Uniswap’s proposal to collect fees from LPs stumbles during first poll

Uniswap’s proposal to collect fees from LPs stumbles during first poll Uniswap’s proposal to collect fees from LPs stumbles during first poll

The poll found 45% opposition to a fee and divided support for two fee plans.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A poll of Uniswap’s governance community on June 1 found divided support for a feature that could eventually draw fees from liquidity providers.

Poll finds mixed support

On May 10, GFX Labs published a proposal titled “Making Protocol Fees Operational,” which suggests collecting fees from liquidity providers for a project treasury.

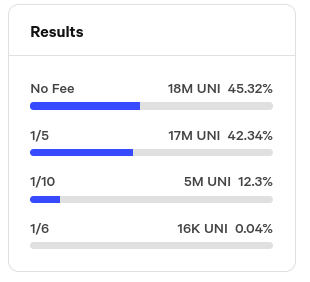

On June 1, a poll to determine support for that proposal concluded with close results. Approximately 45% of votes expressed opposition to a fee. Meanwhile, 42% of votes supported charging 1/5 of the pool fee across all Uniswap v3 pools, while 12% of votes supported a few charging 1/10 of the pool fee across those pools.

Though support for a fee collectively surpassed opposition to a fee (55% vs 45%), no single category had greater support than the “no fee” category.

Fifty-six (56) million UNI tokens ($280 million) were used to cast votes.

These results will not necessarily prevent further votes on the proposal. The poll page suggests that polling data will be used to prepare a more formal “temperature check” vote. Nevertheless, opposition to a fee seems to be significant.

Should Uniswap introduce the fee?

GFX Labs’ initial proposal said that the fee would demonstrate that Uniswap can generate revenues. The fee would also show that liquidity providers are operating professionally and earning enough revenue not to need rebates.

Though governance members expressed tentative support for the idea, many members including GFX itself noted that such a decision could potentially carry regulatory and legal implications. The proposal could require the payment of income taxes as well.

Finally, the current proposal indicates that this plan would not affect fees paid by most Uniswap users. Instead, it would collect fees directly from liquidity providers.

As with most Uniswap decisions, the choice will be made by users who hold a significant stake in Uniswap’s UNI token. Similar votes have recently taken place around other proposals such as deployment to Coinbase’s Base network and Binance’s BNB Chain.