Why the world’s biggest crypto exchanges are making a big bet on India

Why the world’s biggest crypto exchanges are making a big bet on India Why the world’s biggest crypto exchanges are making a big bet on India

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Four months after the high-profile acquisition of Indian crypto exchange WazirX by Binance, BitMEX invested in a $3 million funding round for another local cryptocurrency exchange in India called CoinDCX.

The world’s biggest crypto exchanges by daily volume have started to actively invest in India’s crypto market after the reversal of the Reserve Bank of India (RBI)’s prohibition on cryptocurrency trading.

Can India evolve into a big crypto market?

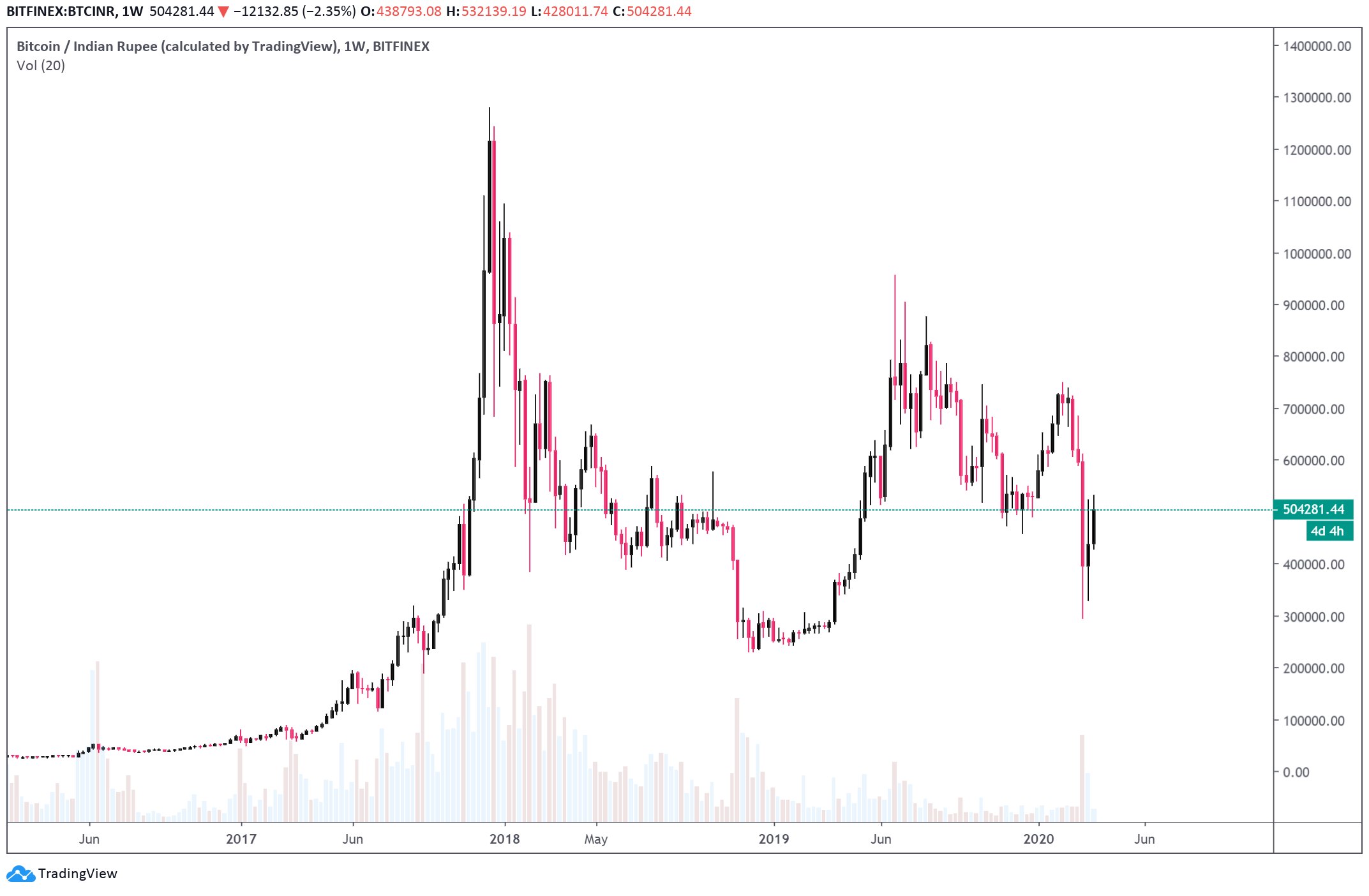

Prior to the RBI’s crypto trading ban in 2018, the crypto exchange market of India accounted for a fairly large portion of the global cryptocurrency trade volume.

Reports suggest that the crypto exchange market of India was valued at $12.9 billion, with top five exchanges at the time recording consistently high volume.

For instance, Koinex, one of the top exchanges in India before the RBI’s ban was implemented, was recording around $240 million in daily trade volume at the peak of December 2017.

The company said in June 2019, as it closed down:

“Within 4 months of operations, Koinex became India’s largest and favourite digital assets exchange — recording $265M in trading volume and on boarding 40K+ new users in 24 hours at peak in the month of December. Koinex also became India’s fastest growing startup to see such metrics and an ultra-quick profitability.”

India was once a juggernaut in the global cryptocurrency market, and a blanket ban imposed by the nation’s central bank teared down the industry. After nearly two years since the ban was imposed, key players in the crypto sector are seemingly anticipating the revival of India’s crypto sector for the first time since 2018.

Binance CEO Changpeng Zhao, who acquired WazirX before the trading ban was overruled, has consistently expressed optimism towards India and its potential to become a major crypto market.

Welcome to #India https://t.co/uDev0eQaPL

— CZ Binance ??? (@cz_binance) March 21, 2020

In November 2019, when the legality of cryptocurrencies and the trading of digital assets still remained uncertain, Zhao said:

“The acquisition of WazirX shows our commitment and dedication to the Indian people and strengthen the blockchain ecosystem in India as well as another step forward in achieving the freedom of money.”

Despite the support of the industry’s front-running companies, whether India will rapidly see a recovery in its local cryptocurrency exchange market still has to be seen.

For years, crypto investors in India dealt with instability of banking services and a lack of clarity in regulatory frameworks. The nation’s central bank is still to this date expressing its intent to combat the Supreme Court’s ruling to lift the ban on trading crypto assets.

Industry leaders unfazed

CoinDCX, WazirX, and Unocoin, three exchanges that stayed open throughout the past two years without any banking support to facilitate new users, remain unfazed and confident that the local market has a “huge potential” for the asset class.

Sumit Gupta, co-founder and chief executive officer of CoinDCX, specifically pointed at India’s massive remittance market and a large number of individuals in some regions that have no stable access to banking services.

Local companies and exchanges believe cryptocurrencies can fill the gap of the unbanked, as it looks to grow India to the pinnacle of crypto trading once again.

CryptoQuant

CryptoQuant