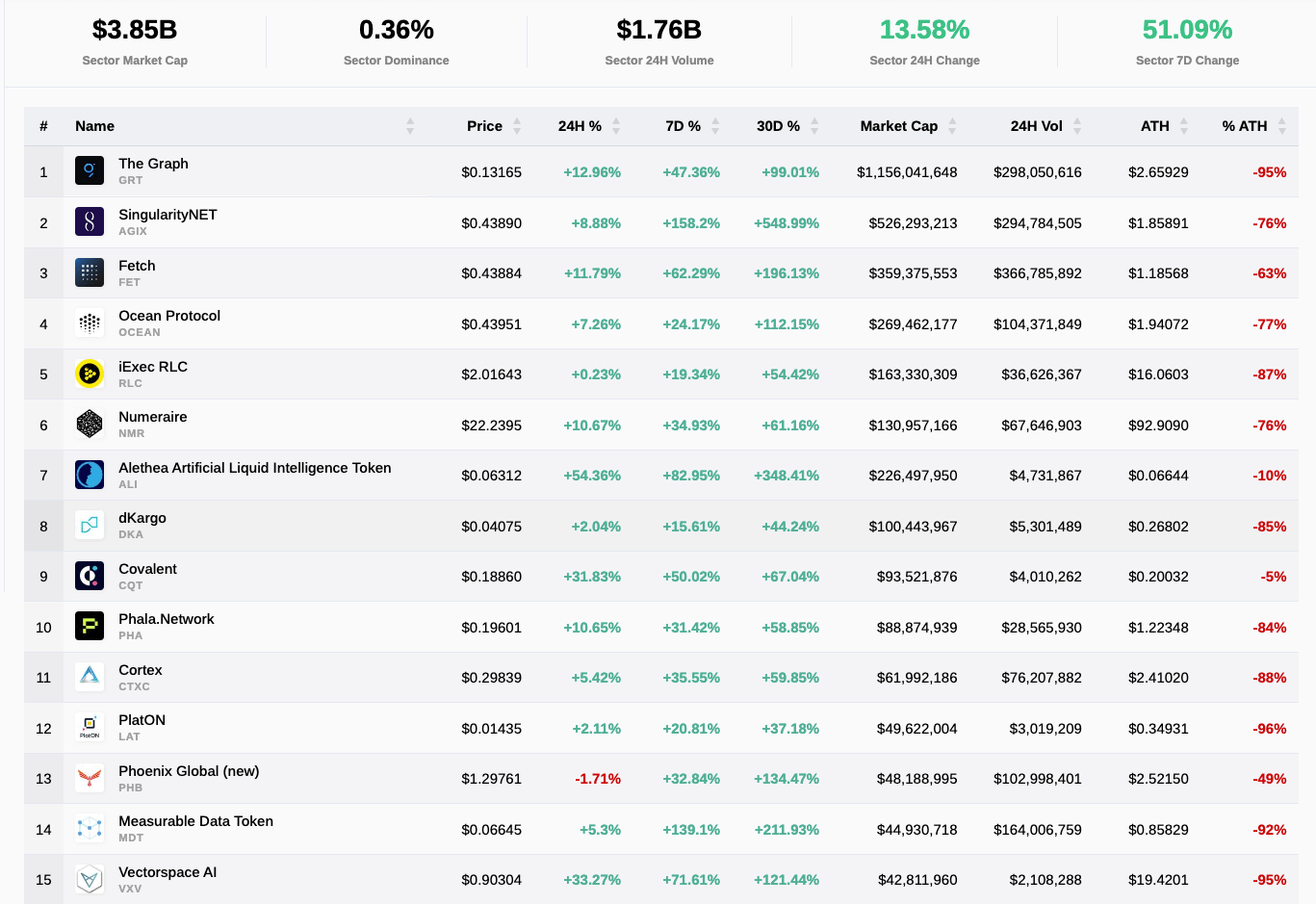

AI cryptos continue to sizzle with the market sector up over 51% in the past week

AI cryptos continue to sizzle with the market sector up over 51% in the past week AI cryptos continue to sizzle with the market sector up over 51% in the past week

Many mid-cap utility tokens provide protocols for everything from decentralized data to a human robot.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The market sector of AI crypto continues to sizzle, with the top 30 tokens all in the green over the last 30 days, a trend has left many investors wondering: how frothy can this top possibly get?

The news comes on the heels of the widely successful launch of ChatGPT, backed to the tune of $10 billion by Microsoft (a significant portion of which comes in the form of cloud computing credits via Microsoft’s Azure cloud platform); as well as a renewed push by Alphabet Inc. (Google’s parent company), who late last week reportedly committed to also invest at least $400 million in a ChatGPT rival, Anthropic.

ChatGPT is already upending many workflows and industries. It was the quickest app to achieve a 1 million downloads, a feat it achieved only five days after launch last December. It has also been integrated into Microsoft Teams, allowing the tool to act as a powerful virtual agent and office assistant.

The meteoric rise of the AI crypto sector also comes as institutional investors continue to look more deeply into the sector. In Cathie Wood’s recent ARK Invest report, for example, she cited the confluence of AI and blockchain as part of a broader shift in the coming years that will see investors increasingly look toward disruptive innovations in both sectors.

Other analysts, however, are more skeptical.

According to a recent JP Morgan report, which drew from a survey of 835 institutional investors across 60 global markets, more than half of those surveyed said that they believe AI and machine learning will be the single most impactful technology in the coming years. That same survey, however, put shade on institutional investment in crypto, with nearly three out of four respondents saying that they “have no plans to trade crypto.”

So what explains the recent rise in the price of AI cryptos? Let’s look at some of the underlying technologies behind some of the sector’s biggest movers and shakers.

AI Cryptos – Movers and Shakers

The Graph (GRT) market capitalization: $1.1 billion

GRT is the top-ranked AI crypto by market cap at over $1.1 billion, with a dominance of over $500 million to its closest competitor (SingularityNET, whose market cap presently stands at $517 million). GRT is a decentralized platform for indexing and querying data from blockchains, specifically designed for the decentralized web (Web3). It uses a novel indexing and querying mechanism that enables fast and efficient data retrieval from decentralized sources, making it a key infrastructure component for decentralized applications (dApps).

GRT’s focus on providing efficient and reliable data retrieval for decentralized applications sets it apart from other AI-based cryptocurrencies.

Additionally, GRT is designed to be a decentralized network, where validators are incentivized to contribute their computing resources to index and query data. This makes it a truly decentralized and open platform for data indexing and retrieval, setting it apart from other centralized solutions in the market.

- Price: $0.13

- 24H%: +11.6%

- 7D%: +47.18%

- 30D: +93.09%

- % ATH: -95%

SingularityNET (AGIX) market capitalization: $529.62 million

AGIX is an AI marketplace that serves as an ecosystem for AI-related apps and projects. It has gained popularity due to its focus on democratizing AI and allowing developers to access AI resources easily, allowing developers to create, share, and monetize AI services across their ecosystems. AGIX runs on Ethereum and Cardano, created by a team of AI and blockchain experts led by Dr. Ben Goertzel, who is also known for his work on the development of Sophia the Humanoid Robot.

AGIX was created to provide a decentralized platform for AI development, with Sophia serving as a demonstration of the potential of the technology. AGIX is now mainly an AI marketplace that allows different actors to use its network. It also includes a staking platform allowing AGIX tokens to help maintain the platform’s AI marketplace.

- Current Price: $0.43

- 24H%: +2.35%

- 7D%: +152.41%

- 30D%: +491.69%

- % ATH: -76%

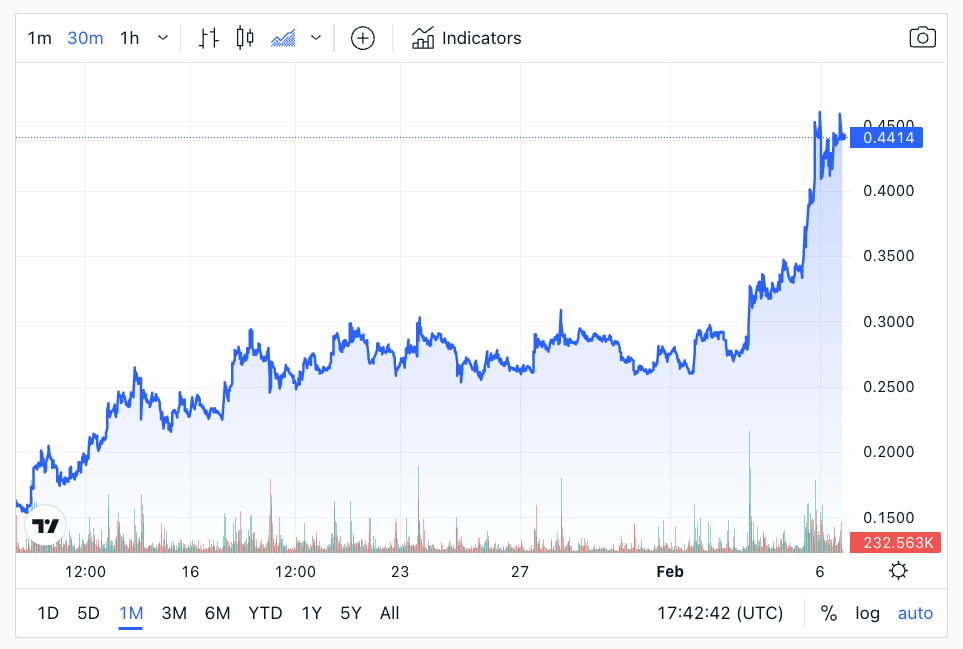

Fetch (FET) market capitalization: $359.54 million

FET is located in the Cosmos ecosystem and essentially functions as a layer 1 protocol that allows users to use its peer-to-peer automation bot service using AI. A team of experts in AI, blockchain, and cryptography created it. The team is founded by Humayun Sheikh, Thomas Hain and Toby Simpson, who have extensive experience in developing intelligent systems and decentralized technologies.

What makes FET unique is its use of AI and blockchain technology to create a decentralized network for intelligent automation. The network enables self-organizing systems and provides a platform for creating and deploying other AI-powered decentralized applications. But unlike Singularity, which is essentially an AI marketplace, Fetch uses agents to create smart contracts, able to detect and perform certain functions.

Additionally, FET has a unique consensus mechanism that combines elements of Proof-of-Work (PoW) and Proof-of-Stake (PoS), using this unique consensus mechanism to operate as a decentralized AI-powered network that enables intelligent automation and self-organizing systems.

Their focus is on intelligent automation, with Fetch.ai’s digital tokens serving as a means of accessing the platform’s resources and services, providing a direct incentive for token holders to use and participate in the network actively.

- Price: $0.43

- 24H%: +15.71%

- 7D%: +61.83%

- 30D: +177.88%

- % ATH: -63%

Ocean Protocol (OCEAN) market capitalization: $272.29 million

OCEAN is a big data project created by a team of experienced technology and business professionals led by Bruce Pon and AI researcher Trent McConaghy.

The two combined to create Ocean in 2017, based on the idea it could function as a decentralized data storage and privacy service (think VPN, browsers, etc.). They provide Data NFTs, Data farming and expansion of the Ocean DAO and ecosystem. The data NFTs developed by OCEAN provides an IP framework that combines ERC20 and ERC721 and potentially enables multiple revenue streams against the base IP, with different sub-licenses. OCEAN has also been featured in the World Economic Forum’s list of innovators in the data economy.

- Price: $0.43

- 24H: +4.71%

- 7D%: +18.3%

- 30D%: +102.81%

- % ATH: -77%

VAIOT (VAI) market capitalization: $40.34 million

VAI is very low-cap in crypto AIs, with a market cap of only $40.34 million; interest in it seems to stem from the fact it provides intelligent services powered by IBM. It offers a portfolio of blockchain-based AI assistants and on-chain Intelligent contracts for businesses and consumers to provide automated services and transactions.

Similar to ChatGPT’s integration with Microsoft’s Teams, VAIOT combines AI and blockchain to create a collection of business-focused Intelligent Virtual Assistants that cater to consumers and businesses. These virtual assistants will serve as a new digital medium for selling, delivering products and services, and conducting transactions, and importantly have a focus on allowing mobile integration (something a lot of other AI-focused apps tend to ignore, choosing instead to focus on desktop applications).

VAIOT ultimate aim seems to be to create a digital platform for both business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions between users, which utilize VAIOT’s blockchain and VAI tokens.

- Price: $0.20

- 24H: +9.4%

- 7D: +83.48%

- % ATH: -29.55%