Uniswap daily volume crosses $20 million; Ampleforth/ETH leads activity

Uniswap daily volume crosses $20 million; Ampleforth/ETH leads activity Uniswap daily volume crosses $20 million; Ampleforth/ETH leads activity

Photo by Wilmer Martinez on Unsplash

Riding the DeFi wave, trade volume crossed $20 million on Uniswap yet again on Thursday. Average volumes on the exchange are now over $19 million per day—representing true transactions and not artificially pumped wash trading.

AMPL surges after Geyser launch

Ampleforth (AMPL) led Uniswap’s trade volumes on June 8. The platform launched its “Geyser” yield product last month as per DeFi Rate.

In a release shared with CryptoSlate, deposits have crossed $5.8 million deposits in Geyser. The ETH/AMPL pool is ranked first on Uniswap 2.0, while AMPL tokens are now in the top-20 DeFi list.

On Ampleforth’s site, Geyser is touted as a smart faucet that incentivizes on-chain liquidity. Users receive AMPL for providing liquidity on Uniswap, with their pool share increasing in proportion with the amount of liquidity provided.

The yield crossed over 103 percent APR as of the last week in June. The release noted over 25,000 AMPL are set to be distributed each month. Yesterday, AMPL’s 24-hr trading volume spiked from $75k to $3.4 million.

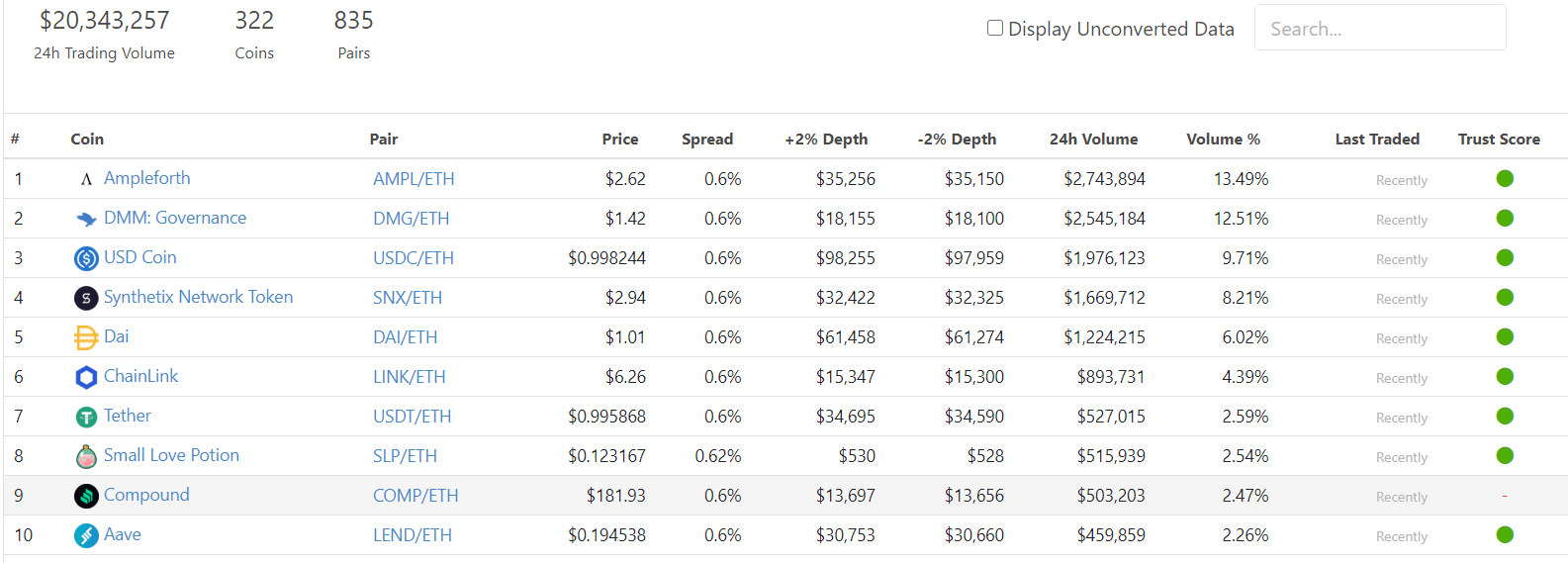

Other tokens have seen similar surges on Uniswap. The below graph shows the top-10 gainers as of July 9:

DMM Governance and USDC — the Circle-owned stablecoin — boast volumes of $2.1 million and $1.9 million each. Blockchain agnostic tool Chainlink comes sixth with an $800k trade volume, while Compound makes up a little more than $500,00.

Interestingly, a so-called “Small Love Potion” is above COMP in Uniswap activity. It links to a blockchain gaming application called Axie Infinity.

The top 2 trending coins on @coingecko right now:

1. Small Love Potion by @AxieInfinity – Up 770% in the last 24 hours

2. @dogecoin – Up 43% in the last 24 hours$SLP pump driven by 4Chan, $DOGE pump driven by TikTok. Who will have a stronger effect in this new alt-season? pic.twitter.com/PnWg0Jm7i0— Bobby Ong (@bobbyong) July 8, 2020

Meanwhile, commenters on a relevant Reddit thread said most observers were still skeptical of a fake bull market. However, the past three years have brought on real-life use-cases instead of just a currency alternative, the user noted.

Uniswap 101

Uniswap is a decentralized, peer-to-peer token exchange on Ethereum. It’s been around since late-2018, but gained prominence and fame this year as DeFi activity surged.

The platform allows users to swap ERC20 tokens using a simple, MetaMask-connected interface. Uniswap also features a model for pooling liquidity reserves which serve as a liquidity provider for traders.

Unlike centralized exchanges; one does not wait around for buyers or sellers to show up before trading on Uniswap. The protocol creates a market automatically, solving the infamous liquidity problem on DEXs.