Bitcoin volatility craters to 2020 lows; Is the crypto market coiling up for a major move?

Bitcoin volatility craters to 2020 lows; Is the crypto market coiling up for a major move? Bitcoin volatility craters to 2020 lows; Is the crypto market coiling up for a major move?

Photo by Joe Green on Unsplash

For a brief period yesterday, it seemed as though Bitcoin was making a trend-defining movement that would mark a resolution to the extended period of sideways trading that the crypto has faced over the past several weeks.

This movement – like most seen over the past few weeks – proved to be fleeting and has once again resulted in Bitcoin trading within its over month-long range.

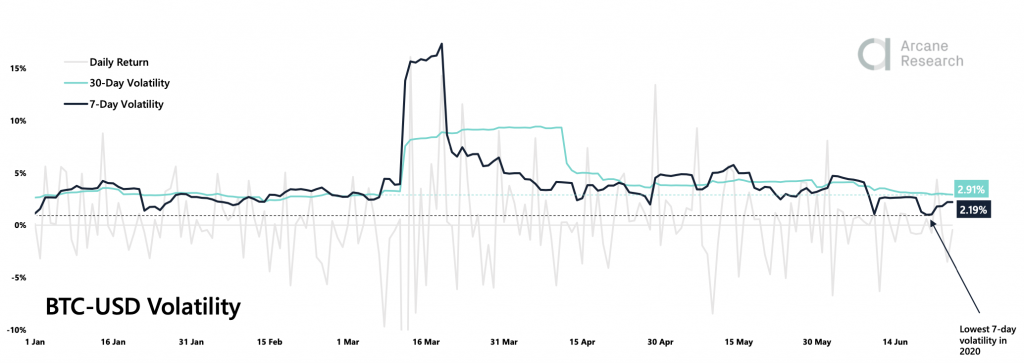

Its volatility has now dipped to fresh yearly lows, which tends to occur before it makes a massive movement.

This indicates that the crypto market may see some monumental volatility in the coming few days – potentially setting the tone for where BTC and other altcoins trend throughout the rest of the year.

Bitcoin 7-day volatility plunges as crypto researchers forecast imminent volatility

Bitcoin has been trading within a tight trading range between $9,000 and $10,000 for over a month now.

On a few occasions, buyers have catalyzed enough strength to propel it above the upper boundary, but each rally to this region has been met with significant selling pressure that sparks violent rejections.

The same goes for the lower boundary of this trading range as well. Bitcoin has, on multiple occasions, attempted to break below $9,000, but each venture into the $8,000 region has been fleeting.

Yesterday was the latest instance of an attempt from sellers to spark a selloff. The crypto dipped to lows of $8,900 before ultimately rebounding back above $9,000.

This price action has done little to offer insight into its mid-term trend and has caused Bitcoin’s 7-day volatility to hit yearly lows – according to the latest report from Arcane Research.

They conclude that the imminent monthly close will likely help reverse this trend and catalyze some movement.

“Larger daily movements have been observed at the monthly close both in April and May, and it is not unlikely to see the volatility pick up going into next week.”

The longer BTC consolidates, the bigger its next movement will be

The aggregated crypto market’s consolidation phase can be thought of as a spring coiling up – the longer it coils the bigger the subsequent move will be.

Analysts do believe that this next movement could provide Bitcoin and its peers with clear direction in the weeks and months ahead.

Willy Woo, the co-founder of Hypersheet and a prominent data analyst, recently explained that one pricing model he is looking towards suggests that a Bitcoin bull market is imminent.

It also shows that the longer BTC consolidates now, the higher its next peak will be.

“The longer this bull market takes to wind up, the higher the peak price (Top Cap model). A long sideways accumulation band is ultimately a good thing.”

Bitcoin Market Data

At the time of press 9:47 pm UTC on Jun. 29, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.08% over the past 24 hours. Bitcoin has a market capitalization of $168.37 billion with a 24-hour trading volume of $15.76 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:47 pm UTC on Jun. 29, 2020, the total crypto market is valued at at $260.21 billion with a 24-hour volume of $53.91 billion. Bitcoin dominance is currently at 64.71%. Learn more about the crypto market ›