Bitcoin’s short-term skew collapses as CME options volume rockets

Bitcoin’s short-term skew collapses as CME options volume rockets Bitcoin’s short-term skew collapses as CME options volume rockets

Photo by Martin Jaroš on Unsplash

Bitcoin’s short-term market dynamic has shifted greatly following the volatility seen overnight.

This turbulence caused the benchmark cryptocurrency to rally to highs of $9,700 before posting a slight rejection that led it back down to the lower-$9,000 region.

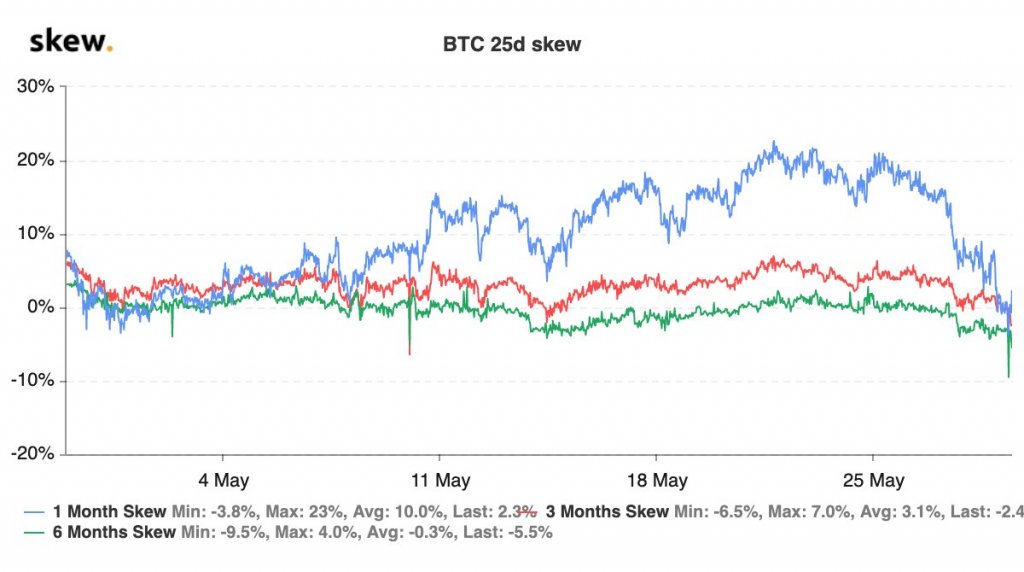

It now appears that options traders are beginning to grow increasingly bullish on the cryptocurrency – a trend that is elucidated by the recent collapse in BTC’s short-term options skew.

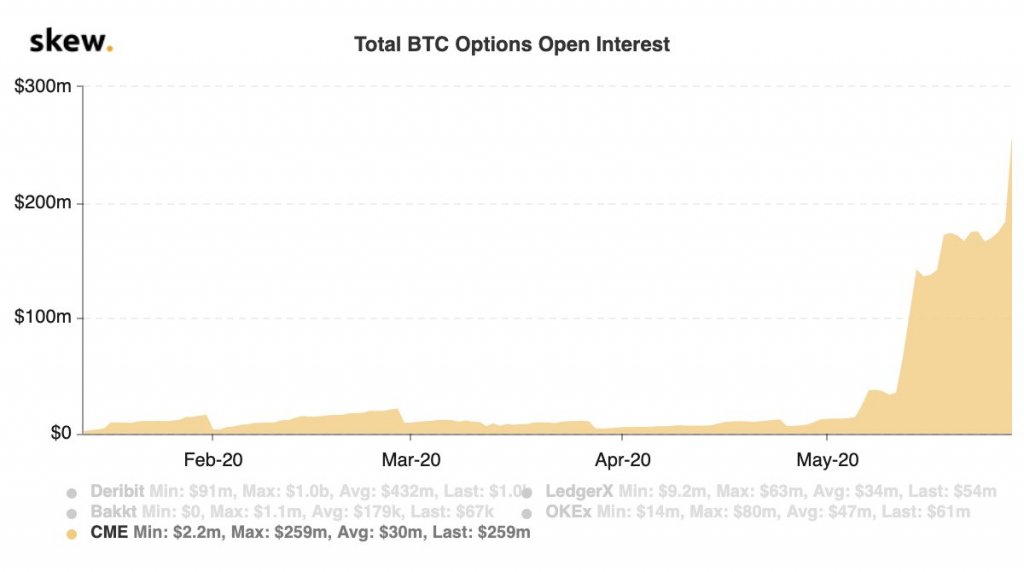

This has also coincided with a massive rise in options open interest on the CME, which signals that traders are preparing for the crypto to see some major volatility.

Bitcoin sees collapsing options skew following overnight rally

Overnight, Bitcoin’s buyers were able to extend the momentum that was first incurred when it bounced at $8,800, leading the crypto to highs of $9,700.

This price rise was followed by a sharp decline, however, signaling that bulls are still plagued by some underlying weakness despite their recent strength.

It does appear that $9,350 has become a strong support level for BTC, as buyers have continued defending against a decline beneath this level throughout the past few days.

It now appears that this rally – despite it being somewhat fleeting – has shifted the dynamic amongst options traders.

Data shows that the cryptocurrency’s short-term options skew has cratered throughout the past couple of days.

Options skew refers to the volatility rates seen between contracts with different expiration dates for the same underlying asset.

One prominent blockchain data firm – aptly named Skew – spoke about the shift in dynamics seen while looking towards BTC’s options skew in a recent tweet, noting that its decline shows that traders are going long.

“Short term skew has collapsed to flat in the last few days as bitcoin options traders turn bullish.”

Traders are gearing up for BTC to make a big movement

Following the overnight rejection at $9,700, Bitcoin has been caught within a bout of sideways trading around $9,400.

It doesn’t appear that traders are anticipating this to last for long, however, as options open interest on the CME has climbed by $250 million in the past few weeks – likely in anticipation for today’s May expiry.

Skew also spoke about this trend, saying:

“Open interest is climbing >$250mln before expiry today of approx 2,000 May contracts.”

Because the recent dive in options skew suggests that traders are leaning bullish, it does seem that they widely anticipate the crypto’s recent uptrend to continue strong.

It does face heavy resistance around $10,000, however, that may be enough to stunt its growth.

Bitcoin Market Data

At the time of press 7:23 pm UTC on May. 29, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.4% over the past 24 hours. Bitcoin has a market capitalization of $173.27 billion with a 24-hour trading volume of $34.69 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 7:23 pm UTC on May. 29, 2020, the total crypto market is valued at at $263.08 billion with a 24-hour volume of $110.58 billion. Bitcoin dominance is currently at 65.87%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)