Aftermath of the shocking $1,500 Bitcoin plunge: where do top traders see BTC next?

Aftermath of the shocking $1,500 Bitcoin plunge: where do top traders see BTC next? Aftermath of the shocking $1,500 Bitcoin plunge: where do top traders see BTC next?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

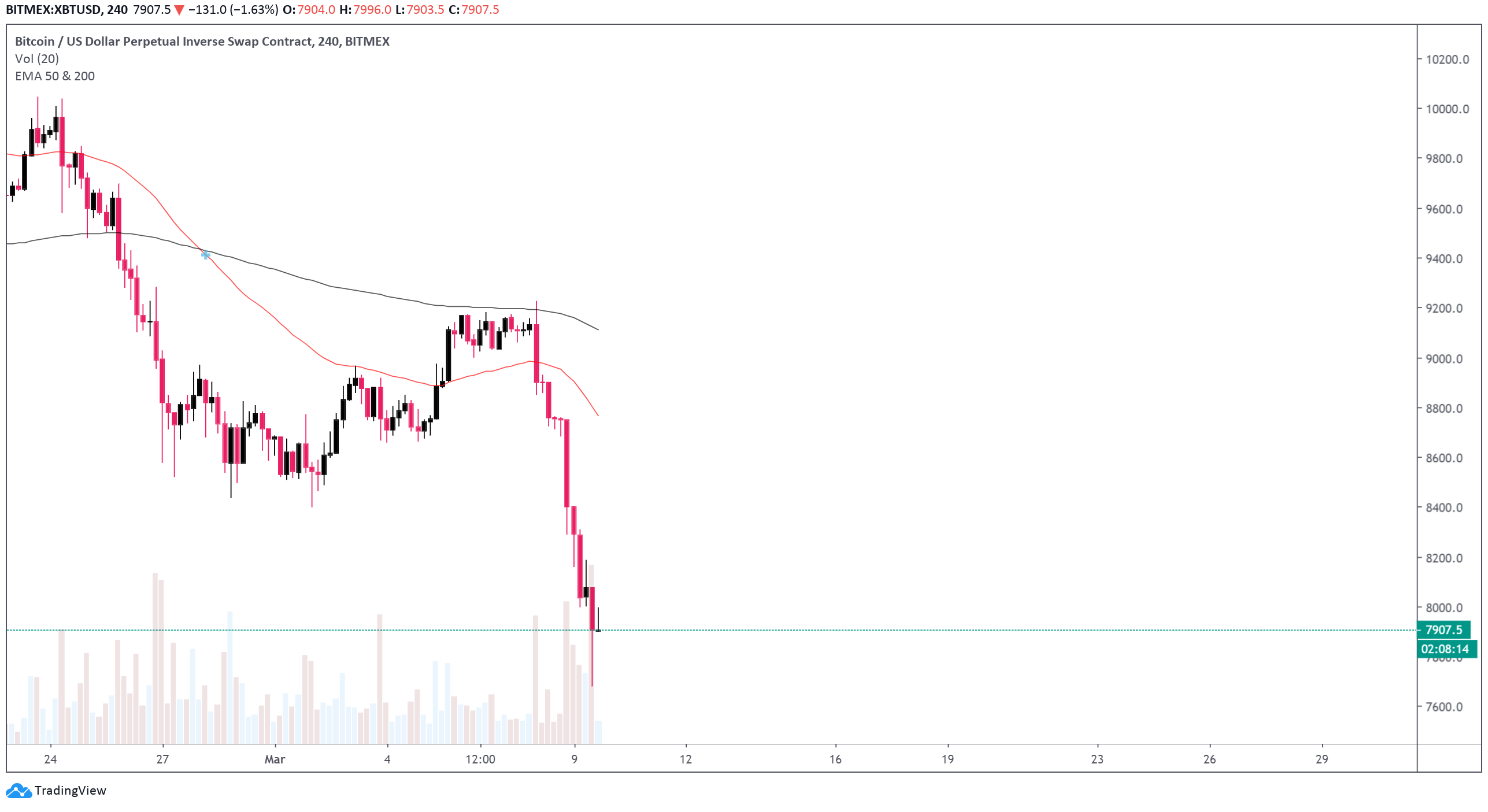

The Bitcoin price has dropped by 16 percent since March 8 in one of the steepest sell-offs in recent months. After the brutal drop, the sentiment of top traders on the short-term price trend of BTC remains divided.

Bitcoin trend is bearish, for a start

As reported by CryptoSlate, the overnight $1,500 plunge of Bitcoin led to the liquidation of around $185 million.

Highly-leveraged longs were forced to readjust their positions or market sell as the price started to fall rapidly, applying a massive level of selling pressure onto the market.

While there is a lack of correlation or inverse correlation between Bitcoin and the broader financial market, Bitcoin traders remain cautious about the current environment of both cryptocurrencies and other risk-on assets like single stocks.

Global markets analyst Alex Krüger said that amidst heightened uncertainty and unprecedented levels of fear, the Bitcoin price could drop 20 percent in a short time frame.

Compared to established safe-haven assets like gold, the market capitalization of Bitcoin remains at a mere $145 billion. A significant shift in sentiment in an unexpected manner can abruptly change the trend of the market.

Krüger said:

“BTC in this environment can drop 20% in an hour. It could come out of nowhere, as large whales panic or decide to liquidate positions to cover margin calls or hunt for bargains in other asset classes. No analysis of the past will uncover this.”

Since early February, analysts like Adaptive Fund’s Nik Yaremchuk said that the Bitcoin price is likely to test the $7,500 region, as it has acted as a liquidity pool for an extended period of time.

Often, when major support level like the $7,500 to $7,700 range is hit, it triggers a strong reaction from buyers.

The Bitcoin price went onto see a relief rally to around $8,000 but has fallen back to the low $7,900s since.

One prominent cryptocurrency trader said that after the breach of the $8,200 support, the main areas of lower level supports remain at $7,300 and $7,500. The trader said:

“And not even $8,200 is providing support. Now looks like it’s overdue for a bounce, but not expecting it to break $8,500. As discussed yesterday, main areas around $7,350-7,500 after $8,200.”

Renowned trader known as Romano said that while the $7,700 to $8,200 range remains as a favorable region for long-term buys, he said that whether $7,670 hit earlier today is a bottom remains unclear. He said:

“Not entirely convinced this was the bottom. The dream is to long between 7.7k-8.2k and if possible hold till new all highs. Sad for the people who longed their longs and didn’t close hoping for new all time highs without a pullback. Had the same last bull run summer.”

Expect significant volatility

As said by Joe007, the largest individual Bitcoin whale on Bitfinex, the Bitcoin price has never endured the risk of an actual recession or a global financial market crash.

In such a period, the price trend of BTC could rely more on the sentiment around global markets, rather than the technical and fundamentals of the crypto market.

Bitcoin Market Data

At the time of press 10:04 am UTC on Mar. 9, 2020, Bitcoin is ranked #1 by market cap and the price is down 9.38% over the past 24 hours. Bitcoin has a market capitalization of $144.78 billion with a 24-hour trading volume of $47.11 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:04 am UTC on Mar. 9, 2020, the total crypto market is valued at at $228.42 billion with a 24-hour volume of $179.2 billion. Bitcoin dominance is currently at 63.45%. Learn more about the crypto market ›