Bitcoin’s safe-haven narrative vanishes as investors flee risk-on assets

Bitcoin’s safe-haven narrative vanishes as investors flee risk-on assets Bitcoin’s safe-haven narrative vanishes as investors flee risk-on assets

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The global markets have been rattled by the rapid spread of the Coronavirus (COVID-19), which has led the US equities markets to see an intense selloff over the past seven trading sessions. This has also come as investors flee Bitcoin and other cryptocurrencies, marking a mass exodus away from so-called “risk-on” assets.

Analysts are now noting that the recent BTC selloff’s close correlation to that seen by the equities market seems to confirm that the Bitcoin safe-haven narrative is null, with investors fleeing the asset in order to protect their capital amidst global instability.

Global markets face violent selloff as Coronavirus fears spread

The past week has been quite dire for the global markets, with the benchmark US stock indices shedding $4.3 trillion in value over the past seven trading sessions.

This intense downwards movement has marked the Dow Jones’ worst week since the 2008 financial crisis and has led many investors to forecast the possibility that the COVID-19-driven selloff will lead the markets into recession territory.

This intense selloff hasn’t been limited to equities, as Bitcoin and traditional commodities have also been caught within firm downtrends.

Currently, Bitcoin is trading down significantly from its recent highs of $10,500, with its recent capitulatory selloff to lows of $8,400 erasing a good bulk of the gains incurred throughout the course of its recent uptrend.

It doesn’t appear that COVID-19 fears have directly contributed to the crypto’s intense selloff, but it does seem as though it comes as investors flee risk-on assets in an effort to preserve their capital.

Bitcoin’s safe-haven narrative dissolves as its price degrades

It has long been said that Bitcoin is a safe-have asset – or a gold 2.0 – that will see major price climbs amidst global instability.

The recent downtrend, however, seems to have invalidated this narrative, as its decline alongside that of the global equities market seems to confirm its status as a risk-on investment that investors will flee during times of turbulence in traditional markets.

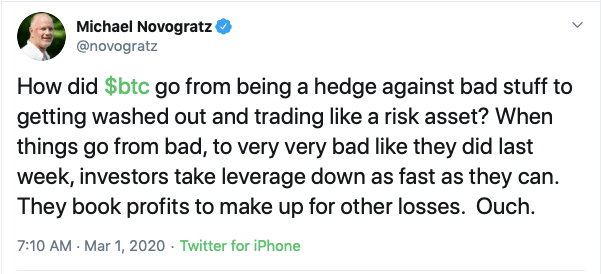

Billionaire investor Michael Novogratz spoke about this in a recent tweet, noting that it is now trading fully as a risk-on asset.

“How did BTC go from being a hedge against bad stuff to getting washed out and trading like a risk asset? When things go from bad, to very very bad like they did last week, investors take leverage down as fast as they can. They book profits to make up for other losses. Ouch.”

Unless Bitcoin miraculously incurs intense upwards momentum that allows it to surge significantly higher, it is a possibility that it will see further downside as the global equities market continues correcting.