Billionaire investors: Bitcoin rally fueled by US-China currency war and tension in Hong Kong

Billionaire investors: Bitcoin rally fueled by US-China currency war and tension in Hong Kong Billionaire investors: Bitcoin rally fueled by US-China currency war and tension in Hong Kong

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Amidst intensifying geopolitical risks and growing uncertainty in the global financial market, heavyweight investors like Michael Novogratz and Travis Kling foresee Bitcoin emerging as a viable alternative store of value.

“With the yuan over 7.0, an FX war, instability in HKG and the beginnings of capital flight, BTC rally could have real legs,” said Novogratz.

Throughout the past two weeks, Bitcoin prices increased from $9,110 to $11,530 across most major exchanges, achieving $12,300 at the weekly high.

Is capital flowing into Bitcoin as a result of global economic uncertainty?

Following the devaluation of the Chinese yuan, the U.S. equities market crashed, promptly leading the Dow Jones to crash by more than 1,200 points overnight. Consequently, the value of safe-haven assets like gold, for instance, surged by over 3.5 percent in a seven-day span. Yet, analysts remain divided on magnitude of the effect of the tension between the U.S. and China on the Bitcoin price.

Several indicators suggest that the interest towards Bitcoin, and crypto assets more broadly, in China increased in recent months as the probability of a favorable trade agreement with the U.S. declined.

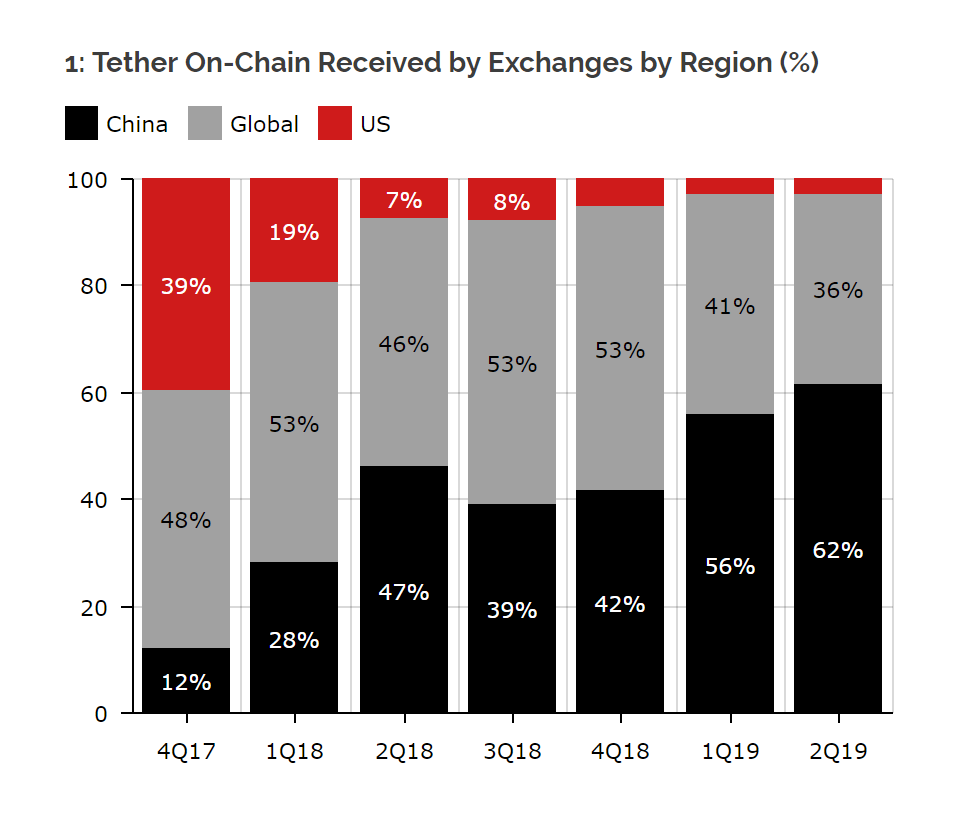

Diar, a digital assets and regulation trade publication, reported in June that China accounts for 62 percent of Tether’s onchain activity, dwarfing other major markets like the U.S. and Japan.

“Data provided to Diar by blockchain analysis firm Chainalysis highlights the magnitude of Chinese Tether demand with over $16 billion received by exchanges based in that market in 2018. This year the number has already surpassed an outstanding $10 billion, setting the stage for the biggest year yet. 2019 to date flows into exchanges catering primarily for Chinese traders beat the $7 billion of all the transactional value for 2017,” the report read.

Mike Novogratz, the billionaire founder and CEO of Galaxy Digital, stated that strict capital controls imposed by China are preventing trillions of dollars from leaving the country and said that the “manipulation,” an accusation made by the U.S. treasury, may be a positive factor for the price growth of Bitcoin.

“The only manipulating China is doing to the RMB is keeping it stronger. If they truly let it float and removed capital controls, multiple trillions would leave. Long BTC,” added Novogratz.

Similarly, former Wall Street equities portfolio manager and Ikigai Fund CEO Travis Kling emphasized that cryptocurrencies as an asset class is moving to the center of the global financial market in the wake of heightened tensions between leading economies.

“Take a step back and look at the forest through the trees. Crypto is moving to front and center of the global stage in response to the needs of people everywhere. This is no tulip [bubble]. This is the most important technological innovation since the internet the first time around.”

Where the asset class is heading

Although Bitcoin is up by more than 26.5 percent within a two-week span, the market has shown a relatively high level of volatility in comparison to past months, with volatility at levels not seen since the market crash in early 2018.

With Bitcoin ranging, technical analysts such as Hsaka have said that if the Bitcoin price can climb above key resistance levels then there is a possibility it tests yearly highs, depending on the reaction of the asset following a minor correction from $12,300.

Bitcoin Market Data

At the time of press 1:10 pm UTC on Dec. 15, 2022, Bitcoin is ranked #1 by market cap and the price is up 2.84% over the past 24 hours. Bitcoin has a market capitalization of $147.87 billion with a 24-hour trading volume of $15.48 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:10 pm UTC on Dec. 15, 2022, the total crypto market is valued at at $222.24 billion with a 24-hour volume of $55.35 billion. Bitcoin dominance is currently at 66.52%. Learn more about the crypto market ›