Understanding the hype behind Polkastarter, the latest fundraising craze in crypto

Understanding the hype behind Polkastarter, the latest fundraising craze in crypto Understanding the hype behind Polkastarter, the latest fundraising craze in crypto

Polkastarter has quickly reached superstar status as a DeFi launchpad.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

You have probably heard of Polkastarter (POLS), the decentralized finance project that provides users with a decentralized launchpad for crowdfunding. But what makes Polkastarter different from other ICO or IDO platforms, and why do projects launched on the platform show 20x+ returns even with relatively small volumes?

It’s important to understand the market dynamics for that. In the past year, decentralized exchanges (DEX) have grown in user base and volumes, surpassing even top centralized exchanges at times.

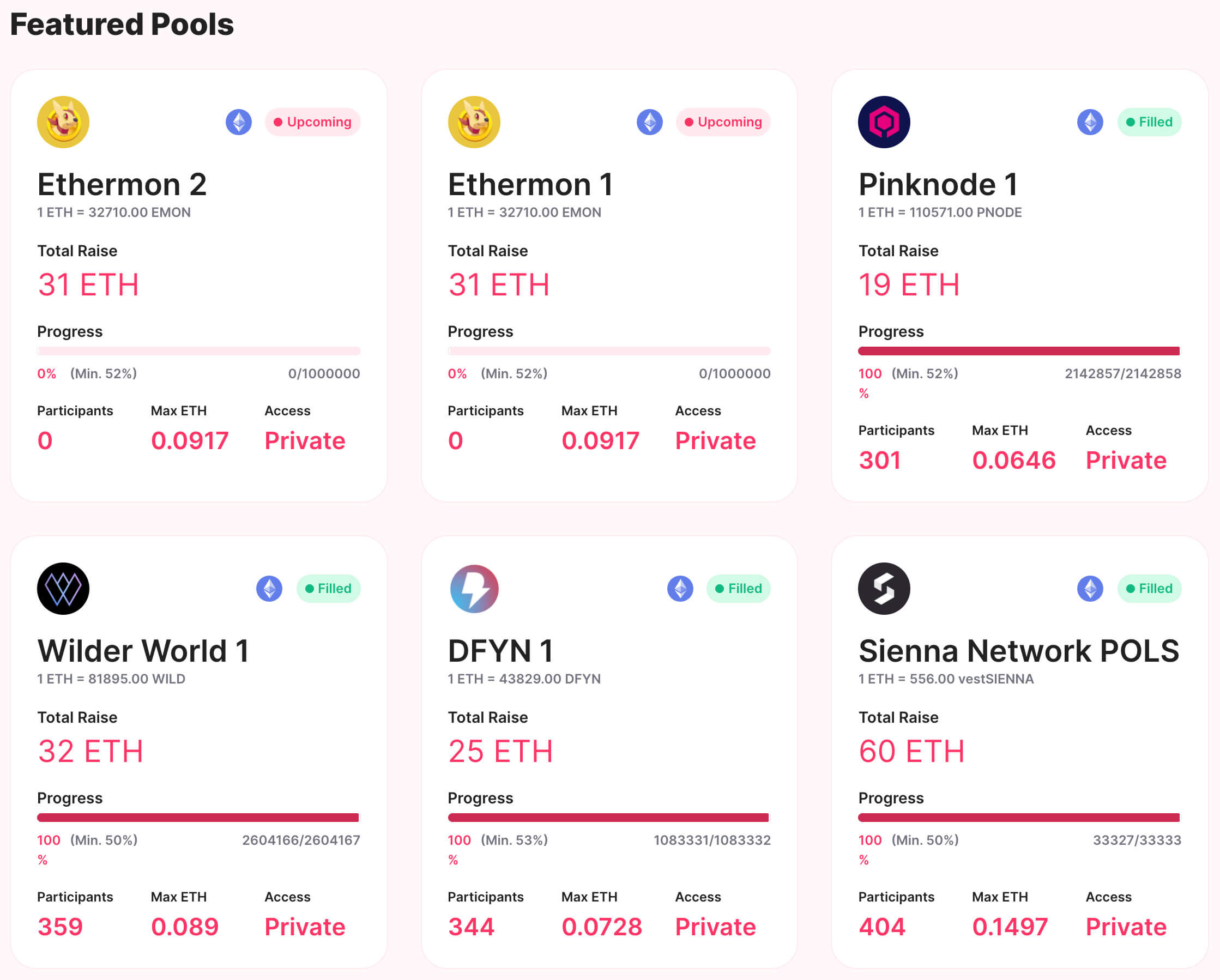

IDOs, or Initial Decentralized Offerings, provide participants and projects with a cheap, welcoming, and straightforward path to capital growth. Polkastarter is the leading IDO platform, offering their community access to the best early-stage crypto projects out there, and offering those projects a strong platform for raising capital.

But the IDO space suffers one major problem in the form of congestion. Since anyone can launch a token, it is difficult for the broader crypto community to consistently identify and invest in quality, high-potential projects.

Polkastarter addresses this problem through a very thorough due diligence process before onboarding a project. Being part of Polkastarter’s launchpad also adds a lot of credibility to the project since the community values the Polkastarter team for their research and due diligence.

We explore the ins and outs of Polkastarter and take a look at some of the most promising projects launched on the platform.

What is Polkastarter?

While the days of the infamous 2017 ICO mania might be long behind us, the need cryptocurrency projects have for funding remains almost the same. The fact that there is now over $50 billion locked in the DeFi industry has only attracted more companies looking to capture a piece of the booming financial market.

Polkastarter is an IDO platform that connects early-stage projects with community members. Through fixed pool swaps, projects that raise through Polkastarter distribute tokens to these early community members in exchange for capital.

The goal of the platform is to provide an all-in-one solution for all blockchain and DEX needs a project might have. Crowdfunding on Polkastarter isn’t limited only to ERC-20 tokens on Ethereum and can be also done using BEP-20 tokens on Binance Smart chain.

It launched back in December 2020, raising $875,000 in seed and private sale backed by crypto funds such as NGC Ventures, Moonrock Capital, Signum Capital, and Astronaut Capital.

The oversubscribed round saw more than $20 million in interest, showing that there was a strong demand for a decentralized fundraising platform.

What makes Polkastarter work?

Fixed ratio swaps are Polkastarter’s answer to the rampant problems of blockchain crowdfunding. Aside from preventing the typical volatility of the tokens being sold, they provide better transparency both to users and investors.

Fixed swaps enable projects to set a cap on how much an individual can invest. This prevents short-term speculators from pumping and dumping the token being sold and provides investors with the assurance that their purchase won’t suddenly and aggressively lose its value.

To purchase tokens during a Polkastarter IDO, users must participate through a POLS pool. POLS pools can only be participated in by individuals whose addresses have been whitelisted. Your chances of being whitelisted are directly proportional to the number of POLS you own.

There are two ways to be whitelisted. First, you can hold POLS on Ethereum or BSC. For every 250 POLS you have in your wallet, you will receive one “ticket” that will count towards you in the whitelist selection. Projects choose addresses to be whitelisted at random, so the more tickets you have, the greater your chances of being whitelisted.

Second, you can provide liquidity to the Uniswap ETH-POLS pool (and, coming soon, the PancakeSwap BNB-POLS pool). If you provide liquidity, your LP tokens will also be counted towards tickets for being whitelisted. Each LP token is the equivalent of 100 POLS. Therefore, the 250 POLS required for a ticket is equal to 2.5 LP tokens. If you have 5 LP tokens (equal to 500 POLS), you will have 2 tickets.

Learn more about Polkastarter’s whitelist and IDO process here.

The addition of permissionless listing enables projects to launch fixed token swap pools without having to go through complex and often expensive listing processes. Projects can just use the core framework of the platform to launch their own crowdfunding campaign or auction.

If auctions are the chassis of Polkastarter, then the POLS token is the fuel that powers the platform. POLS are available on Ethereum and BSC as ERC/BEP20. The fundamental use-cases for the token are staking and governance. POLS token holders are also eligible to participate in the fundraising of the projects which are open only to POLS holders.

POLS was listed on Uniswap at a $5 million fully diluted cap in 2020 at the rate of $0.05/POLS and the token is currently trading at prices above $3.2. The token is now up 60x+ and trades with healthy volumes and liquidity.

Fostering innovation with an unprecedented ROI

Polkastarter’s simple and straightforward listing mechanism, low fees, and interoperability quickly made it popular among ambitious DeFi projects looking for funding.

The first several projects that launched on Polkastarter all shared the same basic idea—offering an innovative service while solving the problem of current blockchain frameworks. MahaDAO, SpiderDAO, Royale Finance, and FIRE Protocol were among the first ones to utilize Polkastarter’s framework and fund their visions of what the DeFi market should look like.

Most of these protocols quickly caught on and provided their investors with an incredible return on investment (ROI). Always looking for the next big thing, the rest of the crypto market quickly realized the potential that lies in Polkastarter IDOs and rushed to invest in young projects looking to change the face of DeFi and other verticals.

This had an avalanche-like effect, pushing dozens of new projects to swarm Polkastarter and fight for a portion of the funds that were being poured into the platform.

So far, the biggest return has been Ethernity Chain (ERN), a digital platform that produces authenticated non-fungible tokens (NFTs), which recorded an ATH ROI of 272.10x.

The huge rise in popularity of NFTs in the past few months has fueled an investing frenzy in other Polkastarter projects offering solutions for NFTs. Superfarm (SUPER), a cross-chain protocol that enables users to deploy crypto and NFT farms without coding, saw an ATH ROI of 189.33x and reached a market cap of over $274 million in less than two weeks since it launched.

The third highest-grossing project on Polkastarter was also riding on the wave of NFT popularity. Polkamon’s (PMON) digital collectibles have a market cap of $55 million but have generated an ATH ROI of 185x for its investors.

And while most of these insane returns lasted for only a short while, most of the two-dozen projects that have so far had their sales on Polkastarter saw the price of their tokens double at least.

As of press time, Ethernity Chain (ERN) and its NFT platform are still the best performing project on the platform, with an ROI of over 140x.

A killer combination of being at the right place at the right time and an interface that fosters innovation and rewards investors that have skin in the game is what lies behind Polkastarter’s success.

Set to add new features to its auction platform and additional functionality to the POLS token in the near future, Polkastarter is well on its way to change the way DeFi projects raise capital.