Bitcoin hashrate ATH promising for BTC’s long term price trend

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

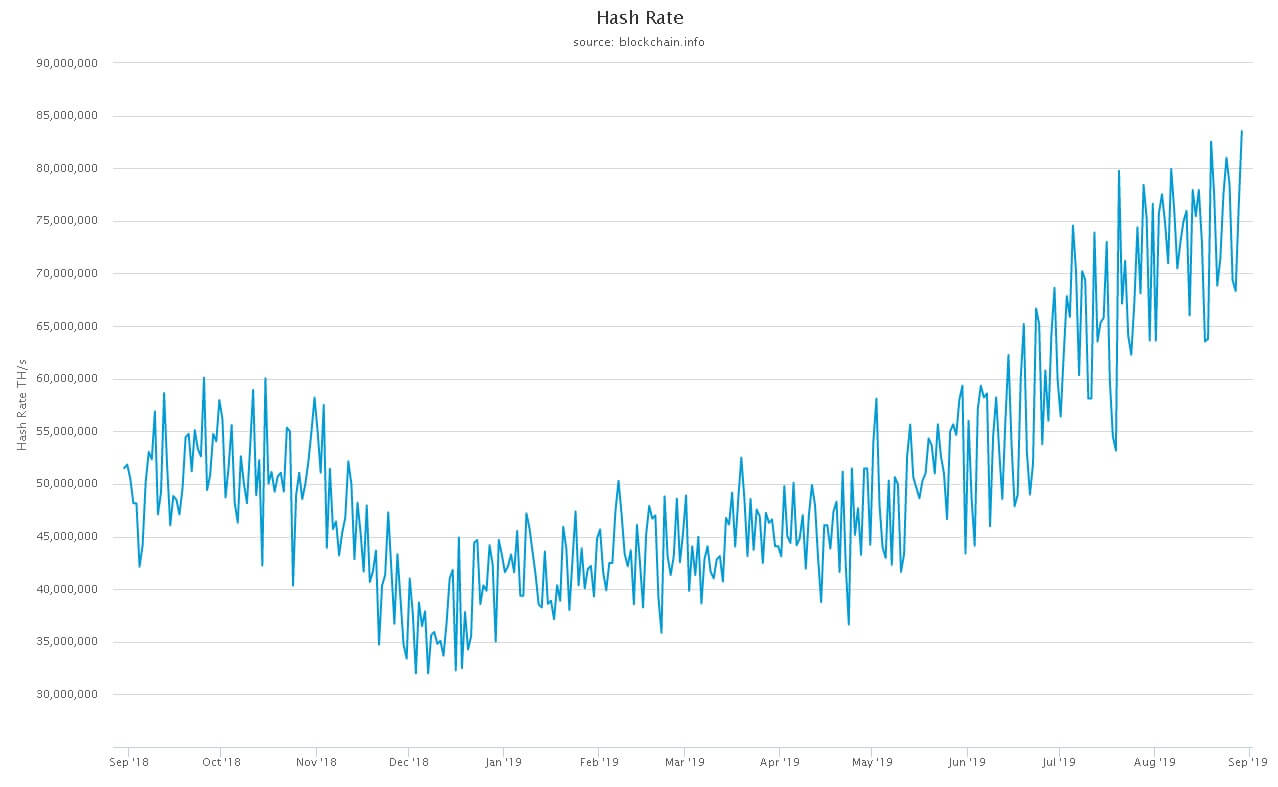

The hashrate of the Bitcoin network, which demonstrates the amount of computing power used to secure the protocol to process transactions, achieved a new all-time high at 83 exahashes.

At the start of the year, the hashrate of the Bitcoin network was hovering at 35 exahashes, showing a 137 percent increase within an eight-month span.

What the hashrate says about Bitcoin’s trend

In mid-2020, the Bitcoin blockchain network is expected to go to through a mechanism called a block reward halving, which would reduce the revenues received by BTC miners by 50 percent.

The halving would substantially decrease the amount of BTC mined by miners. These coins are passed on to the market through exchanges and over-the-counter (OTC) operations, putting downward pressure on the price of BTC. Historically, the block reward halving of the Bitcoin network acted as a fundamental catalyst for the medium to long term price trend of the coin by decreasing the rate of BTC emission (and thus decreasing supply inflation).

Something to note, however, is that the halving also tends to reduce the overall hashrate of a proof-of-work network, in line with lower miner revenues. This may make BTC less secure to 51% attack.

The rise in the hashrate of the Bitcoin network prior to the halving may show that a growing number of miners intend to mine as much BTC as possible before mid-2020 in anticipation of price recovery of the dominant cryptocurrency.

In July, BKCM founder Brian Kelly stated that many miners have acquired enough capital to fund the next 12 months of operations to hold onto BTC they mine throughout 2019 and the first half of 2020.

“I’ve talked to a lot of miners around the world, a lot of them have said they have sold enough bitcoin to get us through the next year or so and we are going to hoard bitcoin at this point in time and we are not going to sell it and the supply of bitcoin will get cut in half. Just real simple economics: lots of demand hitting little supply, price goes higher,” said Kelly on CNBC’s Fast Money.

If miners are sustaining their operations without selling BTC on exchanges or OTC markets to cover expenses, it indicates that miners foresee the Bitcoin price to perform well in the medium to long term despite the recent pullback.

For the sixth time this quarter, the Bitcoin price has dipped below a key psychological level at $10,000, testing a range support between $9,400 to $9,700. Several technical analysts said that as the support range for BTC weakens it increases possibility that BTC tests a stronger support level in the $8,000 region in the near term.

“Currently holding above the previous low on the daily close but if price breaks down, it’s going to the $8.7ks. After that, it heads towards $8k but everyone is watching it so either it bounces before or goes through. Needs to break back above $10,100 to get bullish,” technical analyst Josh Rager said.

It remains uncertain whether the launch of Bakkt, a physically-settled Bitcoin futures contract offering market on September 23, could overturn the short term downside of BTC considering the weakness the asset has portrayed since early August against the U.S. dollar.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.12% over the past 24 hours. Bitcoin has a market capitalization of $171.93 billion with a 24-hour trading volume of $11.63 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $248.62 billion with a 24-hour volume of $40.71 billion. Bitcoin dominance is currently at 69.16%. Learn more about the crypto market ›