CryptoSlate Wrapped Daily: Ethereum losses deflationary gains; Andre Cronje reveals how DeFi saved Fantom

CryptoSlate Wrapped Daily: Ethereum losses deflationary gains; Andre Cronje reveals how DeFi saved Fantom CryptoSlate Wrapped Daily: Ethereum losses deflationary gains; Andre Cronje reveals how DeFi saved Fantom

Andre Cronje said that Fantom invested about $4 million into DeFi yields and grew its treasury to over $51 million in 2021, crypto exchanges dismiss growing insolvency rumors post-FTX fallout, and much more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptoverse for Nov. 29 includes exchanges dismissing rumors of insolvency, NEXO releasing proof of reserves, Andre Cronje revealing how DeFi helped Fantom grow its reserve, U.S. politician Beto O’Rourke returning a $1 million donation to Sam Bankman-Fried, and ETH erasing 80% of deflationary gains post-FTX collapse.

CryptoSlate Top Stories

Exchanges dismiss rumors of insolvency amid rampant speculation

With the unexpected collapse of FTX, BlockFi, Celsius, and Voyager, the crypto community is questioning the solvency of more crypto exchanges including Binance, KuCoin, and Nexo.

Particularly, KuCoin’s Dual Investment product which promises up to 200% APR has raised questions about the exchange’s liquidity state.

However, KuCoin CEO Johnny Lyu in a recent interview with CryptoSlate dismissed the insolvency rumors, adding that his exchange is “fully liquid” and collaborating with third-party auditors to publish its proof of reserves.

Andre Cronje reveals how DeFi saved Fantom; FTM surges 17%

Fantom founder Andre Cronje acknowledged the role of DeFi earning activities in helping the layer-1 blockchain grow its treasury to over $51 million in 2021.

According to Cronje, as of February 2020, Fantom was left with about $4 million from the $40 million it raised in 2018. It took advantage of yield farming on Compound and similar DeFi platforms to generate about $2 million yearly.

At the moment, Cronje said that Fantom held over 450 million FTM tokens ($96.43 million), $100 million worth of stablecoins, $100 million in other crypto assets, and $50 million in non-crypto assets.

NEXO releases proof of reserves showing no exposure to FTX

Nexo published its proof of reserves which revealed that it has a 100% collateralization for about $3.4 billion of customers’ assets held in its custody. Additionally, it had $0 exposure to FTX and Alameda Research, as it was able to withdraw all its debt before the exchange blew up.

Nexo called on other lending platforms to be cautious when issuing uncollateralized loans as it may be difficult to repay during bear market conditions.

Bitcoin Volatility Index exceeds 100% for the third time in 2022

The BTC Volatility Index (BVIN) which was lingering at its all time-lows prior to the FTX collapse, has surged by over 100% in recent weeks.

Historical data shows that during the 2014-2015 bear market, BTC fell by 85% from its all-time high following a similar surge of the BVIN metric.

Ripple general counsel calls BlockFi bankruptcy another success for SEC’s ‘regulation by enforcement’ approach

Ripple general counsel Stuart Alderoty said that the SEC’s $100 million fine against BlockFi may have contributed to the latter’s bankruptcy.

Ripple CTO David Schwartz added that BlockFi may have turned to FTX for $400 million so it can pay off the SEC fine, on a condition that BlockFi’s assets will be held on FTX.

BlockFi still owes the SEC about $30 million accounting to its bankruptcy court filings.

ETH deflationary gains erased post-FTX collapse

As of Nov. 12, Ethereum (ETH) was at its most deflationary rate of -0.00514%, however, it has retraced by over 80% to sit at -0.00090% as of Nov. 29.

Despite shedding off some deflationary gains, on-chain data shows that ETH addressed with more than 32 ETH has hit an all-time high.

Research Highlight

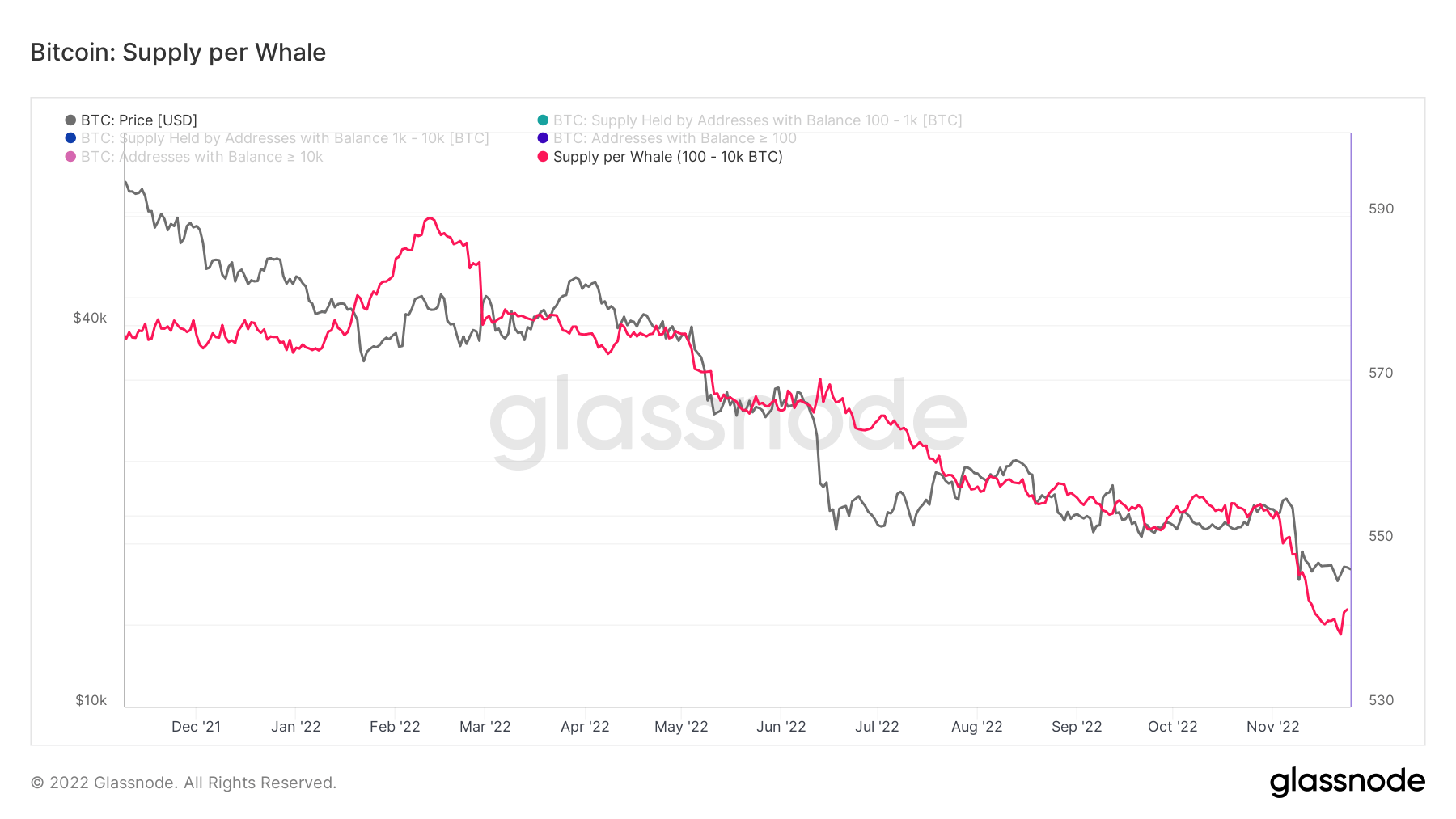

Whales have been offloading Bitcoin since 2021

CryptoSlate’s analysis of the Bitcoin supply per whale metric shows that whales have been selling off their holdings following the BTC price decline since the end of 2021.

From the chart, it is observed that the supply per whale metric has been mimicking Bitcoin’s price movements, particularly since Dec. 2021. Consequently, more whales have been liquidating their positions in the bear market.

News from around the Cryptoverse

U.S politician returns $1 million to SBF

Texas gubernatorial candidate Beto O’Rourke has reportedly returned a $1 million donation embattled FTX CEO Sam Bankman-Fried (SBF) gave to support his political campaign.

O’Rourke campaign spokesperson Chris Evans said the funds had to be returned as it was unsolicited, adding that O’Rourke has no direct relationship with SBF.

Phantom wallet to go multichain

Phantom which was initially launched as a Solana-only self-custody wallet has announced plans to go multi-chain.

It will add support for the Ethereum and Polygon networks, with additional functionalities for users to manage their NFTs using the browser extension.

Binance, Coinbase, and 4 others under probe by U.S. Congress

Chairman of the U.S. Senate Finance Committee Ron Wyden has issued letters to leading crypto exchanges including Binance, Coinbase, Bitfinex, Gemini, Kraken, and KuCoin to explain how they protect investors from FTX-like collapse, and systems to prevent market manipulation.

Wydan requested that the exchanges should include their balance sheet and proof of reserves information in the response which will be considered in the Congress’s next sitting.

Crypto Market

In the last 24 hours, Bitcoin (BTC) increased slightly by _1.35% to trade at $16.454, while Ethereum (ETH) increased by -+4.04% to trade at $1,219.

Biggest Gainers (24h)

- Telcoin (TEL): +26.62%

- Ribbon Finance (RBN): +19.28%

- Mask Network (MASK): +15.73%

Biggest Losers (24h)

- Ren (REN): -11.35%

- BrainTrust (BTRST): -10.83%

- MXC (MXC): -8.95%

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  Fantom

Fantom  XRP

XRP  FTX

FTX  Nexo

Nexo  Ripple

Ripple  BlockFi

BlockFi  Celsius Network

Celsius Network  Binance

Binance  KuCoin

KuCoin  Coinbase

Coinbase  Bitfinex

Bitfinex  Andre Cronje

Andre Cronje  Sam Bankman-Fried

Sam Bankman-Fried

CoinGlass

CoinGlass

Farside Investors

Farside Investors