Trailing 4chan, an “elite” investor group is keen on Ethereum DeFi yield farming

Trailing 4chan, an “elite” investor group is keen on Ethereum DeFi yield farming Trailing 4chan, an “elite” investor group is keen on Ethereum DeFi yield farming

Photo by Johny Goerend on Unsplash

There’s been a lot of money made in Ethereum’s decentralized finance (DeFi) sector over recent weeks.

Tokens related to DeFi have literally surged hundreds of percent. Also, users have found ways to leverage protocols such as Compound and MakerDAO to make an annualized return above 100 percent.

Thus far, the growth in DeFi has largely been driven by two groups:

- Ethereum diehards who know of resources and tools that may elude “normies.”

- Users of the 4chan, specifically the anonymous messaging board’s “biz” forum. This group of users has been infatuated with DeFi for months now, actually inducing unnatural pumps in some altcoins.

Yet it seems that word has spread so far about Ethereum and what is known as

“yield farming” that a prominent online investment club has begun to discuss the subject.

The Value Investors Club is talking about Ethereum and yield farming

When talking about cryptocurrency, the knowledge of most traditional investors ends at Bitcoin. After all, BTC is the only digital asset that receives regular mainstream media coverage and has become an entrenched part of pop culture.

But it seems that the high yields offered in Ethereum’s DeFi sector are catching the eyes of traditional investors.

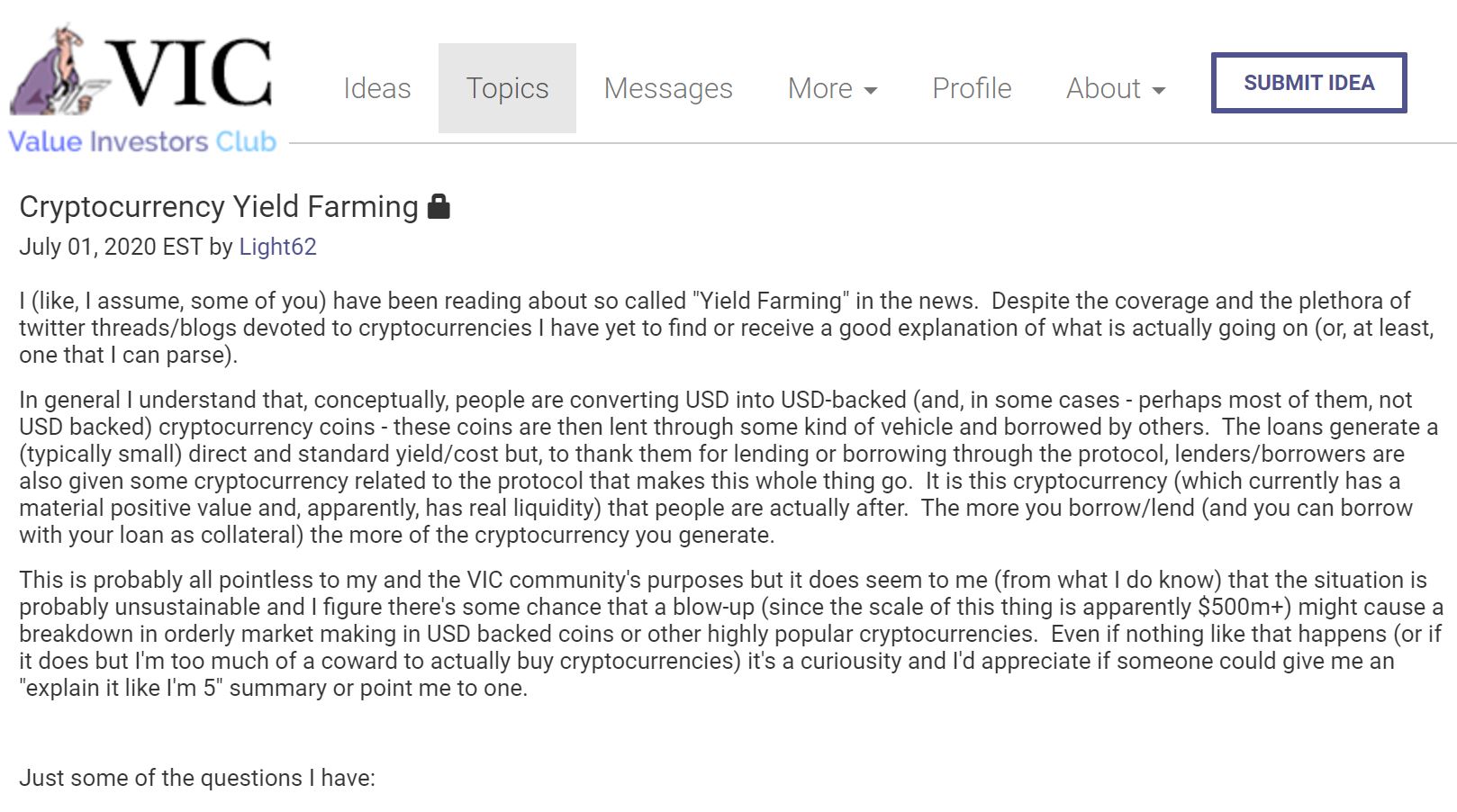

On Jul. 1, an anonymous user of the Value Investors Club, one “Light62,” made a post titled “Cryptocurrency Yield Farming.”

The post is not public as the Value Investors Club makes many of its threads private. Though a screenshot shared by a cryptocurrency investor that is a member of VIC revealed what was said.

The screenshot shared indicates that Light62, who has been tracking “the plethora of Twitter threads and blogs devoted to cryptocurrency,” is confused about “what is actually going on” in DeFi.

It was then speculated that “the situation is probably unsustainable” due to the high amounts of leverage, meaning there could be a “breakdown in orderly market-making in USD-backed coins or other highly popular cryptocurrencies.”

The Value Investors Club is a self-proclaimed “elite” group of anonymous investors literally made up of “partners at hedge funds,” according to Barron’s. The only way you can get in is to impress the admins of the site with a really, really good stock pick.

It’s funny, then, that users of the site — who are literally the crème de la crème of Wall Street — are now talking about yield farming and other intricacies of crypto.

Ethereum’s trend of growth

Even though we don’t know how the user’s post was received, users of the Value Investors Club taking interest in Ethereum is a trend representative of a broader theme of growth for the blockchain.

Blockchain analytics firm Santiment reported last week that the number of new ETH addresses created each day “just crossed above 100,000 again.”

Santiment further explained the significance of the growth with the following comment:

“Ethereum’s network growth metric has rapidly been on the rise since the beginning of 2020, creating 237% more addresses yesterday than it did on Jan 1, 2020 (and ~+200% accounting for rolling averages now vs. then).”

Similarly, Etherscan has reported that over recent days, there have been in excess of over 1,000,000 confirmed Ethereum transactions.