Voyager redeems $150M of USDC to fiat through Circle

Voyager redeems $150M of USDC to fiat through Circle Voyager redeems $150M of USDC to fiat through Circle

It comes as Voyager account holders continue to advocate for a restructuring plan that would see Binance recoup most of customer accounts.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Arkham Intel has reported that Voyager has initiated converting its USDC holdings into fiat currency by redeeming $150M via Circle’s service, also reporting that Coinbase had transferred $150 million in USDC to Circle.

gm

Voyager has begun cashing out its USDC to fiat, redeeming 150M through Circle's service.

The funds were subsequently transferred to Circle, but have not yet been burned.

That day, Coinbase also transferred $150M USDC to Circle, presumably for withdrawal. pic.twitter.com/xfjz5EA1b0

— Arkham (@ArkhamIntel) March 29, 2023

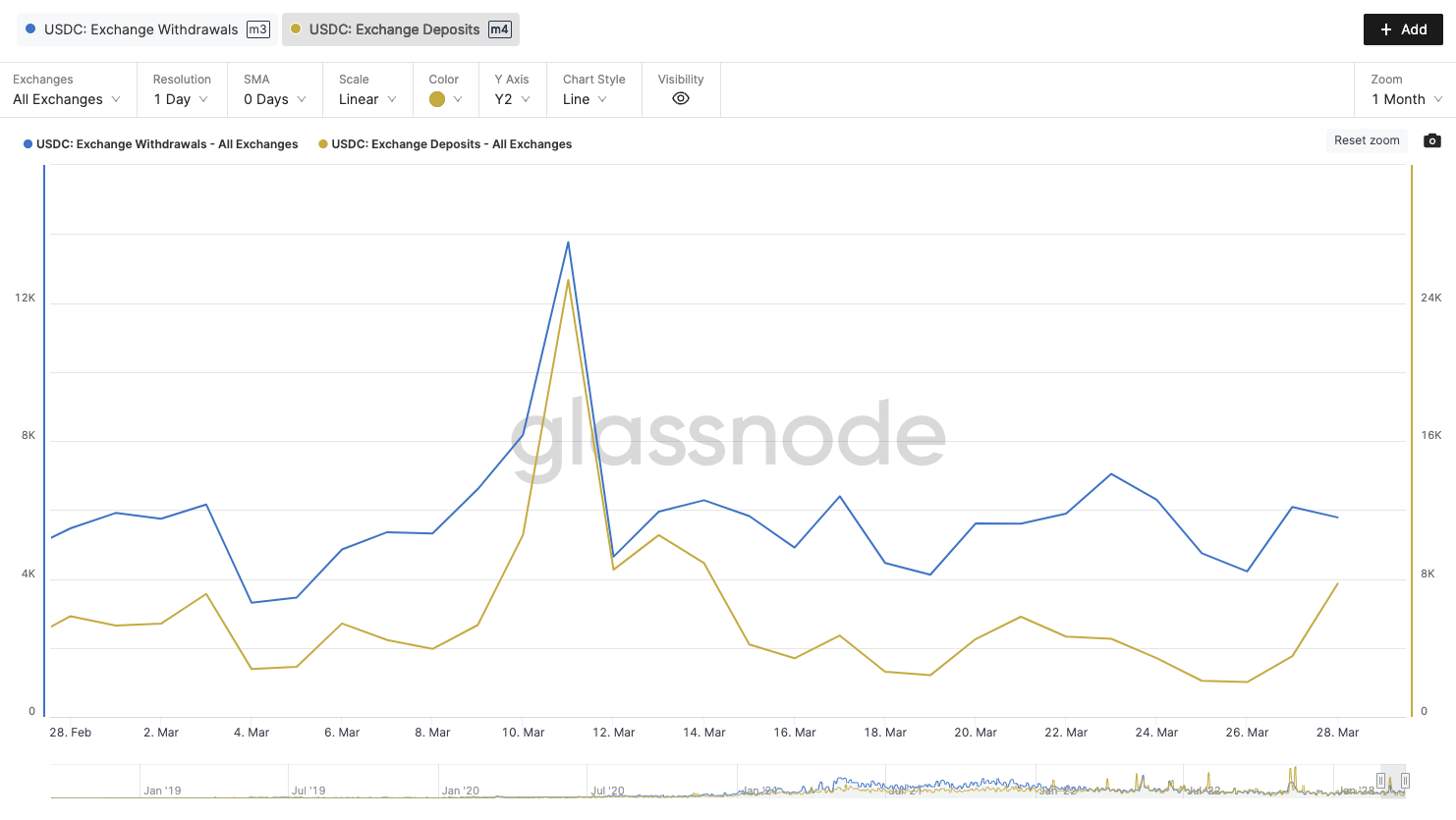

The move comes on the heels of Voyager’s ongoing battle over its restructuring plan, including Binance’s bid to purchase the company, as well as numerous changes to the stablecoin market in recent weeks, in which the near collapse of USDC was triggered by a run on three traditional U.S. banks.

Around 14 days have elapsed since the USDC lost its USD peg because of the SBV crisis. Subsequently, a significant reshuffling took place, with numerous crypto users diverting their focus from USDC to alternative stablecoins.

Voyager’s troubles

Voyager, the private hedge fund founded in 2018, entered into liquidation in July 2022 after it had been exposed to unpaid loans totaling $666 million from the Singapore-based Three Arrows Capital, which led to a contagion still being felt today all over crypto.

After the bankruptcy of FTX, Binance’s bid of $1 billion to take over the company has run into regulatory hurdles, namely from the SEC, which has said that Binance failed to provide certain pieces of information that would allow the sale.

This is despite having the overwhelming support of Voyager account holders, 97% of whom voted in favor of Binance’s proposed restructuring plan last December, which would see account holders recoup about 73% of the funds remaining in their balance.