Bitcoin Scalability Update: SegWit, Transaction Efficiency, and Lightning Network Implementation

Photo by Paul Smith on Unsplash

Bitcoin SegWit transactions now constitute over 40% of all Bitcoin network activity as adoption continues steady growth amongst scalability concerns.

Recent statistics from transactionfee.info show that SegWit adoption has maintained robust growth as large exchanges continue to support the scalability solution.

The SegWit update enabled the network to rapidly clear a backlog of pending transactions during the start of 2018 and its increased adoption resulted in a persistently low average confirmation time of around 15 minutes.

Benefits of SegWit

The SegWit update also permitted the Bitcoin network to provide malleability in its transactions, allowing the implementation of functionality like the Lightning Network and atomic swaps operating as a smart contract layer upon the BTC network.

These features increased usage of the platform by providing users with a reliable mechanism for low-cost exchange and payments.

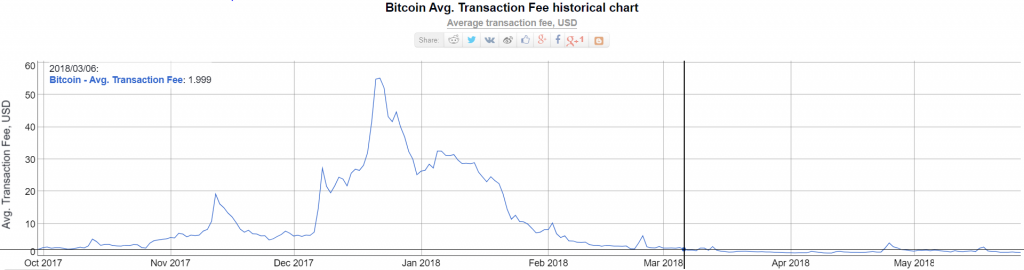

The result of these changes to the core network maintained an average transaction fee below $2 since the start of March 2018, a decrease from the record high of $55 in December 2017.

The price of transactions may fall as service providers follow the lead of major exchanges like Binance and Coinbase, with the recent addition of cold wallet and vault provider Xapo being among other recent additions.

Xapo provides an institutional-grade custodial service for Bitcoin management by giving large-scale investors secure vaults and electronic biometric verification.

Xapo’s vaults currently contain roughly 7% of total global Bitcoin supply, placing the Swiss company as having more substantial deposits than 98% of the roughly 5,670 US banks.

Xapo’s recent adoption of SegWit will enable significant amounts of Bitcoin transactions to be processed as SegWit-enabled, further decreasing costs and network burden.

MIT Helps to Bring BTC into the Future

Research taking place at MIT’s Distributed Technology Initiative has provided cutting-edge techniques to reduce the negative cost of scalability on the network further.

The demo utilized an experimental use case for the Lightning Network through the functionality of SegWit with smart contracts to handle millions of transactions with a higher degree of complexity.

By providing smart contracts with trusted data channels (oracles), the team has demonstrated a level of dynamic flexibility previously unavailable to the network.

These trusted avenues would have the added benefit of allowing large amounts of non-integral data to be offloaded from the blockchain, decreasing the overall workload required to process and verify transactions.

Users will be able to draw data from a range of outside sources without having to rely on a single trusted party by pulling data from a network of redundant oracles that operate under an incentivized data integrity scheme.

Oracles allow dApps to retrieve information such as stock prices, news, and weather from publically available repositories to supplement the data-driven elements of their functionality.

Business Facing Bitcoin Payment Solutions on the Rise

Meanwhile, companies like ACINQ are lowering the barrier to entry for business adoption by developing a Stripe-like API for the Lightning Network.

The development of the payment platform, called Strike, allows for a flat fee per lightning transaction while providing web developers with a familiar framework by using API calls and listening for webhook events.

Stripe’s digital payment platform currently occupies 18% of the market alongside industry giants like PayPal, Square, and AmazonPay.

Many customers have gravitated towards Stripe as a result of its simple fee structure, portable data management, and stable RESTful API. By enabling a similar scheme for Bitcoin transactions through Strike, ACINQ eliminated a significant hurdle for business adoption across internet driven marketplaces.

As SegWit usage increases to become a ubiquitous network-wide update, the ability for service providers to leverage the extended functionality of the BTC network will integral for mass adoption.