Tether USDT stability tested amid crypto market shakeup

Tether USDT stability tested amid crypto market shakeup Tether USDT stability tested amid crypto market shakeup

Crypto traders are showing preference for other stablecoins as Curve's pool is slighly imbalanced.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Tether’s USDT stablecoin value wobbled from its $1 peg amid the market carnage that wiped nearly $100 billion from the crypto market on Aug. 17.

Typically, cryptocurrency traders resort to stablecoins as a hedge against the inherent market volatility within the industry. These assets are designed to consistently maintain their pegged value, irrespective of prevailing market conditions.

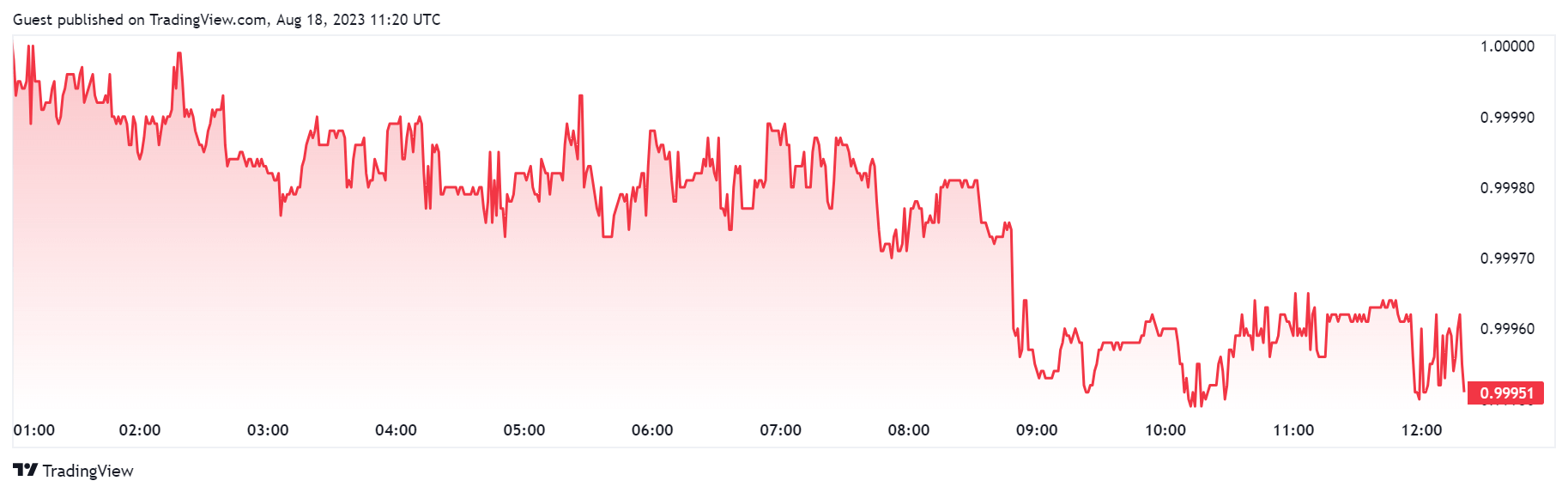

USDT, however, failed at that during the last 24 hours as its value oscillated between $0.99847 during the thick of the carnage on Aug. 17 to as high as $1.0007 during the early hours of today, according to Tradingview data.

Data from CryptoSlate shows that USDT has recovered but has yet to fully regain its $1 peg as of press time. The stablecoin was trading for $0.99951 at the time of writing.

Tether’s USDT is the largest stablecoin by market cap, controlling more than 60% of the entire market, according to CryptoSlate’s data. Per its quarterly attestation, the stablecoin issuer has an excess reserve of up to $3.3 billion.

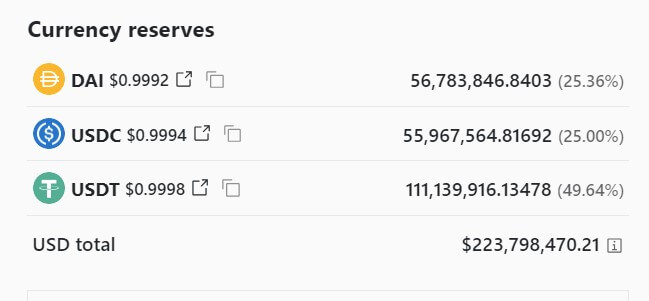

However, a look at 3Pool’s dashboard — the largest liquidity pool on Curve —shows that crypto investors favored rival stablecoins options over USDT during the market situation. According to the dashboard, USDT accounts for nearly 50% of the reserve, while USD Coin (USDC) and DAI make up the 50% balance.

This means traders have likely been selling USDT for DAI and USDC, as the pool is supposed to contain an equal amount of 33.33% of each of the three stablecoins.

Additionally, Tether’s market cap saw a slight decline from a peak of $83.08 billion to its current balance of $82.8 billion, according to CryptoSlate’s data. This further indicates how the market situation impacted USDT as traders sought refuge in other assets.

Notwithstanding these challenges, USDT emerged as the most traded stablecoin in the past 24 hours, boasting a trading volume exceeding $50 billion. This figure is six times higher than its rival, USDC, recorded during the same period.