72% of institutional traders have no plans to trade crypto, JPMorgan survey

72% of institutional traders have no plans to trade crypto, JPMorgan survey 72% of institutional traders have no plans to trade crypto, JPMorgan survey

The survey shows that only 14% of the traders currently trade crypto or have plans to begin trading within the next year.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A survey of 835 institutional traders from 60 different global locations revealed that 72% have no plans for crypto trading in 2023, according to data released by JPMorgan.

According to the survey, most traders had no interest in crypto trading because of market volatility. 46% of the traders said volatile markets’ would be their greatest daily trading challenge in 2023, while 22% said liquidity availability would be the most significant issue. Others cited issues like regulatory change, data availability, price transparency, etc.

The traders’ decisions could have been influenced by the crypto market’s record poor performance in 2022. In the past year, Bitcoin (BTC) and other digital assets traded at record lows, and the industry also saw the capitulation of several crypto firms.

The survey showed that 8% of the traders currently trade crypto, while 6% plan on trading within the following year. The remaining 14% revealed plans to start trading within the next five years.

Meanwhile, despite the traders’ reluctance about crypto, they predicted that the asset class would see one of the most significant increases in electronic trading volumes over the next year.

The leading financial institution asked these traders about their trading plans and factors that could impact them in a survey conducted between Jan. 3 and Jan. 23.

Blockchain and AI is among the top 3 technology to shape the future of trading

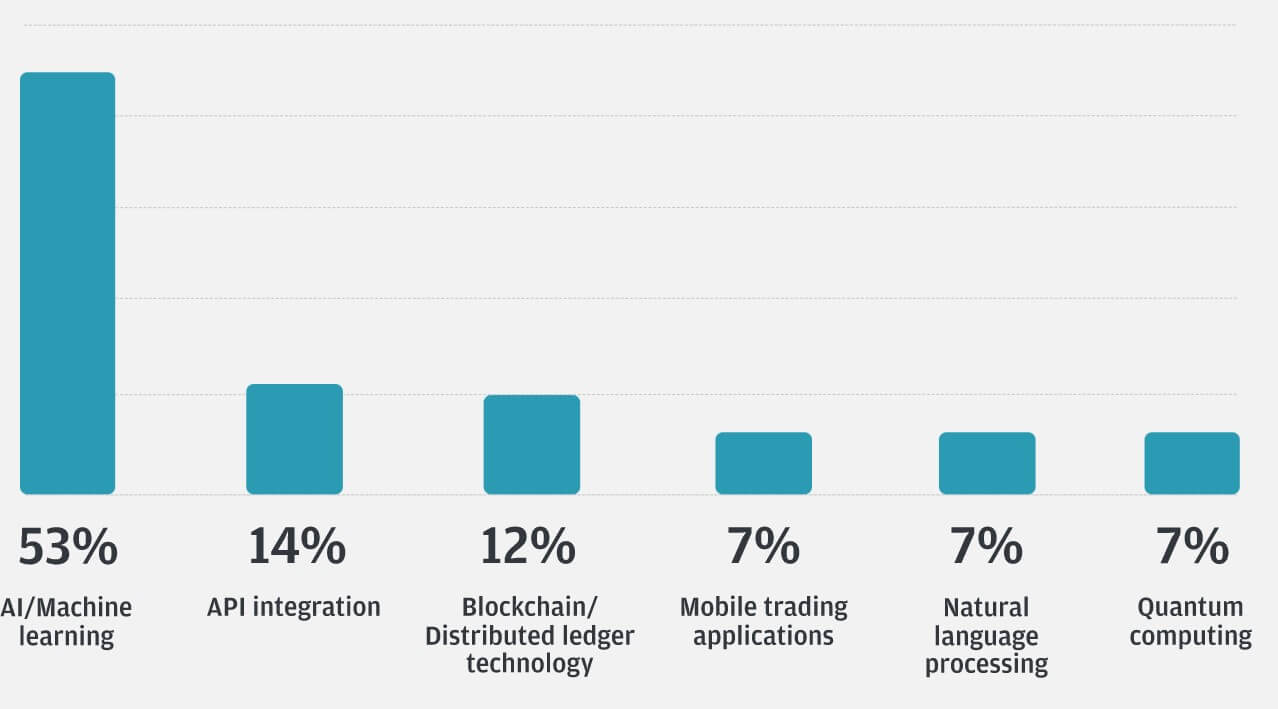

According to the poll, 53% think Artificial Intelligence and Machine Learning would play the most significant role in shaping the future of trading over the next three years. On the other hand, 12% think future trading will be shaped by blockchain technology.

This starkly contrasts with the poll results in 2022, when blockchain technology and AI received 25% of all votes, respectively.

Over the past year, interest in AI technology has soared significantly with the advancements in OpenAI’s ChatGPT.

Macroeconomic factors

On macroeconomic factors that could impact their trades, the traders believe a recession poses the most significant risk to the market in 2023, followed closely by fears of inflation and geopolitical conflicts. In 2022, the traders’ biggest worry was inflation.

Meanwhile, around half of the traders expect inflation levels to decrease, while 37% expect it to level off. 19% of them think inflation will keep rising.

Inflation levels rose to a 40-year high in 2022, forcing financial regulators worldwide to hike their interest rates continuously.