Research: Whales have been offloading Bitcoin since 2021

Research: Whales have been offloading Bitcoin since 2021 Research: Whales have been offloading Bitcoin since 2021

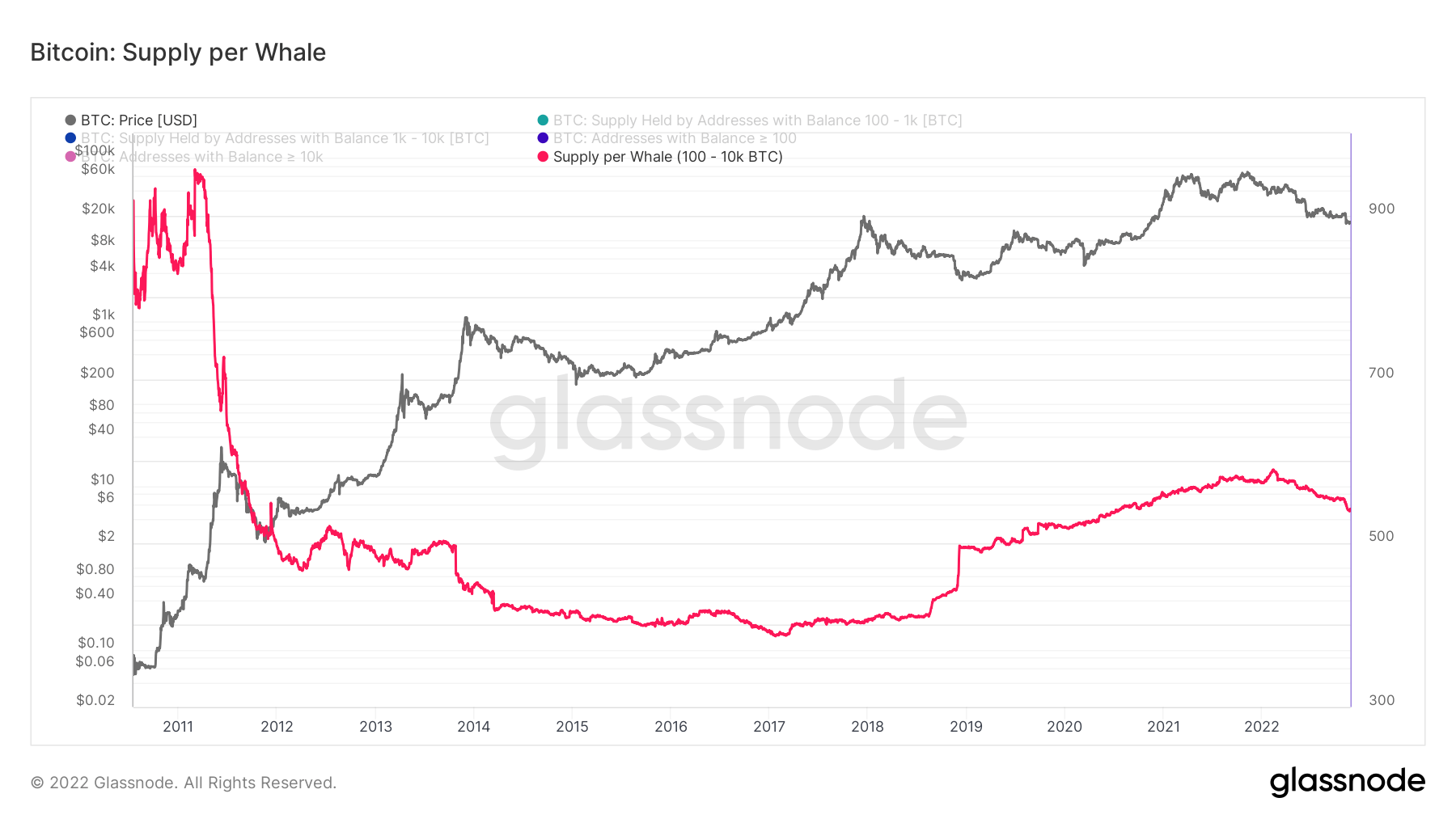

Bitcoin supply per whale has been following the price movements since 2014.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin (BTC) supply per whale has been mimicking the price movements since 2014 and has been declining since the end of 2021, indicating that whales are selling off their holdings, according to data analyzed by CryptoSlate.

Supply per whale takes the total BTC supply of addresses that hold between 100 and 10,000 BTC and divides it by the number of addresses. This metric accounts for a larger range of wallet denominations. It can better account for unspent transaction output (UTXO) consolidation or dividing large holdings across multiple addresses by larger coin holders.

This metric is expected to increase when whales are growing their aggregate holdings, and decrease as they liquidate their positions.

The chart above demonstrates the BTC price movement and supply per whale since 2011. While the whales’ movements were unpredictable for the first years, the data clearly shows that the supply per whale line has been following the BTC price since 2014.

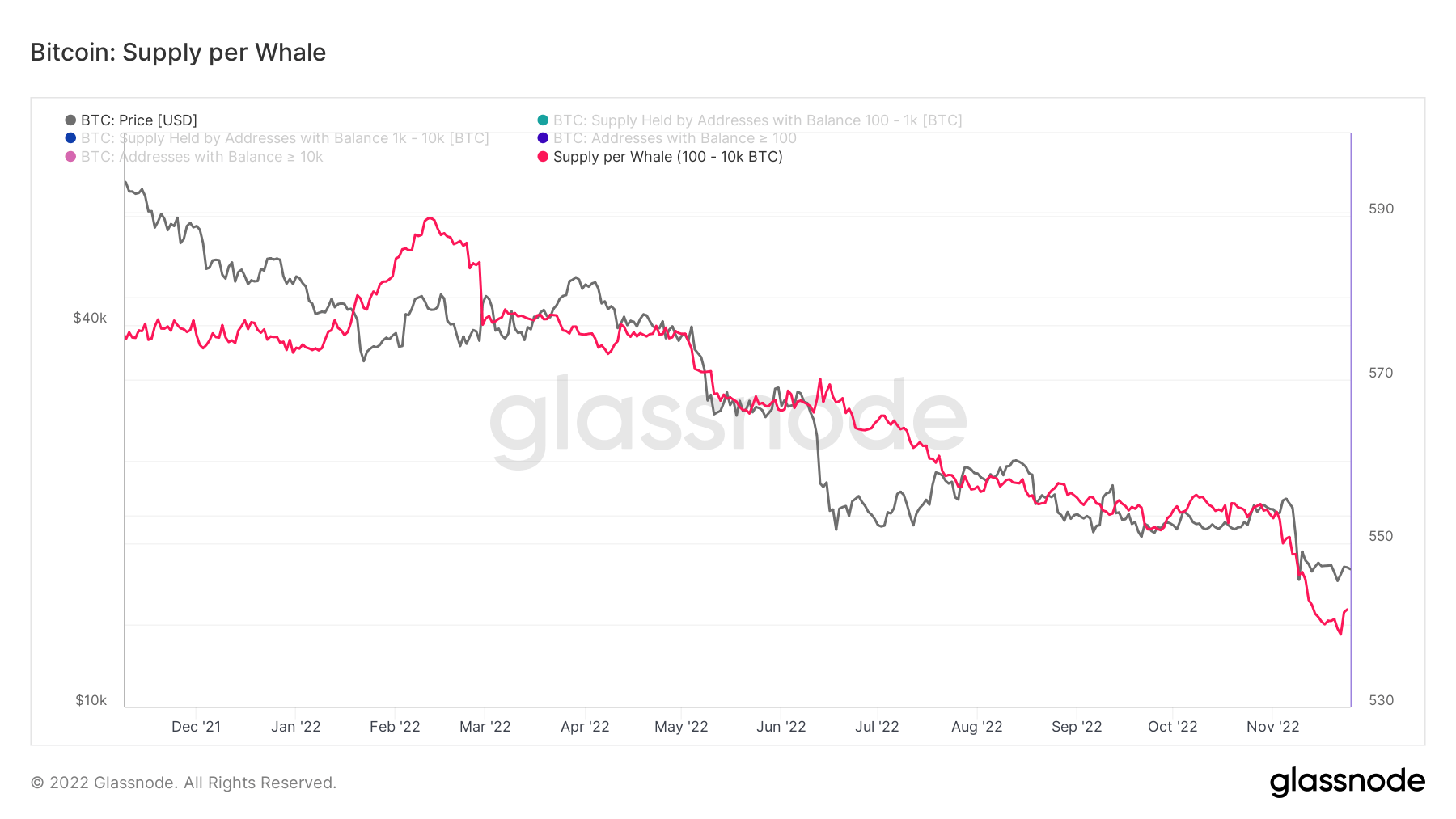

Looking at the BTC price and supply per whale relation since the beginning of the year, it can be seen that after a visible peak in Feb. 2022, the supply per whale line started its downtrend. This movement indicates that the whales have been selling off their BTC since Dec. 2021.

In the meantime, multiple on-chain metrics have been signaling that the bear market bottom is near, as investors take advantage of the low prices and purchase BTC.