Why this trader says Ethereum may rally harder than Bitcoin in a new bull cycle

Why this trader says Ethereum may rally harder than Bitcoin in a new bull cycle Why this trader says Ethereum may rally harder than Bitcoin in a new bull cycle

Photo by Bechir Kaddech on Unsplash

Bitcoin has started to recover from its drop below $17,600. Traders think Ethereum (ETH) could potentially rally harder than BTC in the next bull cycle.

There are three potential reasons why traders might be highly optimistic about Ethereum in the short to medium term.

The factors are Eth2, the gap between the current ETH price to its all-time high, and the popularity of decentralized finance (DeFi).

Ethereum technicals are strong

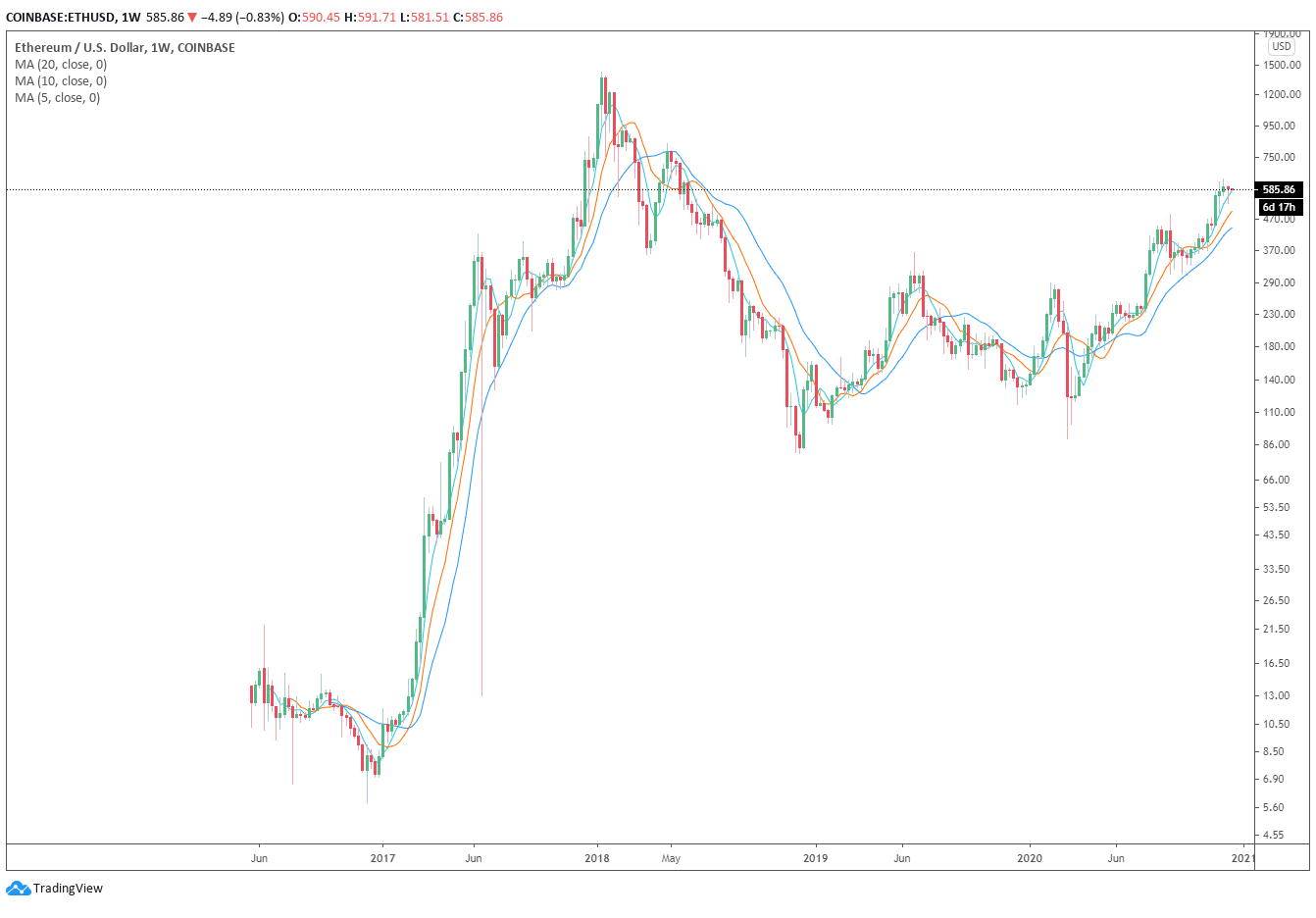

The price of ETH is currently hovering under $600, which it has not seen since early 2018.

But, the all-time high of ETH is at around $1,400, while the Bitcoin price has already achieved its all-time high in December 2020.

An argument could be made that the gap in the performance between the two dominant cryptocurrencies could allow ETH to see a bigger uptrend if a new bull cycle emerges.

Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said:

“Gun to my head: If I had to spend $1,000 on one investment and I had to pick between $ETH and $BTC, I’d take $ETH today.”

Technical analysts say that Ethereum might have seen a breakout on lower time frame charts.

$ETH ? pic.twitter.com/YED2mOLhZV

— CJ (@IrnCrypt) December 12, 2020

Throughout the past two weeks, ETH has underperformed against Bitcoin. Due to the uncertainty in Bitcoin’s short-term price cycle, other major cryptocurrencies stagnated.

The recent near-term price range breakout coincides with Bitcoin’s convincing recovery above $19,000. Hence, the combination of the two technical factors could aid a strong ETH rebound.

Eth2 and high DeFi TVL are consistently positive catalysts

When the price of ETH was at near $600 in 2018, the total value locked (TVL) across DeFi was lower than $200 million.

Since then, the TVL in DeFi on Ethereum has grown from $200 million to over $14 billion, recording a 70-fold increase within three years.

It is also a reassuring sign that dominant early players, like Maker, have been able to maintain their dominance despite the emergence of new DeFi protocols. This indicates that DeFi protocols with network effect have staying power, which shows the confidence of DeFi users.

Nick Tomaino, the founder of 1confirmation, said:

“No farming program this year and lots of questions, yet Maker has maintained its DeFi throne. Dai transaction volume has exploded to over $125B and TVL is over $2.6B”

Another major component of the Ethereum blockchain that did not exist in 2018 was Eth2.

Eth2 has been a crucial network upgrade that has been in the works for several years. The release of the Beacon Chain in December 2020 marked the launch of Eth2 for the first time in Ethereum’s history.

The confluence of strong technical and fundamental factors, and the improvement in the medium-term outlook of Ethereum due to Eth2, place ETH in an ideal position to see newfound upside momentum.