The bullish case for Bitcoin as 2022 comes to an end

The bullish case for Bitcoin as 2022 comes to an end The bullish case for Bitcoin as 2022 comes to an end

Several Bitcoin metrics like the increase in supply held by long-term holders as well as self-custody points towards a bullish future.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The price of Bitcoin (BTC) saw drastic falls throughout 2022 and is trading at $16,877.39 as of press time — down more than 66% from its all-time high price of over $68,000 in November 2021.

Most investors consider price as the most important metric of growth. While the price of Bitcoin gives little reason to be bullish, an evaluation of other growth metrics makes a strong case for BTC’s growth in the coming years.

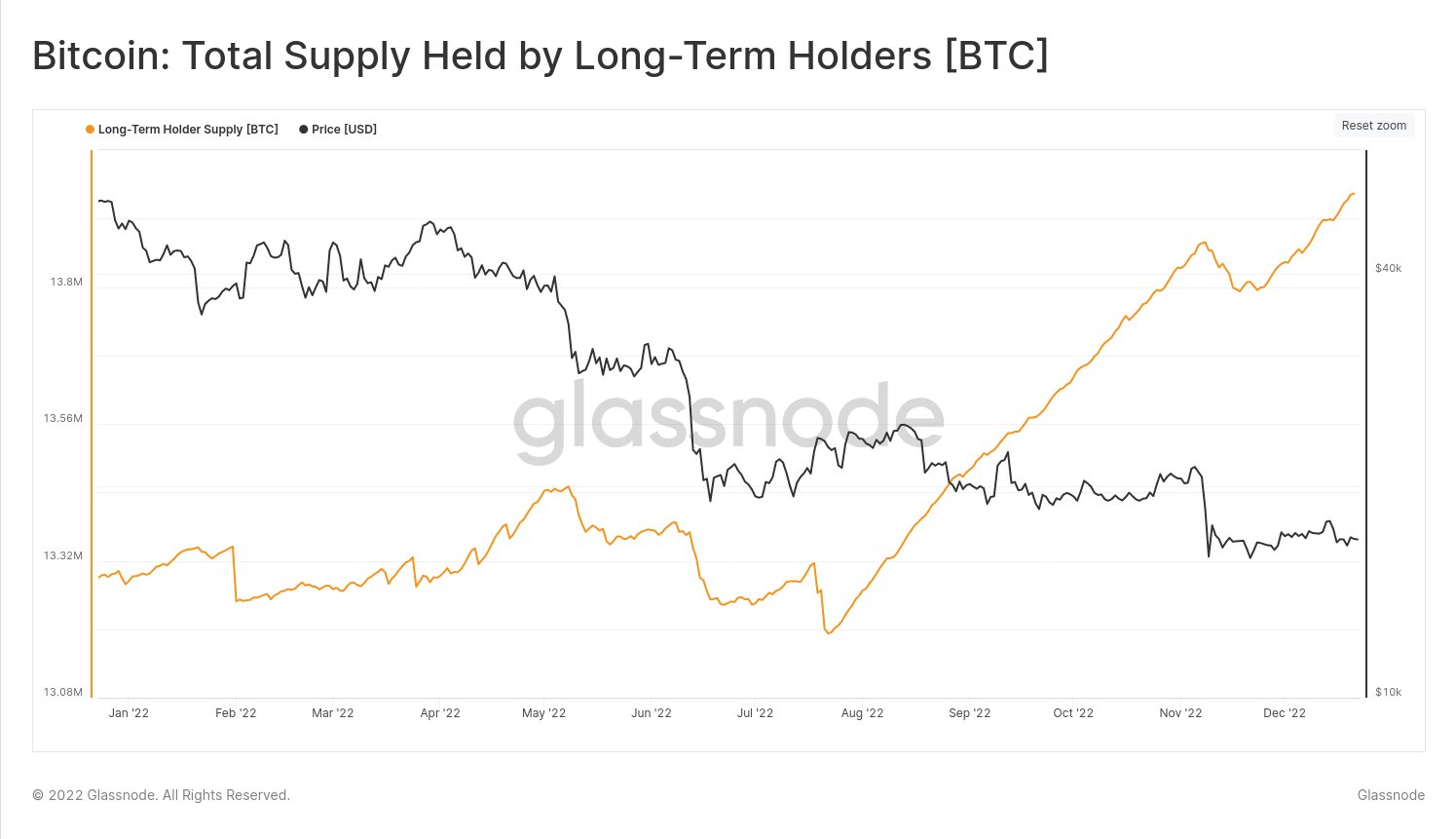

Long-term holders hit an all-time high

The total supply of Bitcoin held by long-term users has been on the rise throughout 2022. But it is worth noting that it staggered during major events like the Terra-LUNA fiasco in May, the bankruptcy of hedge fund Three Arrows Capital (3AC) in June and crypto lender Celsius in July, and the fall of FTX in November. These events created a short-term panic leading long-term holders to offload their BTC holdings.

Despite the dips, however, the total supply of long-term holders has reached an all-time high of over 13.9 million BTC, according to Glassnode data analyzed by CryptoSlate. This indicates that long-term investors hold around 72.7% of Bitcoin’s circulating supply of 19.24 million coins — the highest ever. Long-term holders are those that have been holding Bitcoin for 155 days or more.

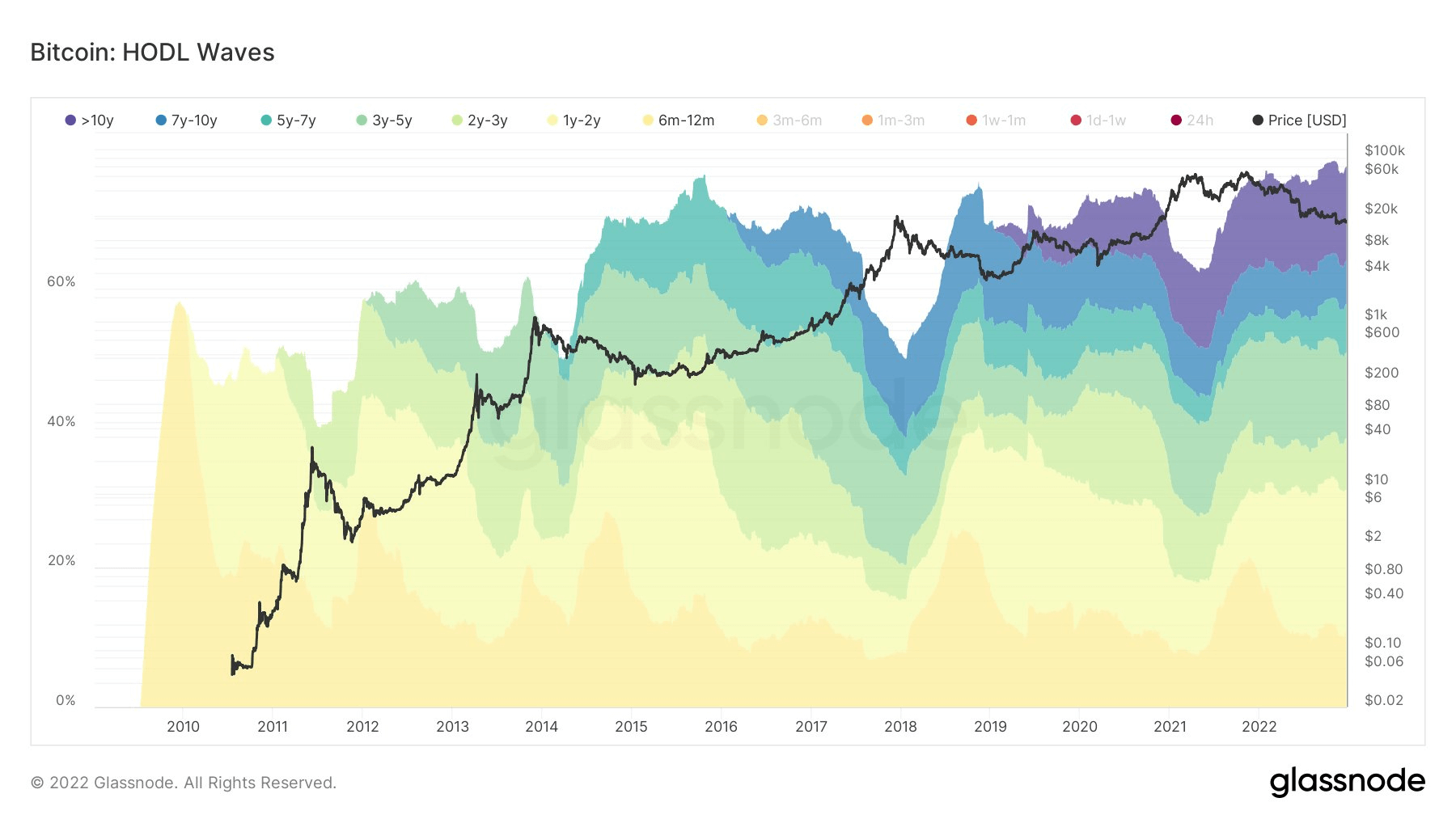

Additionally, the BTC HODL Waves chart indicates that the number of early enthusiasts of BTC who have been holding their coins for over 10 years (purple) is high, despite the dip after the FTX collapse. The HODL Waves chart shows the amount of BTC held for different age bands.

The percentage of investors holding their BTC for 7 years to 10 years has held mostly steady despite market fluctuations throughout 2022, which indicates that long-term holders are maintaining their conviction in BTC.

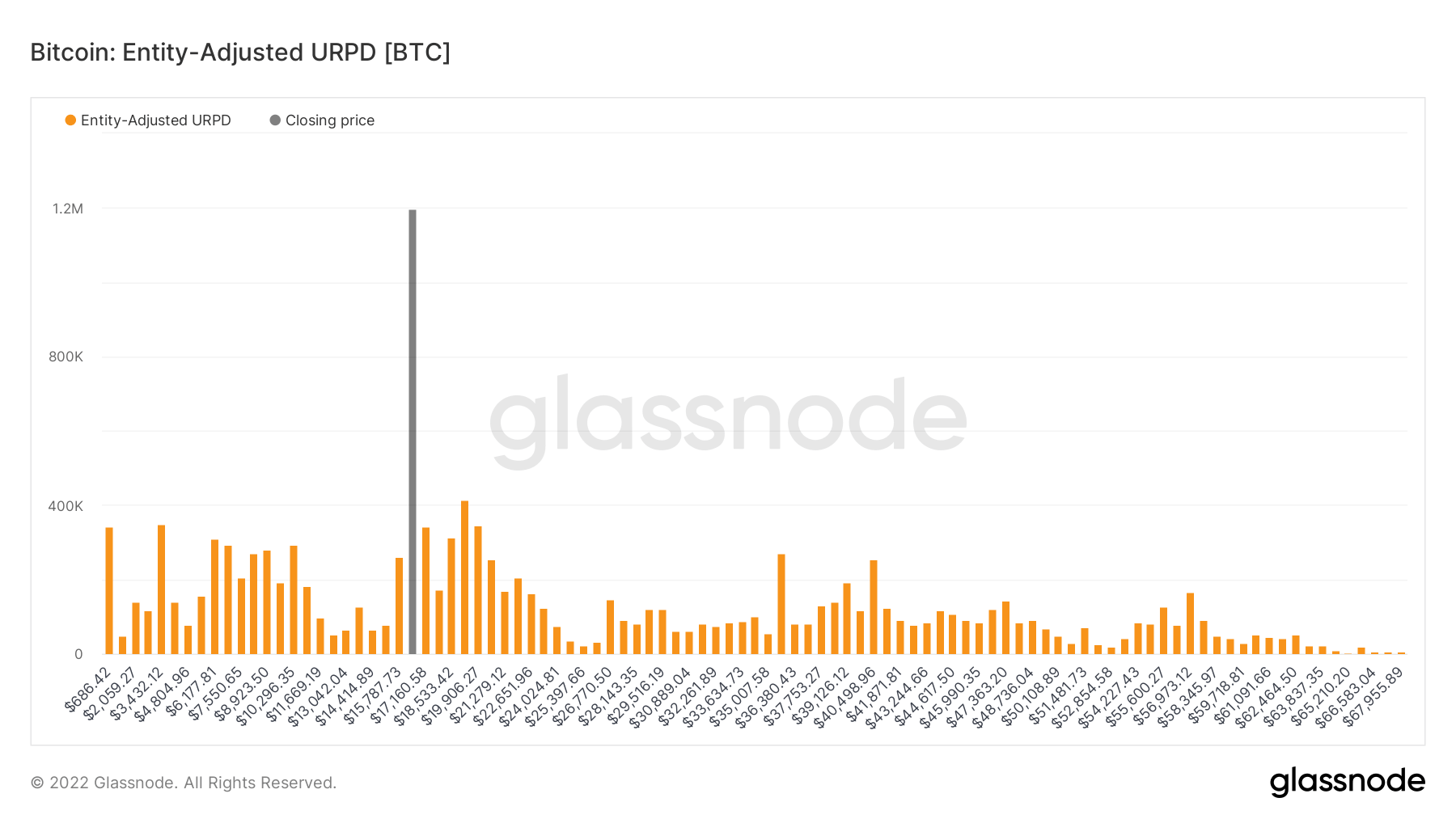

Nearly 1.8 million BTC bought between $15,700 and $17,100

According to Glassnode data, nearly 1.8 million BTC — or over 9% of the circulating supply — was bought in the price range of $15,787.73 and $17,160.58. BTC has only traded in this price range in November 2020 and this year, since November 2022.

While the 9% volume indicates there is a likelihood of more redistribution, Bitcoin’s consolidation suggests long-term holders are in control.

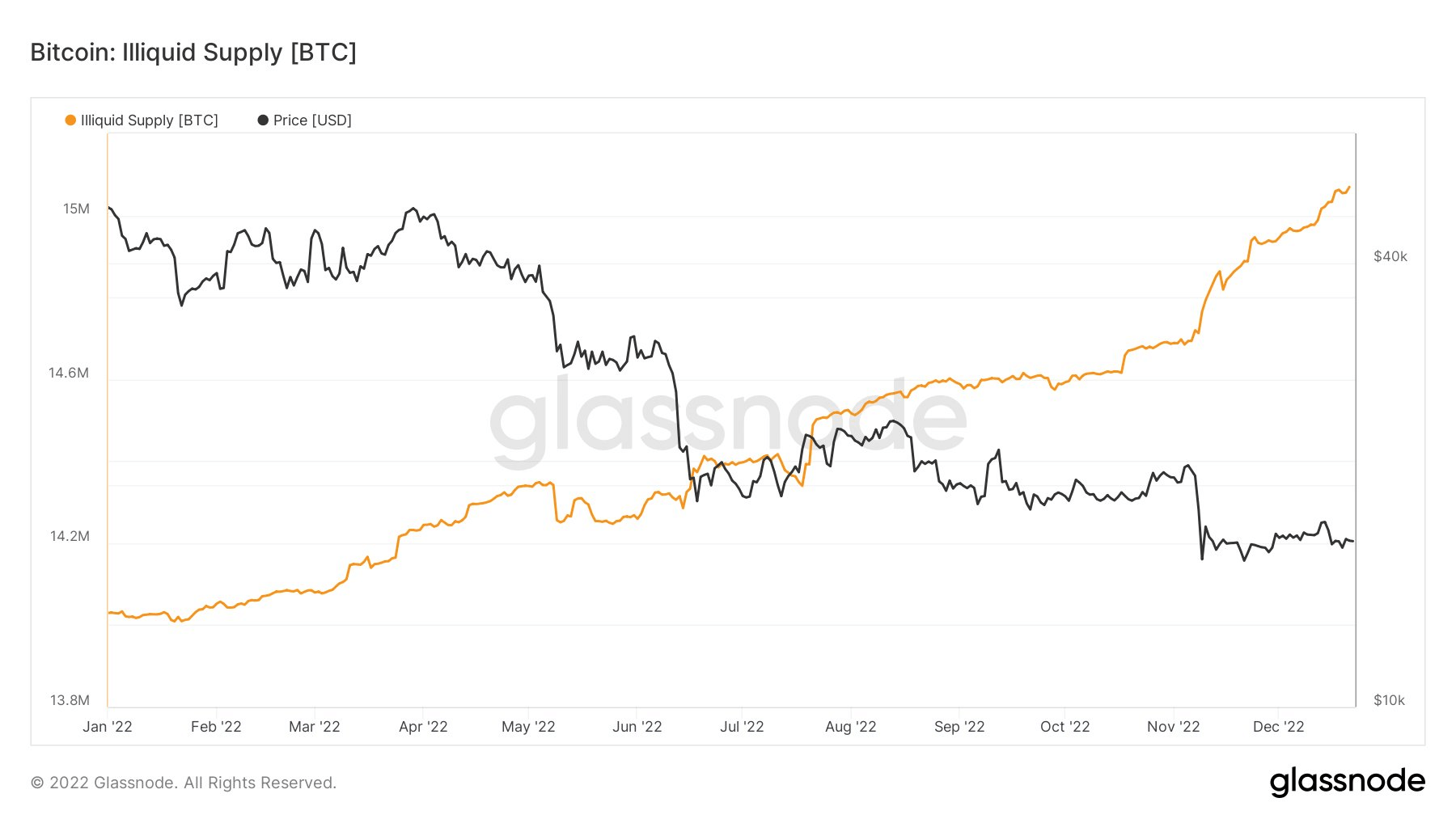

78% of Bitcoin’s circulating supply is in self-custody

The series of high-profile bankruptcies of crypto lenders and centralized exchanges, including Celsius and FTX, drilled an important lesson among investors — not your keys, not your coins. While this phrase has been around for years, with millions of investors collectively losing tens of billions in 2022, the message has finally hit home.

Throughout the year, throngs of investors continued to take control of their assets amid waning trust in centralized exchanges. Over 15 million coins or roughly 78% of BTC’s circulating supply of 19.24 million was illiquid as of Dec. 27. Illiquid supply indicates BTC stored in hardware cold storage wallets or web and mobile-based non-custodial wallets that are not available for trading.

The illiquid supply of BTC has gone up from around 14.8 million coins or 76% of the circulating supply in August. Additionally, Bitcoin’s illiquid supply has grown by roughly 7.4% from just over 14 million coins at the start of the year.