Analyzing Charlie Lee’s legendary Litecoin price predictions

Analyzing Charlie Lee’s legendary Litecoin price predictions Analyzing Charlie Lee’s legendary Litecoin price predictions

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Charlie Lee, the creator and founder of Litecoin, made a number of bold price predictions over the past few years. These predictions have had startling accuracy. Among his predictions, he accurately forecasted the bottom for LTC and also infamously sold his holdings near the top of the 2017 bull market.

Charlie Lee was a former Google employee and computer scientist prior to founding Bitcoin’s complementary cryptocurrency, Litecoin. After Google, Lee was the managing director of engineering at Coinbase. He now works for the Litecoin Foundation to encourage the cryptocurrency’s adoption full-time. Lee said to Forbes:

“When I released Litecoin there were a lot of other cryptocurrencies that were pre-mined by founders [that] wanted to be super rich. I preannounced Litecoin on Bitcointalk, so people could mine it from the get go. It was more widely distributed from the start than Bitcoin.”

Litecoin is a cryptocurrency that aims to be a medium-of-exchange counterpart to Bitcoin’s proposition as a store-of-value. So much so that Litecoin is oftentimes colloquially likened to silver and Bitcoin to gold among crypto-enthusiasts.

Lee’s Legendary Price Predictions

On May 8th, 2017, Litecoin was the first major cryptocurrency to implement Segregated Witness (SegWit). SegWit mitigates a blockchain size limitation problem that reduces transaction speeds and also laid the groundwork for Lightning Network.

More than a month prior to the network-wide implementation of the update, Charlie Lee correlates the number of nodes signaling that they will implement SegWit to the price of LTC:

I figured out what LTC price* will be when we have activated SegWit!

20% => $4

60% => $9

100% => $14* This is not trading advice! ?

— Charlie Lee [LTC⚡] (@SatoshiLite) April 4, 2017

At open on Apr. 3rd, the day of the tweet, Litecoin was trading at $7.74 per coin. With a final prediction of $14, his forecast was expecting an 81 percent increase in the price of LTC.

Two days later, On Apr. 5, the coin closed above $11. On May 10th, the day of SegWit’s full implementation on the Litecoin network, it closed at $31.96—far above what he was expecting, with the price increasing over four-fold.

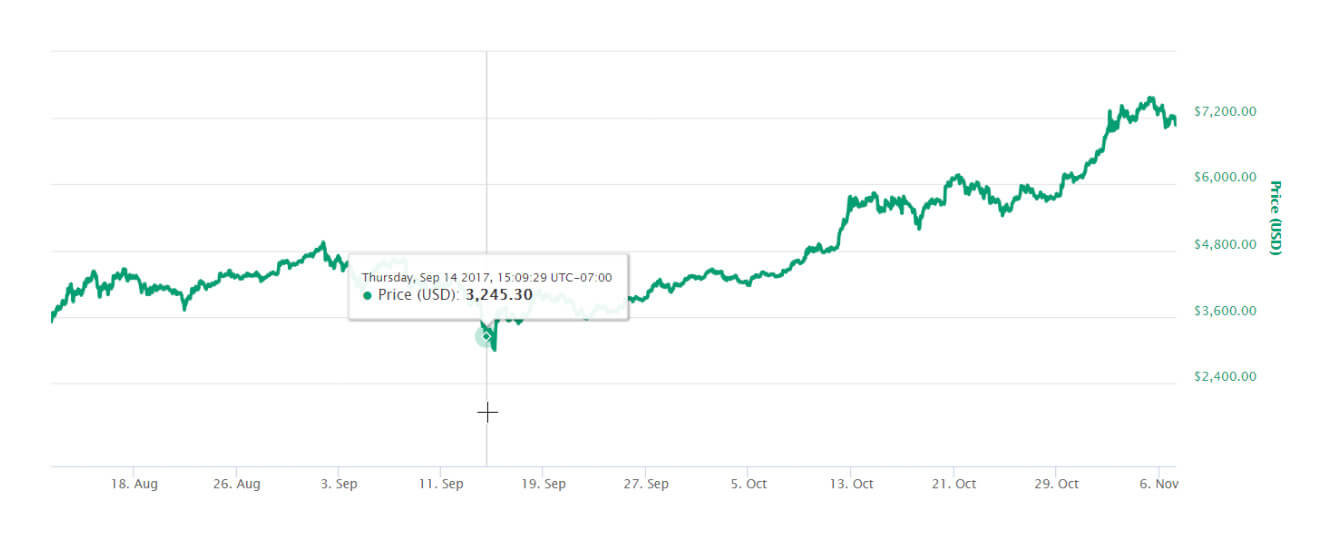

On Sep. 14, 2017, Tuur Demeester—founder of Adamant Capital, a Bitcoin Alpha fund—started buying bitcoin after it precipitously dropped from $4,650 to $3,000 in one week. Charlie Lee agreed, calling the bottom:

I agree. I think we are at the bottom or close to it.

— Charlie Lee [LTC⚡] (@SatoshiLite) September 14, 2017

By the next day, bitcoin hit its bottom just below $3,000. BTC has not traded at such a low price since.

Predicting the Incoming Crypto Winter

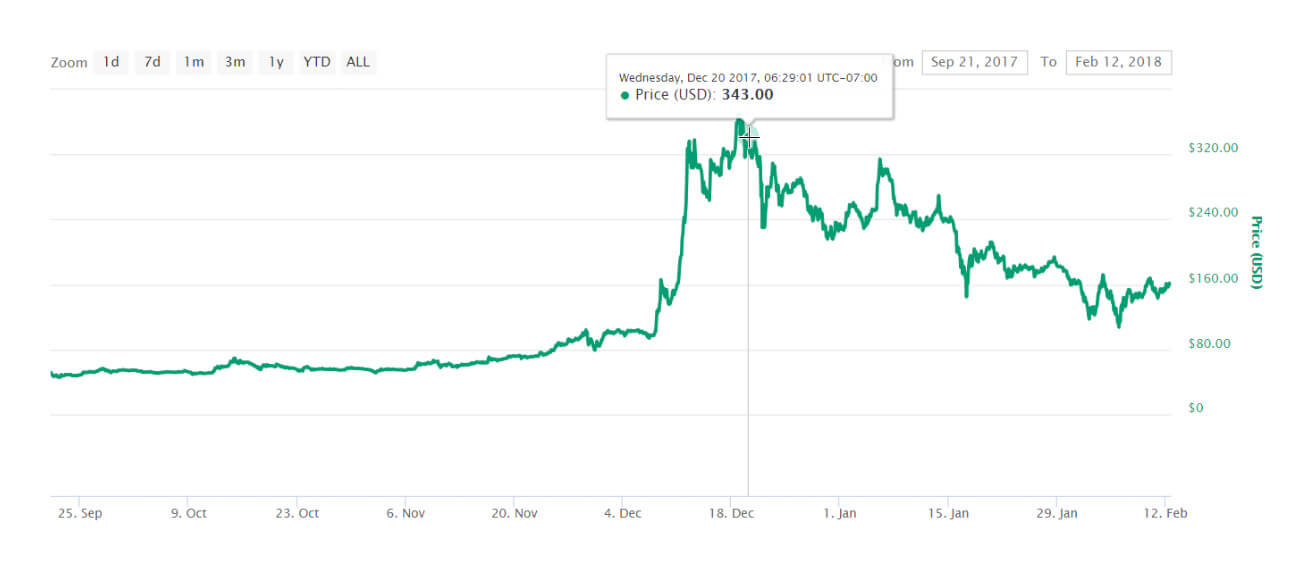

Charlie Lee went on to predict the top of the market in anticipation of the ensuing crypto winter. He announced that he expected a similar multi-year bear market to decimate the price of LTC:

Ok, sorry to spoil the party, but I need to reign in the excitement a bit…

Buying LTC is extremely risky. I expect us to have a multi-year bear market like the one we just had where LTC dropped 90% in value ($48 to $4). So if you can't handle LTC dropping to $20, don't buy! ?

— Charlie Lee [LTC⚡] (@SatoshiLite) December 11, 2017

Roughly one year after cryptocurrency prices peaked in December-January, amidst the lows of the bear market, traders were astonished at Lee’s predictions of Litecoin bottoming at $20:

If $LTC bottom was $22 (which i highly doubt), @SatoshiLite will be considered the best positional trader in my book.

Literally sold the top in December 2017 and told people not to buy if they couldn't handle a drop to $20.

You can't make this stuff up! pic.twitter.com/c4dfJ2Rxym

— The Crypto Monk ⛩ (@thecryptomonk) December 8, 2018

Shortly after his tweet predicting Litecoin’s bottom at $20, Lee also announced that he sold his entire LTC holdings—almost perfectly predicting Litecoin’s bull market peak.

In his announcement to the community on selling his holdings, Lee stated:

“…there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general. For this reason, in the past days, I have sold/donated all my LTC. Litecoin has been very good for me financially, so I am well off enough that I no longer need to tie my financial success to Litecoin’s success. For the first time in 6+ years, I no longer own a single LTC…”

The “Flappening”

The ‘Flappening’ is a play on words on the previously anticipated “flippening,” where Ethereum would overtake Bitcoin by market capitalization. The Flappening is where Litecoin would overtake Bitcoin Cash in the rankings, with BCH outranking LTC for several consecutive months.

Litecoin enthusiasts adopted the terminology by embodying its founder, Charlie Lee, into the term–Lee’s online nickname and persona as the ‘Chikun’ makes the vernacular appropriate.

On Feb. 25, 2018, Lee predicted that LTC would overtake BCH’s position:

The flippening (ETH>BTC) will never happen. But the flappening (LTC>BCH) will happen this year. ?? pic.twitter.com/vn9XBdZNC3

— Charlie Lee [LTC⚡] (@SatoshiLite) February 25, 2018

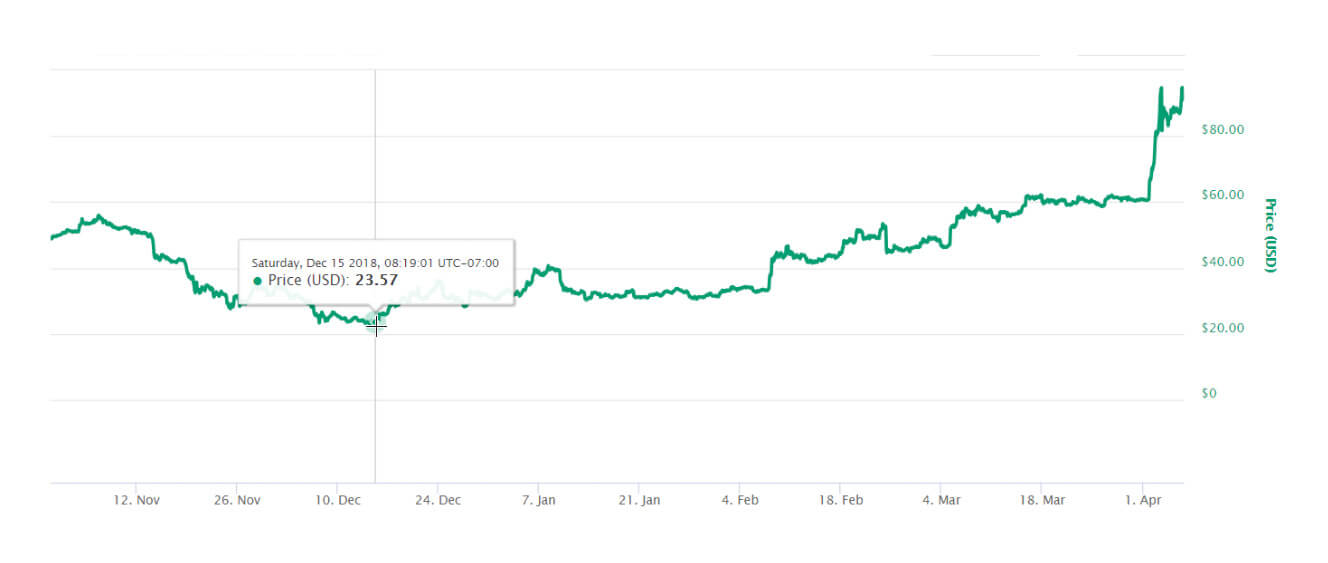

And, in December of that same year, the “flappening” occurred following the Bitcoin Cash hash wars where BCH split into Bitcoin Cash ABC and Bitcoin SV, significantly devaluing the coin.

The flappening! @SatoshiLite Congrats on this. Seriously. $LTC $BCH $BSV pic.twitter.com/LTcL1mzrUb

— WhalePanda (@WhalePanda) December 14, 2018

On Dec. 15, 2018, the day after the flappening, Litecoin briefly hit its multi-year bottom of $22—just $2 away from his prediction over a year earlier—Lee (aptly) tweeted:

⚡️ “Don't bet against Charlie Lee”https://t.co/sDzXJQ8srL

— Charlie Lee [LTC⚡] (@SatoshiLite) December 16, 2018

Following his tweet, Litecoin rebounded from its $22 low and has not traded at a lower price since.

These are only a limited selection of the predictions that Charlie Lee has made. Unlike other pundits who assert that they can predict the price of Bitcoin or see into the future, Lee doesn’t make those claims. And, the times he does make predictions he often does so with astounding accuracy.

If his track record tells investors anything, the Litecoin founder’s advice “don’t bet against Charlie Lee” seems sound.

Credit to Jacob Canfield for his TradingView observations which inspired this post.

Litecoin Market Data

At the time of press 2:33 am UTC on Nov. 7, 2019, Litecoin is ranked #5 by market cap and the price is up 0.03% over the past 24 hours. Litecoin has a market capitalization of $5.42 billion with a 24-hour trading volume of $4.62 billion. Learn more about Litecoin ›

Crypto Market Summary

At the time of press 2:33 am UTC on Nov. 7, 2019, the total crypto market is valued at at $220.9 billion with a 24-hour volume of $75.47 billion. Bitcoin dominance is currently at 59.20%. Learn more about the crypto market ›

CoinGlass

CoinGlass

Farside Investors

Farside Investors