USDC in circulation fell over 10% since de-peg event

USDC in circulation fell over 10% since de-peg event USDC in circulation fell over 10% since de-peg event

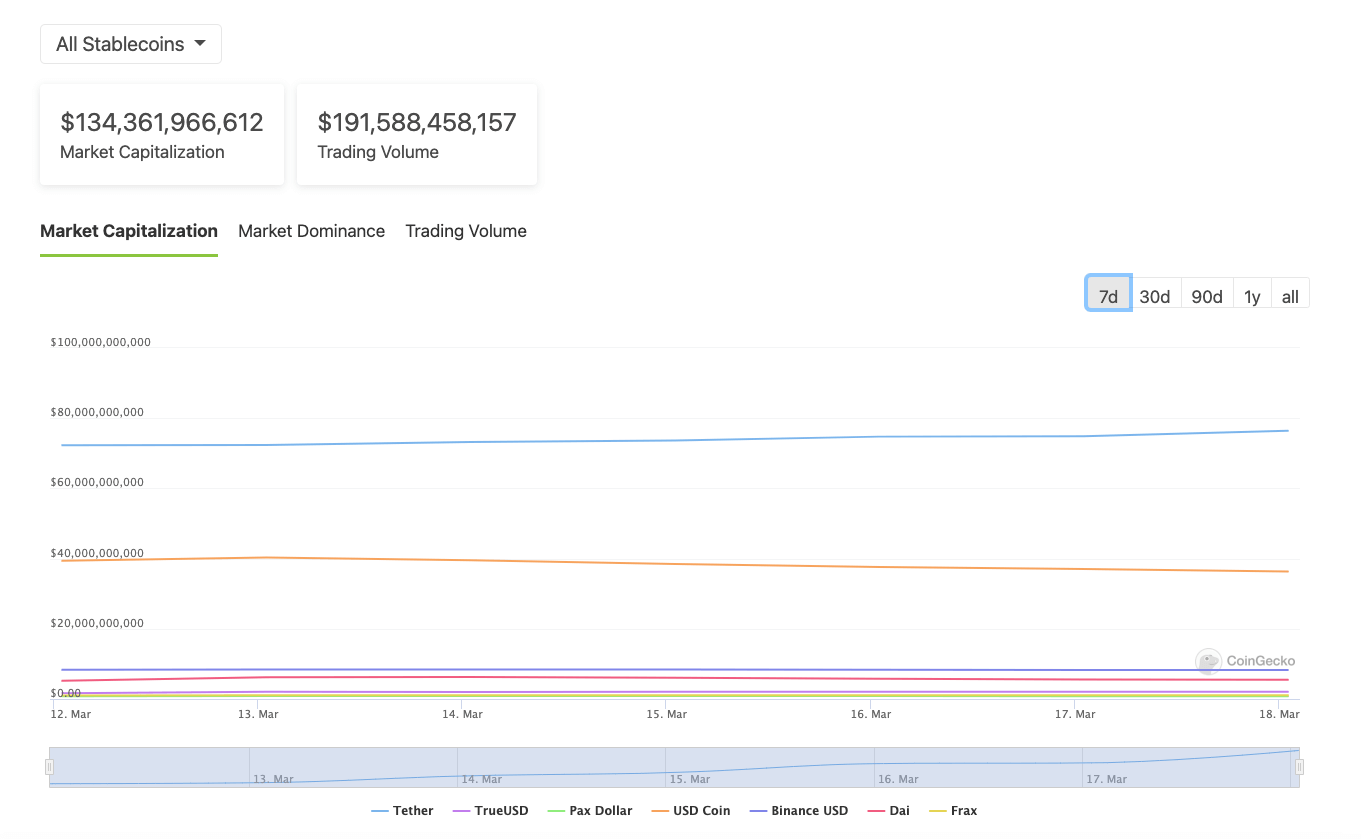

Meanwhile, the largest stablecoin by market capitalization USDT has experienced an 8.7% increase in supply.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The stablecoin market has seen significant changes over the past few weeks — including the removal of over 7 billion USDC stablecoins from circulation following the depegging event on March 11.

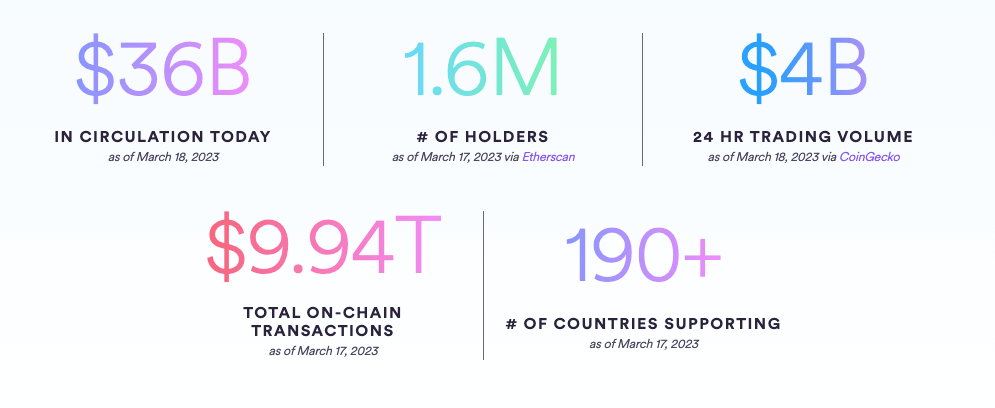

Since then, USDC and other stablecoins have been re-pegged, and Circle’s stablecoin is currently trading at $1 on several centralized trading platforms as of March 18.

De-peg causes sell-off

USDC hit a price point of $0.877 per coin during the de-peg alongside six other stablecoins which also lost their dollar peg on the same day. Nonetheless, USDC and the other stablecoins have since reattained parity with the dollar — with Circle’s stablecoin trading at $1 on several centralized trading platforms since March 17.

On March 6, roughly 43.89 billion USDC was in circulation. On March 17, 7.08 billion USDC was redeemed — falling by 10.2% over 30 days, according to on-chain data by CoinGecko.

BUSD also retreats

On March 17, BUSD’s 24-hour global trade volume across different exchanges was $8.2 billion. Over the last 11 days, 439 million BUSD has been redeemed. During that time, the amount of BUSD in circulation decreased to 8.2 billion from 8.6 billion.

Per Nansen’s proof-of-reserve data, Binance currently holds 7.42 billion BUSD. According to Coin Gecko’s stablecoin market data, the number of BUSD in circulation has decreased by 46.3% over the past 30 days, which analysts attribute to the SEC’s decision to serve Paxos–the US issuers of BUSD–a Wells Notice last month, prompting both Binance and Paxos to distance themselves from the stablecoin.

Tether picks up supply

Between both the USDC and BUSD liquidations over the last several weeks, the largest stablecoin by market capitalization, Tether (USDT), has experienced an 8.7% increase in the number of coins in circulation. Tether currently holds an overall market valuation of approximately $75.29 billion, with 75.17 billion USDT in circulation. On March 17, Tether’s global trade volume of $80.38 billion exceeded that of every other coin in the entire crypto-economy in terms of 24-hour settled trades. BUSD and USDC possess the second and third-largest stablecoin volumes, respectively.