Why DeFi needs oracle cross-chain DeFi with Chainlink / DCRM

Why DeFi needs oracle cross-chain DeFi with Chainlink / DCRM Why DeFi needs oracle cross-chain DeFi with Chainlink / DCRM

Photo by Moritz Kindler on Unsplash

Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›

Defi protocols have registered significant growth in terms of token prices, user adoption, and media exposure in the last few months. According to Defi Pulse, the total value locked in Defi has exceeded 2 billion US dollars, and it keeps rising every single day.

Fusion foundation is a non-profit organization building state-of-the-art blockchain technologies with compelling use cases that will decentralize global finance. Those technologies can help facilitate the mass adoption of their innovative blockchain technologies and Defi in general by building decentralized applications on the Fusion network. The public will benefit from a more accessible, efficient, and transparent financial system with peer-to-peer, time- and value-based applications.

Fusion’s Decentralized Interoperability Solution

Decentralized Interoperability

Interoperability is the capability to share information across heterogenous blockchains, such as cross-chain asset exchanges. Fusion achieves interoperability without centralization by DCRM (decentralized control rights management system). This technology is the backbone of the Fusion platform that innovates cryptographic keys and makes interoperability possible on the Fusion blockchain.

Why is decentralized interoperability indispensable in Defi? Take Wrapped Bitcoin (WBTC) as an example, which is an ERC-20 token that is backed 1:1 with Bitcoin. An entity can send BTC to BitGo, a centralized custodial service provider, to hold their BTC and mint WBTC on the Ethereum chain. Nevertheless, it is all centralized and acts as a single point of failure in the whole Defi ecosystem. The custodian could block anyone from minting WBTC or redeeming BTC, and the Defi network is no longer permissionless or censorship-resistant, which goes against the purpose of Defi. Any centralized mechanism within the Defi pipeline is a bottleneck that hinders the growth of Defi.

However, decentralized interoperability is difficult to realize from a technical perspective, because there exist so many blockchains in the world with distinct underlying technologies and utilities. Blockchain technology operates on a layered protocol similar to the Internet. The protocol consists of, from bottom to top, a data layer, a network layer, a consensus layer, and an application layer. The bottom-most data layer handles and optimizes data storage, whereas the topmost application layer enables users to interact with blockchains using Defi platforms. More abstraction takes place as we move to higher layers. The highly abstracted application layer makes blockchain assets easy-to-manage at the cost of increasing a variety of protocols and slower performance.

The intrinsic difference in various blockchains across layers makes it challenging to exchange heterogeneous assets in a decentralized and trustless manner. Defi without decentralized interoperability will be hard to compete with centralized exchanges that act as intermediaries in cross-chain asset exchanges.

DCRM Technology

Fusion tackles this issue of cross-chain asset exchange from the very bottom data layer in the blockchain protocol, the layer where transactions are signed using cryptographic keys. It is because there is less variety on this layer, given around 80% tokens utilize ECDSA private key encryption algorithm on the data layer, including Bitcoin and Ethereum. The abstraction across multiple layers can also provide a seamless cross-chain integration on the application layer, where most cross-chain communication is abstracted away from the user interface.

On the other hand, DCRM technology combines existing cryptographic technologies with zero-knowledge proof, sharding, and homomorphic encryption. It enables seamless and decentralized executions of cross-chain smart contracts without any governance or intermediaries. Key sharding and distributed ECDSA-compatible encryption algorithm facilitates nodes in the Fusion network to generate multi-asset wallets in a way that no single node or individual can access the private keys that control the assets. Key shards are generated by multiple nodes independently, and each shard represents a fragment of the key. The whole private key is never reconstructed at any stage from key generation to signing transactions and asset storage.

In short, DCRM technology eliminates any single point of failure in the interoperable decentralized cross-chain ecosystem, which is one of the biggest threats of building any cross-chain solution, by decentralizing cryptographic key management.

Current Development

Developed by Fusion’s R&D team in Shanghai, DCRM technology has been vetted by world-class cryptographers. This group includes Rosario Gennaro, Professor of Computer Science at CUNY; Steven Goldfeder, Ph.D., Postdoctoral Researcher in the Department of Computer Science at Cornell University; Louis Goubin, Professor of Computer Science at the University of Versailles; and Pascal Paillier, Ph.D., CEO and Senior Security Expert at CryptoExperts.

Transactions made with DCRM technology are currently being tested in beta and are going to reach a large amount of volume. There are 29 community nodes and 5 organizations already taking part in the protocol. ETH and BTC can now be exchanged in a completely decentralized fashion under DCRM protocol.

How Fusion’s Vision of DeFi is Achieved

Utility drives adoption, and this is especially true in the blockchain community. Fusion’s innovative DCRM technology enables Dapps to maximize the utility of a decentralized and interoperable network.

WeDeFi

WeDeFi is an easy-to-use Defi product for the general public to gain exposure to the revolutionary Defi. The Fusion team is building WeDeFi as the go-to Defi bank for private individuals and businesses alike to utilize Fusion tokens with easy-to-use iOS and Android apps. It also fully utilizes Fusion’s innovative and unique “time-lock” function on the Fusion network, where the time value of money can be asserted explicitly on-chain. This means that users can transfer the future ownership of their digital assets to others on the Fusion network while retaining the ability to use the asset at present.

WeDeFi currently provides high yield saving and risk-free lottery service to users of FSN, Fusion’s native token. Users can manage their crypto assets without ever relinquishing control of their investment or compromising the security of their holdings. Fusion is currently running an incentive program to give out “borrowed” FSN to new users. “Borrowed” token refers to a token that users can use in a limited period, powered by the above-mentioned time-lock function.

It also aims to provide a digital network that connects lenders and borrowers and reduces debt settlement times from days to minutes in the foreseeable future.

Anyswap

Anyswap is a Uniswap-like automated market maker (AMM) powered by state-of-the-art cross-chain secure DCRM protocol that was launched on July 20th. It is a decentralized cross-chain bridge where users can deposit various coins and mint wrapper tokens in a decentralized manner. It also enables cross-chain token swaps and offers swap pairs beyond ETH and ERC-20 tokens supported in Uniswap. Users can provide liquidity for swap pairs to earn passive income from exchange fees.

In addition to the use of Fusion’s cross-chain technology, Anyswap has introduced ANY token which will be used to reward liquidity providers. With major cryptocurrencies such as BTC, ETH, LTC, XRP, and USDT to be added soon, a wide-scale adoption is expected for Anyswap, especially with the current annual yield above 300% for liquidity providers.

Anyswap is also much more secure than its competitors. In fact, ANY is also a governance token, and it will be used by ANY holders to vote on the coins or tokens to be listed on Anyswap. This will make it impossible to list fake tokens and thereby to scam users as this is the case with Uniswap. Another important aspect is the upcoming implementation of Anyswap Working Nodes (AWN) which will be elected using ANY token, this will ensure the full decentralization of Anyswap.

Fusion Defi

It is Fusion’s vision to serve the world as the infrastructure for digital finance by extracting the time value of assets, breaking boundaries on establishing different value systems, and automating finance. These are three of the main problems in the finance industry.

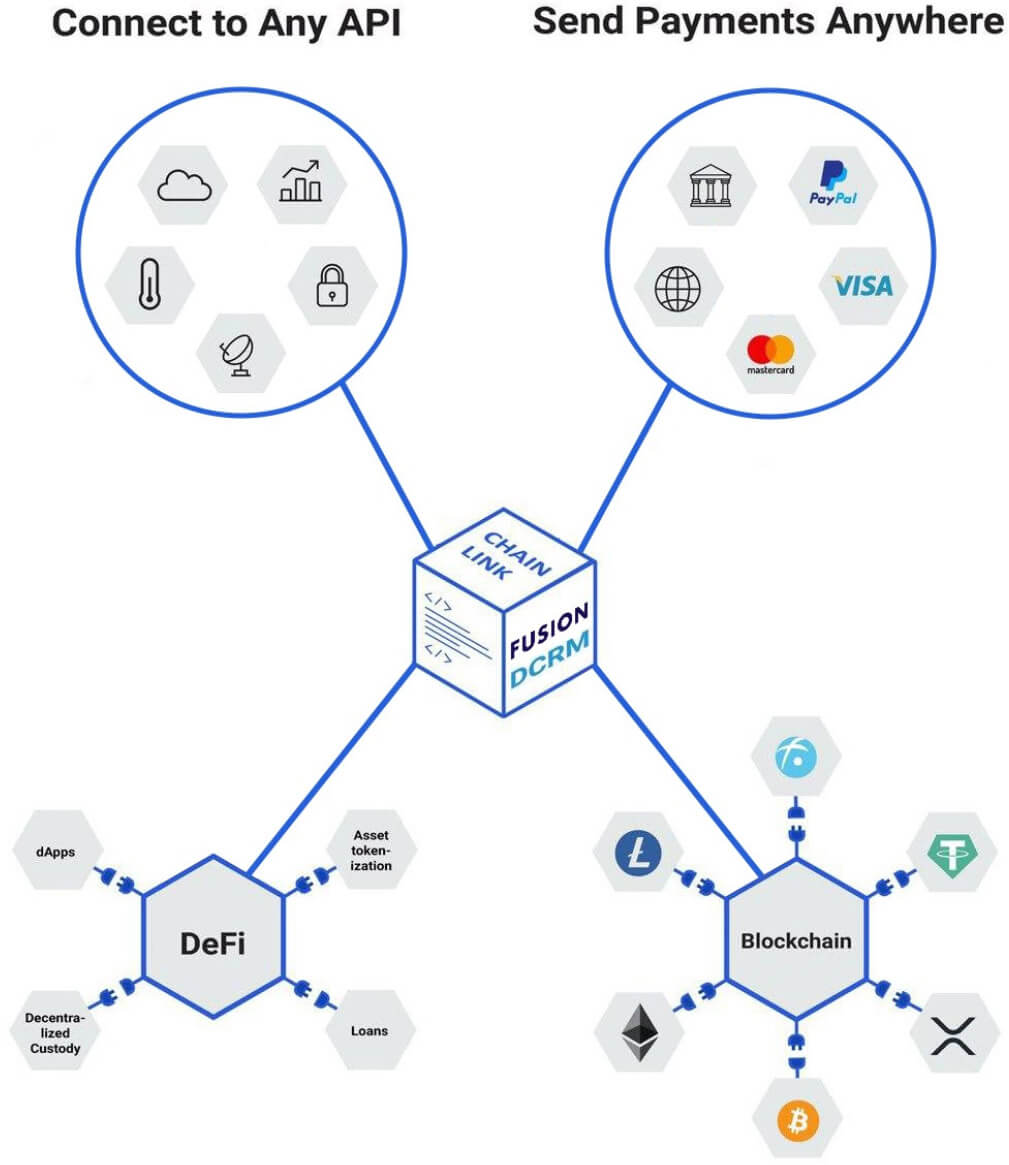

To truly realize the potential of multi-trigger and interoperable smart contracts discussed in Fusion’s white paper, it is essential to link the physical and digital world such that digital smart contracts react to real-world events. Chainlink is a market-leading decentralized oracle network that incentivizes oracles to attest to events in the physical world. By integrating Chainlink’s decentralized oracles with Fusion’s DCRM interoperability network, Fusion’s vision of data-driven smart contracts interfaced with the real world is one step closer to realization.

The Chainlink integration with Fusion went live on March 31st in the upgrade of Fusion Mainnet 3.6, which enables smart contract support for time-value market and assets, as well as the successful implementation of cross-chain transactions from the decentralized custodian pilot built by the DCRM Alliance. Pairing Chainlink’s decentralized oracles with Fusion’s recent protocol developments increases the toolset available to developers substantially to build next-generation Dapps and digital finance solutions on Fusion.