be delayed.”

Between 02:16 and 02:40 UTC 3 March 2020 we became aware of a hardware issue with our cloud service provider causing BitMEX requests to be delayed. Normal service resumed at 03:00 UTC. As a reminder, latest system updates can be found on our status page https://t.co/fVa1FAqSEW

— BitMEX (@BitMEXdotcom) March 13, 2020

A bad day to be on BitMEX

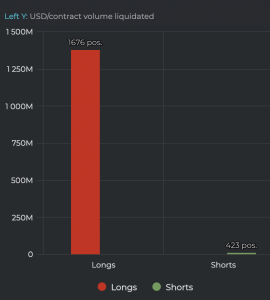

The sudden drop in funding comes after one of the largest bloodbaths ever seen on the Seychelles-based derivatives exchange, with Thursday seeing nearly $1.4 billion worth of long contracts get liquidated, and the BitMEX insurance fund losing 1627 BTC, its biggest intraday drop in two years. After Friday’s early-morning flash-crash, the fund will thinkably post a larger loss (data is yet to be released for Friday).

As Bitcoin hit $4,000 on the spot market BitMEX’s XBTUSD two-hour funding rate saw a drop to a massively low -0.3750 percent, and the contract price wicked down to $3,600.

Jonathan Leong, CEO of crypto derivatives exchange BTSE told CryptoSlate:

“The crypto markets are affected right now because BTC has been trading like its positively correlated with the equities market. If you compare the traditional markets to the BTC market cap of $140 billion it is difficult to consider Bitcoin as a safe haven at this time”

The funding rate is a mechanism unique to perpetual futures offerings like BitMEX’s Bitcoin contract designed to encourage the futures price to stay near spot price. In periods where the funding rate is skewed heavily negative, short contract-holders must pay larger fees to long-holders. Bouts of extreme volatility — like at present — can send the futures price careering away from the index as the funding rate swings in one direction or the other.

According to crypto analyst Alex Kruger, BitMEX’s -0.3750 daily funding rate would work out to short holders paying 400 percent to longs annually.

Amazing. That represents 400% annualized. Shorts pay longs. pic.twitter.com/3Mws9CqFDS

— Alex Krüger (@krugermacro) March 13, 2020

Ross Middleton, CFO at decentralized exchange DeversiFi spoke to CryptoSlate about the reasons for the drop, stating:

There is a general ‘risk-off’ approach to all risk assets, including crypto. Bitcoin will show its safe-haven credentials over a longer time horizon once this move has bottomed out, or at least prove uncorrelated to other asset classes.”

Bitcoin Market Data

At the time of press 1:18 am UTC on Apr. 6, 2020, Bitcoin is ranked #1 by market cap and the price is down 19.36% over the past 24 hours. Bitcoin has a market capitalization of $103.4 billion with a 24-hour trading volume of $79.17 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:18 am UTC on Apr. 6, 2020, the total crypto market is valued at at $161.74 billion with a 24-hour volume of $276.09 billion. Bitcoin dominance is currently at 64.29%. Learn more about the crypto market ›

![BitMEX freezes as XBTUSD crashes 10% below Bitcoin spot price [UPDATED]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/09/bitcoin-logo.jpg&w=45&h=45&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)