Bitcoin just rejected $9450 again; now showing 4 factors of a potential pullback

Bitcoin just rejected $9450 again; now showing 4 factors of a potential pullback Bitcoin just rejected $9450 again; now showing 4 factors of a potential pullback

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price just rejected $9,450 again on lower time frames and is vulnerable to a short-term pullback. It satisfies all four factors that previously led to deep corrections in the past.

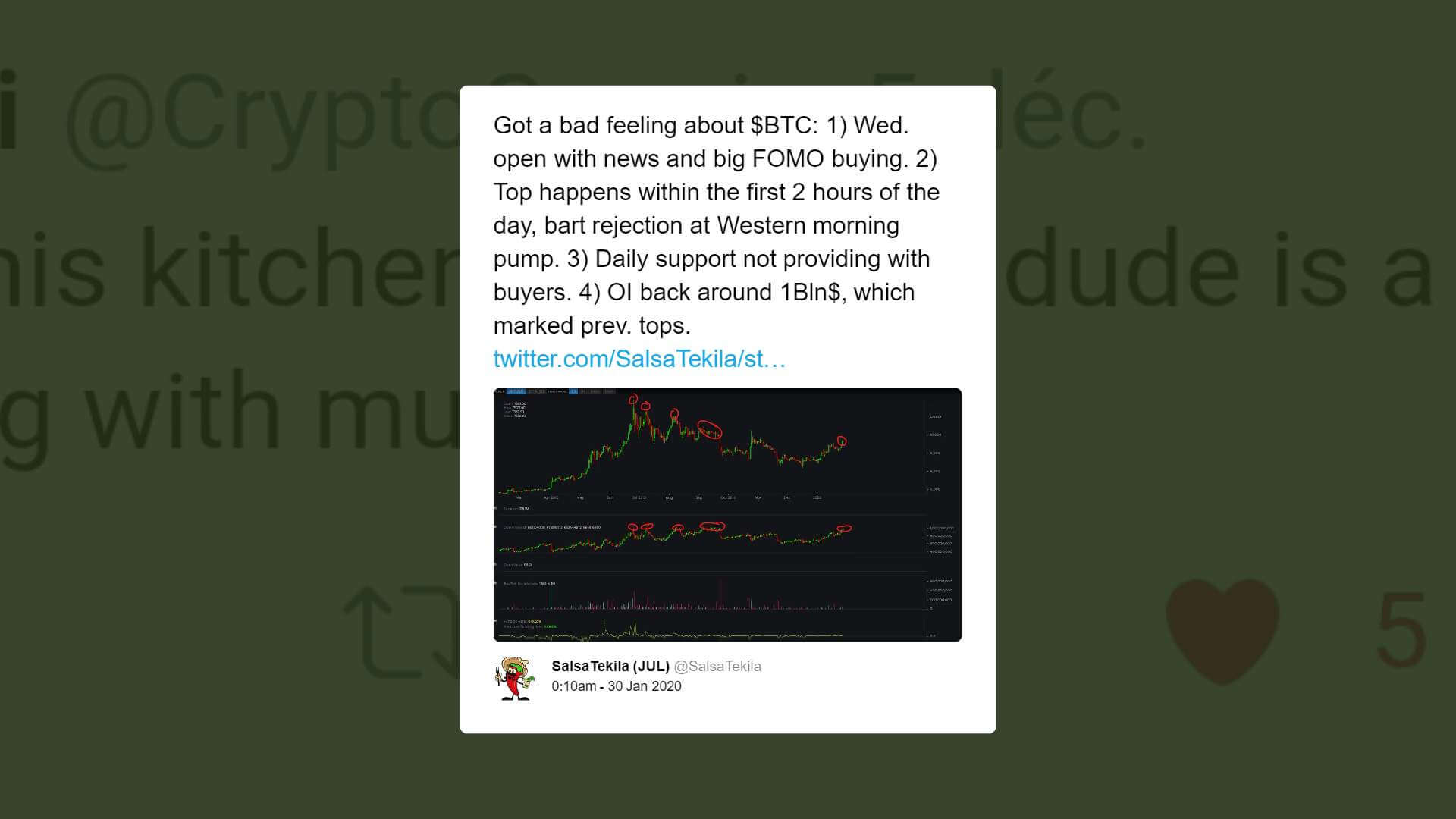

As explained by one cryptocurrency trader, the four factors that often trigger the Bitcoin price to decline substantially after an extended rally are:

- FOMO buying

- An early top

- Weak daily support

- Open interest above $1 billion

What’s likely next for the Bitcoin price?

Prior to the rejection at $9,450 across major exchanges like Binance and BitMEX, traders anticipated the Bitcoin price to demonstrate significant volatility.

Jacob Canfield, a prominent technical analyst, said that when open interest on BitMEX surpasses $1 billion, a major sell-off typically occurs.

He said:

“Open interest on bitcoin is currently at $943 million. Every time we’ve hit $1 billion we’ve seen a pretty big sell off. Let’s see if this time will be different.”

Open interest on a margin trading platform refers to the total amount of long and short contracts open in the market. It normally nears $1 billion after a large extended rally and when the market is uncertain about the short-term direction of the bitcoin price.

The Bitcoin price is also up 48 percent in the past 42 days. Historically, BTC has tended to drop off after a 40 to 50 percent rally to test lower supports.

Traders have emphasized that a CME gap for Bitcoin exists at $8,800. When a CME gap appears, the market tries to close the gap by moving towards that direction.

The area where the CME gap exists also remains a region of high trading activity. Following such an intense rally, a pullback to the high-$8,000 level is being targeted by many traders.

There are variables

The $9,400 to $9,500 range has acted as a heavy resistance area for Bitcoin since October 2019. But, three months ago, the Bitcoin price surged past the $9,400 resistance level in a single day wick to achieve $10,600. The strong upside movement obliterated order books and found a local top in a high area.

In the first half of 2020, especially with the block reward halving scheduled to occur in May, the Bitcoin price is generally anticipated to see a higher level of volatility than in 2019.

Simply put, Bitcoin could see more intense volatility than last year as a major event that affects the supply of BTC and as such its scarcity is set to happen. In the short-term, traders foresee a minor pullback to occur first to alleviate pressure on the market.

Going as planned so far but still nothing to write home about.

> Sells getting eaten up

> A close above $9,400 and I think $9,600 will come

> Not worth being too bullish here imo

> Thinking $9,500 -> $9,100 pic.twitter.com/Yu247Llfl5— Loma (@LomahCrypto) January 29, 2020

Whether the small pullback would lead to a retest of lower supports in the likes of $8,800 and $7,500 remains unclear. It would depend on the reaction of traders to the $1 billion open interest on BitMEX and based on historical data, a deep pullback is more likely than a sustained rally.

Bitcoin Market Data

At the time of press 8:11 am UTC on Jan. 30, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.27% over the past 24 hours. Bitcoin has a market capitalization of $170.44 billion with a 24-hour trading volume of $29.23 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:11 am UTC on Jan. 30, 2020, the total crypto market is valued at at $257.36 billion with a 24-hour volume of $112.35 billion. Bitcoin dominance is currently at 66.23%. Learn more about the crypto market ›

Farside Investors

Farside Investors

CoinGlass

CoinGlass