Bitcoin options skew shows a massive demand for puts; here’s what this means

Bitcoin options skew shows a massive demand for puts; here’s what this means Bitcoin options skew shows a massive demand for puts; here’s what this means

Photo by Victor Garcia on Unsplash

Bitcoin’s options market is suggesting that there is a growing demand for put positions amongst traders. This is a sign that investors are moving to protect themselves from the cryptocurrency potentially seeing significant downside.

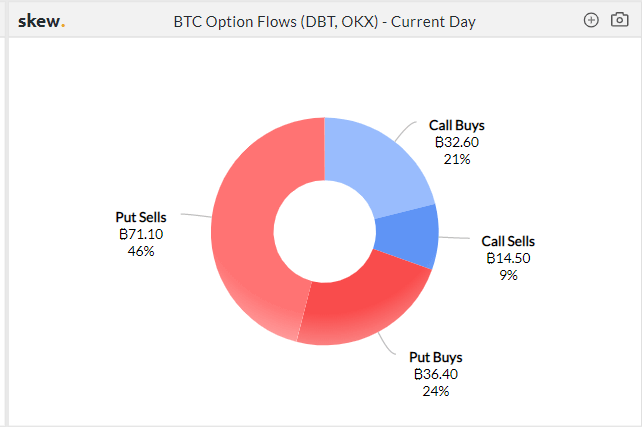

Market markets, however, do not seem to be too concerned about the prospect of the benchmark cryptocurrency seeing further downside – as indicated by the crypto’s order flow being dominated by market makers selling puts.

This comes as the cryptocurrency flashes some signs of weakness as it hovers around its support at $9,000.

Bitcoin options skew reaches new highs

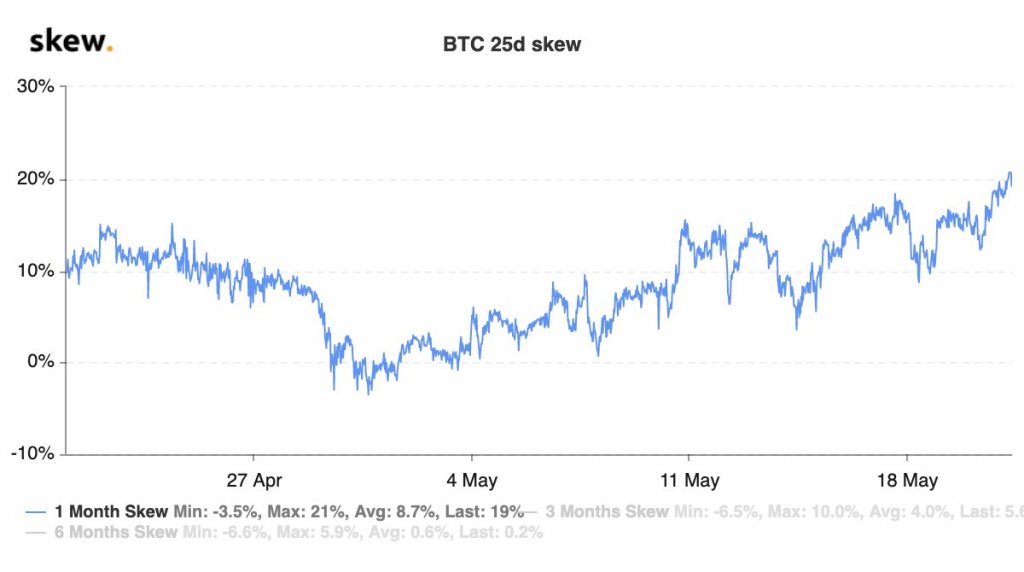

Skew is an options-trading concept that compares the volatility rates between options with the same expiration date for the same underlying asset.

In the case of Bitcoin, skew is currently reaching an all-time high as traders gear up for what could be a massive movement in the days ahead.

It is important to note that the implied volatility between these options contracts suggests that puts are currently in high demand relative to calls. This signals that traders are rushing to hedge against BTC seeing any further downside.

According to blockchain analytics firm Skew, this spike in options skew came about after a trader moved 50 Bitcoin from a Satoshi-era wallet yesterday morning.

“One month skew rallied to new highs yesterday on the 50 bitcoins move. Puts in high demand relative to calls!”

The movement of these 50 Bitcoin did spark fear amongst investors that an early adopter could be preparing to sell a large quantity of the cryptocurrency.

Today’s BTC decline that has led it to the lower-$9,000 region also appears to be the result of this transaction, as it was previously stable around $9,800.

Traders are growing nervous, but market makers remain confident in BTC

One pseudonymous analyst on Twitter recently spoke about the developments regarding Bitcoin’s skew in a recent tweet.

He concludes that it suggests that while traders are growing nervous, market markets who are selling the puts are confident in the cryptocurrency’s strength.

“Bitcoin Options market sentiment. 25d skew is 19%, meaning Puts more expensive than Calls. Sign of nervousness, traders buying protection. But order flow is dominated by market makers crossing spread to sell Puts, so they are not too worried about price crash,” he noted.

How Bitcoin’s price reacts to $9,000 is likely to play a massive role in how its skew trends in the weeks ahead.

Bitcoin Market Data

At the time of press 9:12 pm UTC on May. 22, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.82% over the past 24 hours. Bitcoin has a market capitalization of $168.85 billion with a 24-hour trading volume of $30.86 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:12 pm UTC on May. 22, 2020, the total crypto market is valued at at $255.74 billion with a 24-hour volume of $107.75 billion. Bitcoin dominance is currently at 66.00%. Learn more about the crypto market ›

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)