Uniswap mania: Crypto investors chase massive gains as hundreds of new tokens surface

Uniswap mania: Crypto investors chase massive gains as hundreds of new tokens surface Uniswap mania: Crypto investors chase massive gains as hundreds of new tokens surface

Photo by Andrea Tummons on Unsplash

Throughout the past few weeks, hordes of retail investors have been lured into the DeFi sector by the massive gains posted by many of the crypto assets residing within this fragment of the crypto industry.

As many of these tokens start seeing slowing growth, return-hungry investors are now turning towards unconventional methods of getting the returns – and dopamine – they desire.

These traders are using Uniswap – a decentralized exchange – to trade a plethora of different ERC-20 tokens with tiny market caps, causing many of them to see surges of 1000% or more.

They aren’t using much discretion when it comes to what they’ll throw money into either, as some of the tokens are blatantly useless with names like “Retard Token.”

Crypto traders pump micro-cap tokens as their hunger for high returns grows

Uniswap has been garnering growing utility throughout the past few months due to it being one of the only places to access many popular DeFi crypto tokens.

Users can connect their Ethereum wallet to the platform, and then easily swap their ETH for other ERC-20 tokens.

Although the platform does have some officially supported assets, it also enables users to trade virtually every liquid ERC-20 token contract in existence.

Over the past few days, hundreds of new contracts have been minted by scammers and meme connoisseurs alike, using a variety of methods to try to draw in greedy investors looking to make a quick buck.

Many of these newly minted contracts are scams, in which the creator uses a standard ERC-20 contract to issue the token, fills the liquidity pool with ETH, and then pulls all the money out once some investors jump in.

Despite being absolutely useless and non-unique, some of the issued crypto tokens that aren’t scams have posted massive returns due to them going viral amongst investors.

One such ERC-20 – named “Retard Token” (TARD) – posted a 20x return following its creation, with investors pouring in money due to its “meme potential.”

There are countless other examples of this, and most people trading these tokens simply have a goal of exiting their positions before everyone else does.

Uniswap liquidity sees a massive rise as a result of this trend

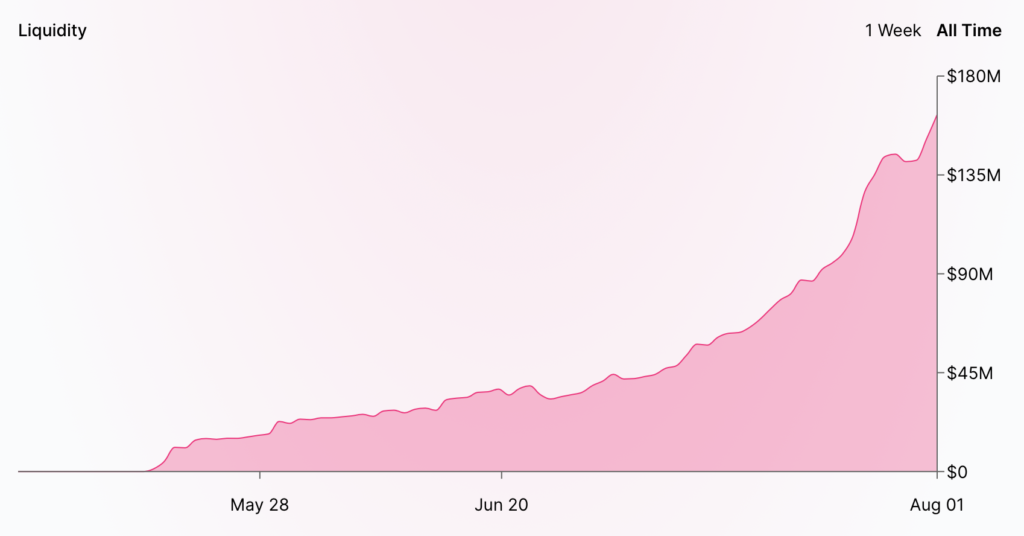

One tangible result of this trend is the amount of new liquidity that has been added to Uniswap in recent months.

According to data from their site, the crypto trading platform’s aggregated liquidity is currently sitting around $162.5 million – marking an 8 percent rise from where it was just 24-hours ago. Its volume is also now averaging well above $100m on a daily basis.

As seen on the above chart, this metric has been trading up for the past few months, but is now starting to go parabolic as investors throw money into just about any small token under the sun.

In many ways, the crypto trading activity seen on Uniswap presently is strikingly similar to that seen in late-2017 – during which time catchy logos and clean websites were the most crucial factors weighed by investors.