Bitcoin mining difficulty expected to reach new all time high

Bitcoin mining difficulty expected to reach new all time high Bitcoin mining difficulty expected to reach new all time high

Bitcoin’s price crashed by over 6% within the last 24 hours to around $20,800.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s (BTC) mining difficulty will reach a new all-time high by 8:21 PM GMT on Sept. 13, as Glassnode data analyzed by CryptoSlate predicts a 3.5% increase within the next few hours.

The mining difficulty refers to how difficult it gets for miners to validate transactions on the network. The mining difficulty increased by 9.26% two weeks ago to reach 30.98 trillion —its highest surge since January.

A 3.7% rise will break the record mining difficulty of 31.25 trillion set on May 11.

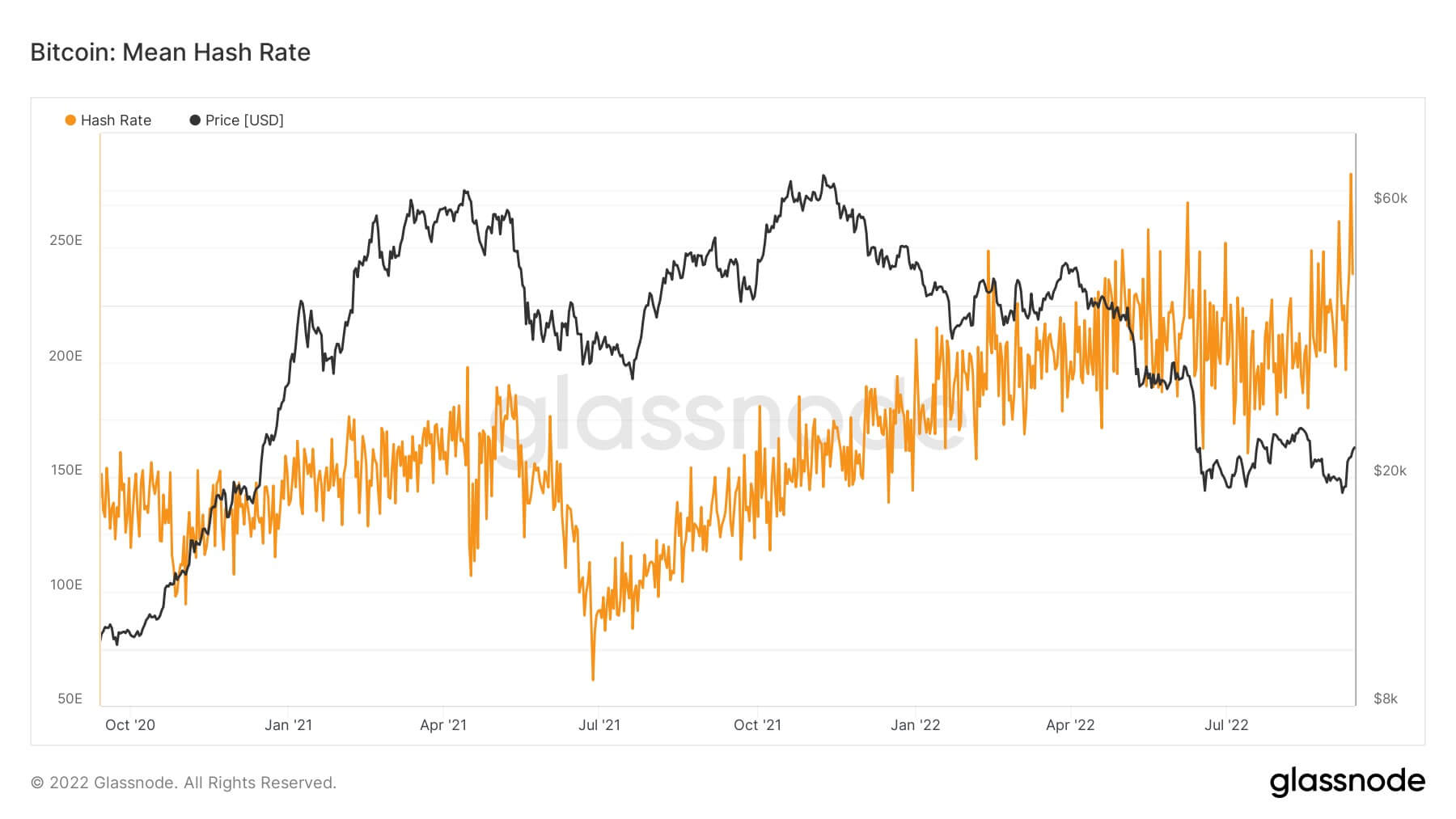

Hashrate is expected to climb too

Bitcoin mining hashrate is also expected to climb to a new all-time high too, according to Glassnode data.

A CryptoQuant analyst pointed out that BTC mining hashrate has been increasing recently.

The increase in mining difficulty and hashrate might seem surprising given the current market conditions that recently saw the asset crash below the $19,000 mark.

However, following a summer heat wave that forced many miners to shut down operations, the arrival of cold weather has led to new machines coming online.

Miners are forced to be more efficient

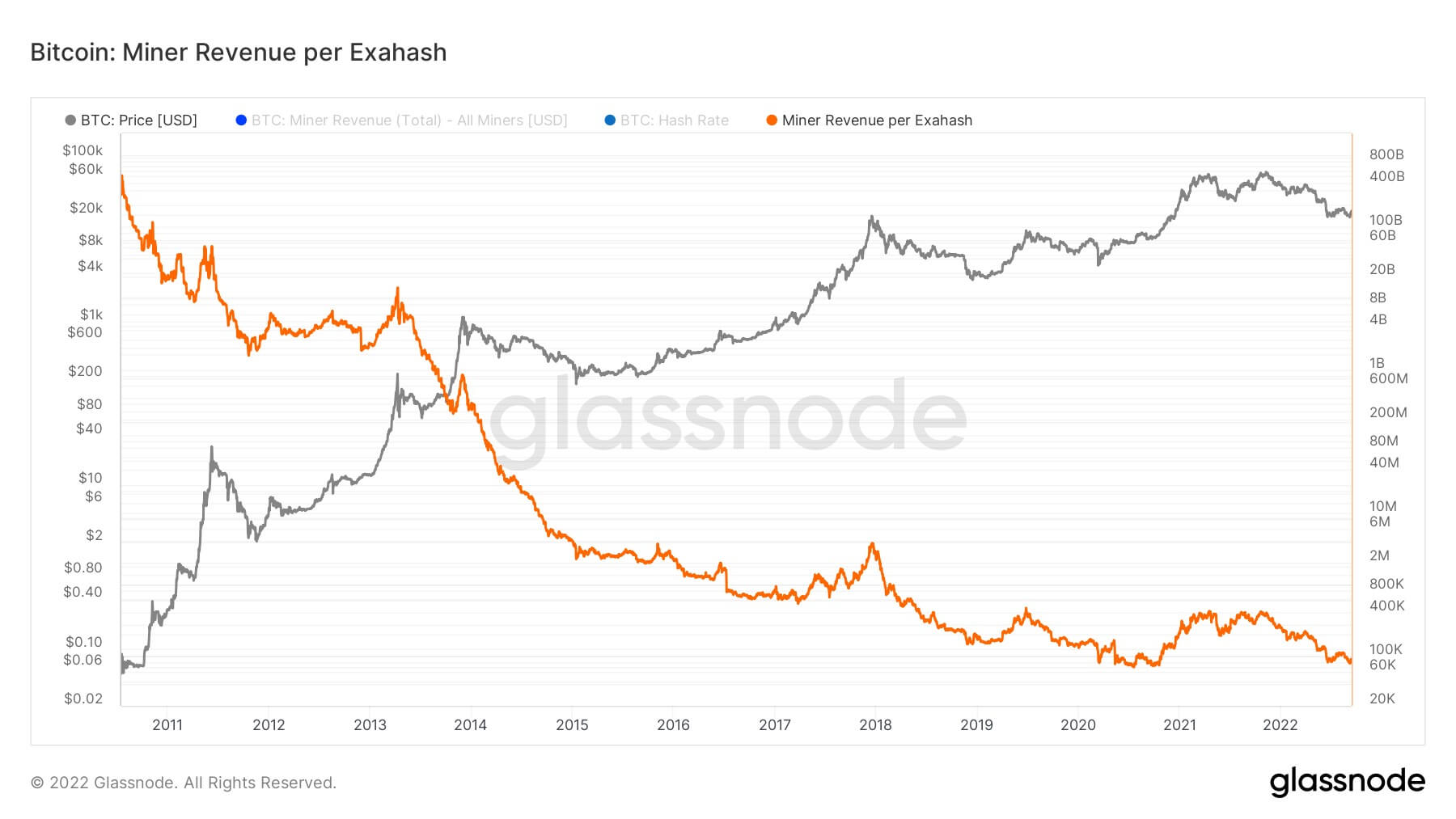

Apart from the reduced heat levels, several miners recently installed the Antminer S19 XP, which is more effective.

Due to the decline in Bitcoin price, miners now have to be more efficient in their operations to stand any chance of making profits.

Meanwhile, not every miner is struggling with the market decline. Some, like CleanSpark, are taking advantage of the conditions to expand their operations.

CleanSpark recently agreed to buy Mawson Infrastructure Group’s mining facility for $33 million while also getting some of its ASICs or around $9.5 million.

The Bitcoin miner had also bought 10,000 Antminer S19j Pro for $28 million and acquired several Bitcoin mining facilities all over the US earlier this year,

However, miners in the country might have to find ways to make their operations sustainable, especially after the White House report raised the possibility of a ban if the carbon emissions continue to rise.