Bitcoin breaking $14,000 will bring a new “regime” of market dynamics

Bitcoin breaking $14,000 will bring a new “regime” of market dynamics Bitcoin breaking $14,000 will bring a new “regime” of market dynamics

Bitcoin’s breakout this past week has captured the attention of those within this industry and those outside of it. CNBC and Bloomberg covered these moves to the upside extensively, and JP Morgan amongst other Wall Street investment firms and analysts weighed in on the rally.

Analysts say that it isn’t time to be entirely excited just yet. Many commentators say that Bitcoin breaking $14,000 will be important as that level has been one of macro importance for the past three years.

Will all hell break loose when Bitcoin hits $14,000?

Prominent crypto-asset analyst Qiao Wang thinks that once Bitcoin breaks $14,000, the market will enter a “different regime in terms of volatility, momentum, retail participation, and so on”:

“Once BTC breaks $14k, we’ll likely be in a different regime in terms of volatility, momentum, retail participation, and so on. A lot of things that worked last few months may no longer work and vice versa. $20k will take this regime to a whole new level. Just a hunch. We’ll see.”

Once BTC breaks $14k, we’ll likely be in a different regime in terms of volatility, momentum, retail participation, and so on. A lot of things that worked last few months may no longer work and vice versa. $20k will take this regime to a whole new level. Just a hunch. We’ll see.

— Qiao Wang (@QwQiao) October 24, 2020

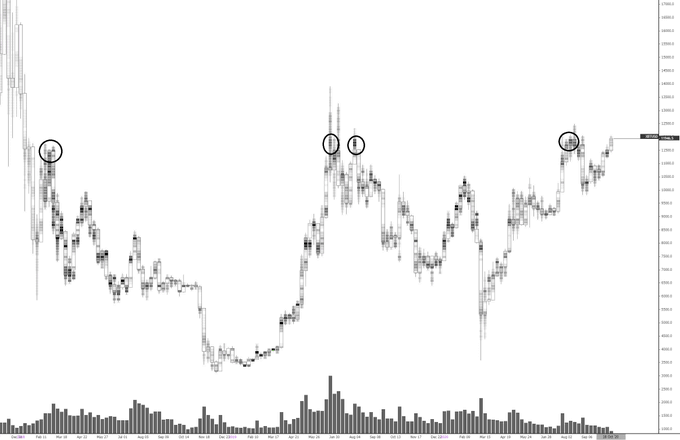

The reason why such emphasis is placed on $14,000 is that this was the point at which Bitcoin’s December 2017 candle closed, and it’s also where the trend almost perfectly topped during 2019’s boom. The multiple macro interactions BTC had at $14,000 suggests it decisively breaking and holding above this level would mark a shift in the market structure.

While Qiao Wang did not elaborate on what type of trends will change within the crypto market, it’s worth noting that there is little futures volume that has been traded above $14,000.

Analyst “CL” shared the chart below amid Bitcoin’s surge this past week, noting that “Almost no one in the current derivatives market ever traded meaningfully above [the] current level.”

This was because prior to 2018 or late 2018, BitMEX and other perpetual swap platforms did not have that much interest, as there was enough leverage as is longing Bitcoin or altcoins through spot markets.

With derivatives believed to be driving a bulk of the crypto market’s price action, the introduction of a whole new price range to derivatives traders could result in volatile price action.

Expect all-time highs?

Some argue that once Bitcoin breaks $14,000, all-time highs should be expected shortly after that.

Kyle Davies, a co-founder of prominent crypto-asset fund Three Arrows Capital, recently commented on Twitter:

“To be clear, when we break $12k clean on a spot-led move with no leverage, who in the lord’s name will sell at $15k. And given that no one sells at $15k, who in the lord’s name would sell at $20k.”

To be clear, when we break $12k clean on a spot-led move with no leverage, who in the lord’s name will sell at $15k.

And given that no one sells at $15k, who in the lord’s name would sell at $20k.

And when they hear that $BTC is still not ded, how much is a bitcoin worth?

— Kyle Davies (@kyled116) October 21, 2020

Bitcoin Market Data

At the time of press 10:03 am UTC on Oct. 26, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.53% over the past 24 hours. Bitcoin has a market capitalization of $242.55 billion with a 24-hour trading volume of $23.36 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:03 am UTC on Oct. 26, 2020, the total crypto market is valued at at $396.71 billion with a 24-hour volume of $81.22 billion. Bitcoin dominance is currently at 61.16%. Learn more about the crypto market ›