The Investor’s Guide to Cryptocurrency Taxes

The Investor’s Guide to Cryptocurrency Taxes

Photo by NeONBRAND on Unsplash

The April 17th tax deadline is fast approaching. The following guide contains instructions on calculating taxes on your cryptocurrency investments.

Cryptocurrencies outperformed nearly every other traditional asset. Since the beginning of the year, the value of cryptocurrencies increased by an average of 900%. Given the staggering increase in value, investors are likely to owe a sizeable chunk of taxes to the IRS.

Cryptocurrency’s Treatment as Property

In order to understand the tax implications of cryptocurrency trading it’s important to firstthe myth that the IRS treats crypto as a “currency.”

According to the IRS, for all intents and purposes, cryptocurrency is considered a property for tax purposes. The treatment is similar to other tangible assets, like gold or raw materials; principles applicable to property transactions apply to those with crypto.

Correspondingly, cryptocurrency is not treated as “currency,” and does not generate foreign currency gains or losses.

Determining the Cost Basis of Virtual Currency

The first step to calculating your taxes is to find the cost basis of your holdings. Cost basis is the purchase price, plus other costs associated with purchasing the cryptocurrency. Things included in cost basis include transaction fees and brokerage commissions.

To calculate the cost basis of your holdings do the following calculation:

- (Purchase Price + Additional Fees) / Quantity of Holding = Cost Basis

The more costs you can include in your basis, the less you will need to pay in taxes. Once you determine the basis, you can calculate a gain or a loss at the time of sale using the following formula:

- Sale Price – Cost Basis = Gain/Loss

Determining Fair-Market Value

One crucial piece of information for cryptocurrency transactions is fair-market value. The best way to determine fair market value is through an exchange.

Reference the price history of the cryptocurrency, in USD, at the time of the transaction.

You may use the open, close, or average price for a given date so long as you apply the treatment consistently to all of your transactions.

Taxes for Purchases Made With Cryptocurrency

Nothing is certain, except death and taxes.

The same holds true for cryptocurrency. You can’t escape taxes, even if you use your coins to purchase goods and services.

Based on statements from the IRS, it doesn’t matter if you sold cryptocurrency for cash or used it to buy a Lamborgini. In both cases, the IRS views it (see Q-6) as if you sold the coins.

This approach is not unique to cryptocurrency. Companies which trade something for company stock incur a similar kind of tax.

Nonetheless, this is a hassle. If you conduct a large number of trades using cryptocurrency, you must report every exchange and calculate the gain or a loss at the point of each transaction.

Incurring Taxes When Trading Cryptocurrency

Like stocks, every time you trade your cryptocurrency, even if it’s for another cryptocurrency, you incur capital gains or losses.

The treatment stems from the IRS’s treatment of commodities in general. The same treatment also applies if you traded company stock for tangible property.

An interesting side effect of the IRS’s treatment is that you’re still liable for taxes, even if you don’t have the cash.

For example, suppose you purchase a Bitcoin for $5,000. Shortly afterward the price appreciates to $5,100, and you trade it for $5,100 worth of Ethereum. The trade triggered a taxable event, and you’re now liable for $100 of taxable income even if you didn’t get any cash.

Due to these taxable events, it is critical that you keep a record of your transactions. The IRS places the onus on the taxpayer, and if you can’t provide records the IRS may have grounds to charge you the highest possible tax rate.

For more information see Publication 544, Sales and Other Dispositions of Assets, for information about the tax treatment of sales and exchanges.

Taxes On Sale: Short-Term Capital Gains

The most common taxable event is short-term capital gains. Cryptocurrency capital gains occur when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than basis.

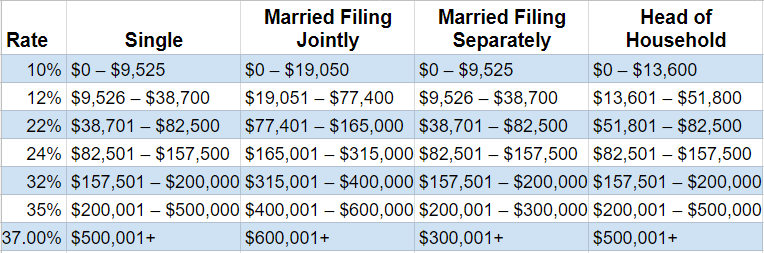

Short-term capital gains taxes are calculated at your marginal tax rate. Below is a table that elaborates on the different tax brackets depending on your filing status:

To illustrate how to navigate the marginal tax brackets, suppose you’re a single filer. You made $38,000 during the current tax year, and you had purchased Bitcoin six months ago for $5000 including fees and commissions. Today, you sold the Bitcoin for $6,000, a net gain of $1,000.

The $1,000 raises your income to $39,000 for the year. Based on the marginal tax rate table above, the first $700 is taxed at the 12% rate, generating $84 in taxes. The remaining $300 is taxed at 22% as it exceeds the $38,700 threshold, generating $66 in tax. In total, the $1,000 would generate $150 in taxes.

Saving on Taxes Through Long-Term Capital Gains

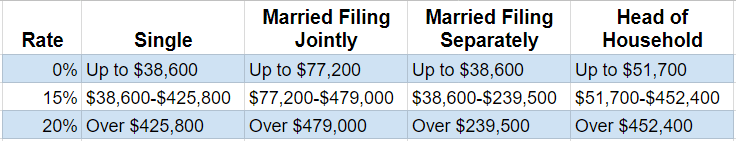

For the HODLers out there, if you held onto your cryptocurrency for a year or more you qualify for a lower long-term capital gains rate. The table below details the brackets for 2018:

The different schedule affords HODLers with a much better tax rate if they hold, continuously, for a year or more.

Any trades into other cryptocurrencies likely reset the counter for long-term capital gains.

Taking the example from the previous section, assume that all the facts of the transaction are the same, except that you purchased the Bitcoin last year.

You still earned $38,000 during the year, and again had a gain of $1,000 from selling your Bitcoin.

Based on the table you would have $600 that would be tax-free, and you would have another $400 taxed at 15%, amounting to $60 in tax, a whole $90 less than the first example.

Even with the same amount of income and gains, taxes were 40% lower in the second example.

The Catch with Capital Losses

If you were stuck holding heavy bags during the market downturn then there a few things that make taxes a little trickier.

In the ideal situation, where you make more than you lose from trading, you simply net your losses against your gains.

However, if your losses exceed your gains, you may only deduct up to $3,000 from your taxable income. Anything in excess of $3,000 is carried forward, year after year, and applied to taxes in subsequent years until the balance reaches zero.

Depending on how heavy your bags were, the $3,000 limit may cause you to carry losses forward for years, or even decades. The good news is these losses don’t expire; the bad news is you don’t get more of a break beyond the $3,000 reduction.

You can learn more about capital losses from this publication from the IRS.

What About Like-Kind Exchanges?

Another confusing feature of the tax code that is tossed around is something called a “like-kind” exchange. Such exchanges substantially reduce taxes for crypto to crypto trades, assuming that it’s applicable.

However, like-kind exchanges, or a 1031 exchange, allow someone to defer paying taxes on gains if the proceeds of the sales are reinvested in real-estate.

Some have argued that like-kind exchanges would allow cryptocurrency investors to trade into another cryptocurrency without triggering any taxes.

That said, Congress has made it clear in the 2017 budget law Tax Cuts and Job Act that like-kind exchanges are indeed, limited to real-estate. According to the law:

Personal property such as patents, machinery, artwork, collectibles, and presumably cryptocurrencies are not covered by Section 1031 of the Internal Revenue Code.

However, the classification is not set in stone until a tax court rules on one of these cases. For additional information regarding like-kind exchanges check out Section 1031 of the Internal Revenue Code.

What if I Did My Taxes Incorrectly for a Prior Year?

You’re in luck, the IRS has your back (/s). In a notice to taxpayers, the IRS provides a stern warning to those who don’t follow the law:

“Taxpayers may be subject to penalties for failure to comply with tax laws. For example, underpayments attributable to virtual currency transactions may be subject to penalties, such as accuracy-related penalties under section 6662. In addition, failure to timely or correctly report virtual currency transactions when required to do so may be subject to information reporting penalties under section 6721 and 6722.”

However, those that are looking to atone for their cryptocurrency-related tax sins may get relief:

“Penalty relief may be available to taxpayers and persons required to file an information return who are able to establish that the underpayment or failure to properly file information returns is due to reasonable cause.”

In all of the complicated codes and laws, it’s nice to know the IRS is willing to give you a helping hand.

If you liked the article above, take a look at our related article The Cryptocurrency Miner’s Guide to Taxes