VC investments in European projects rise in Q1 2023

VC investments in European projects rise in Q1 2023 VC investments in European projects rise in Q1 2023

Circle Director of Research and Policy Patrick Hansen said the EU's regulatory clarity has made it an attractive option for crypto projects.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

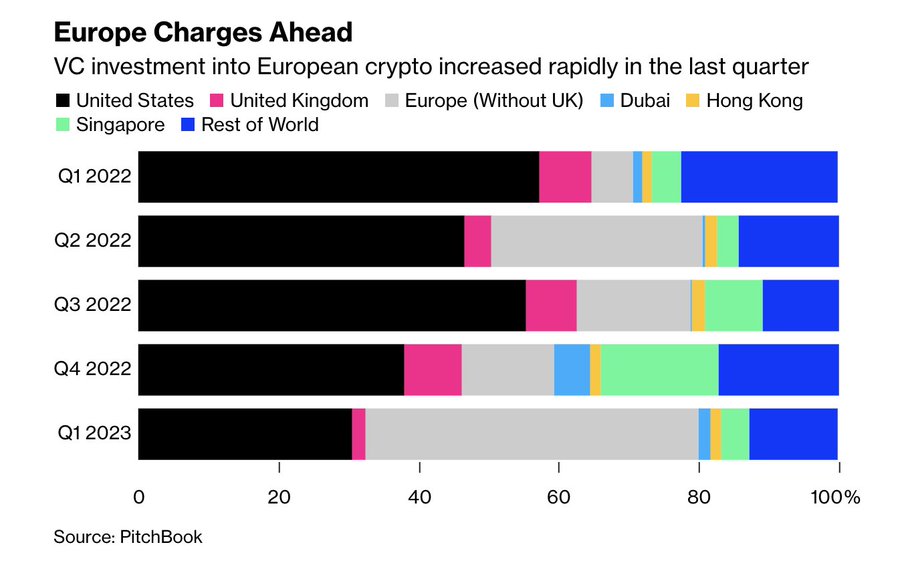

Venture capital investment into European crypto projects increased almost ten times in the past year, going from 5.9% in the first quarter of 2022 to 47.6% in Q1 of 2023.

Circle Director of Research and Policy Patrick Hansen noted that this increase resulted from the region’s regulatory clarity following the European Union passage of the MiCA law.

The European Parliament passed the Markets in Crypto Assets Law (MiCA) in April but will not apply until July 2024. The law — which has garnered large interest from the crypto community — would allow the E.U. to have a unified approach to crypto asset regulation across 27 member states.

Other regions attracting crypto investors

Meanwhile, the E.U. is only one of the many regions attracting interest from crypto investors. Other countries, like the United Arab Emirates and Hong Kong, are also seeing more crypto investments.

All these countries have in common their efforts to provide regulatory clarity for crypto companies operating under their jurisdiction. Hong Kong’s new regulations for crypto exchanges offering retail trading will go into effect by June 1.

Meanwhile, Dubai and Abu Dhabi have also seen interest from several crypto companies, including Coinbase. Earlier this week, Coinbase CEO commended the country for its progressive regulatory effort. Coinbase is working to obtain licenses for virtual assets services in the country.

Things are different in US

Meanwhile, several crypto firms are leaving the U.S., citing regulatory concerns.

From the beginning of the year, crypto firms like Nexo, Beaxy, Bittrex, etc., have shuttered their operation, citing regulatory concerns. Recently, Coinbase and Gemini established an offshore exchange and are also working to expand to other countries.

Market makers Jane Street and Jump Crypto have begun efforts to reduce their crypto exposure citing regulatory issues.