Terra collapse sparked explosive growth in long-term Bitcoin supply

Terra collapse sparked explosive growth in long-term Bitcoin supply Terra collapse sparked explosive growth in long-term Bitcoin supply

Long term Bitcoin supply has spiked significantly since the Terra implosion, suggesting buyers saw value during the collapse and since.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Terra collapse, in which $60 billion of value evaporated, has already gone down as a defining moment in cryptocurrency history.

TerraForm Labs co-founder Do Kwon maintains the issue boiled down to weaknesses in the UST stablecoin protocol design. However, others have openly called out the project as a scam from the off.

The event triggered an exodus of capital, tanking prices across the board from which the market has yet to recover.

Nonetheless, on-chain metrics show an interesting change in the dynamics of long-term Bitcoin holders resulting from the collapse.

Bitcoin supply held by long-term holders soared

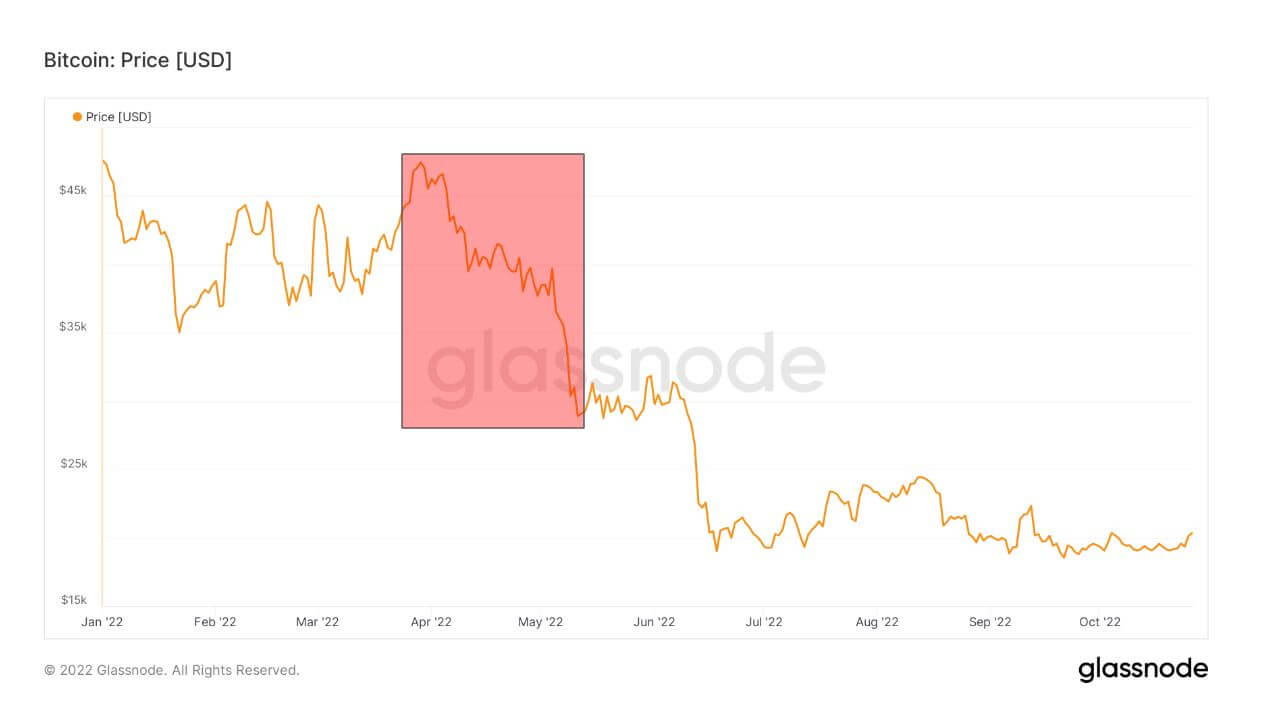

At the end of March, Bitcoin was priced at $47,000 and ticking along despite early warnings of an inflationary spike and trouble in Eastern Europe escalating further.

Moving into May, BTC opened the month at $40,000. But, on May 7, UST began losing its dollar peg price. By May 13, the UST daily close was $0.13, having dipped as low as $0.06 on the day.

As the crisis was unfolding, the knock-on effect saw BTC sink to $30,000 by May 11. And by mid-June, the price had fallen 62% from the end of March to $18,000.

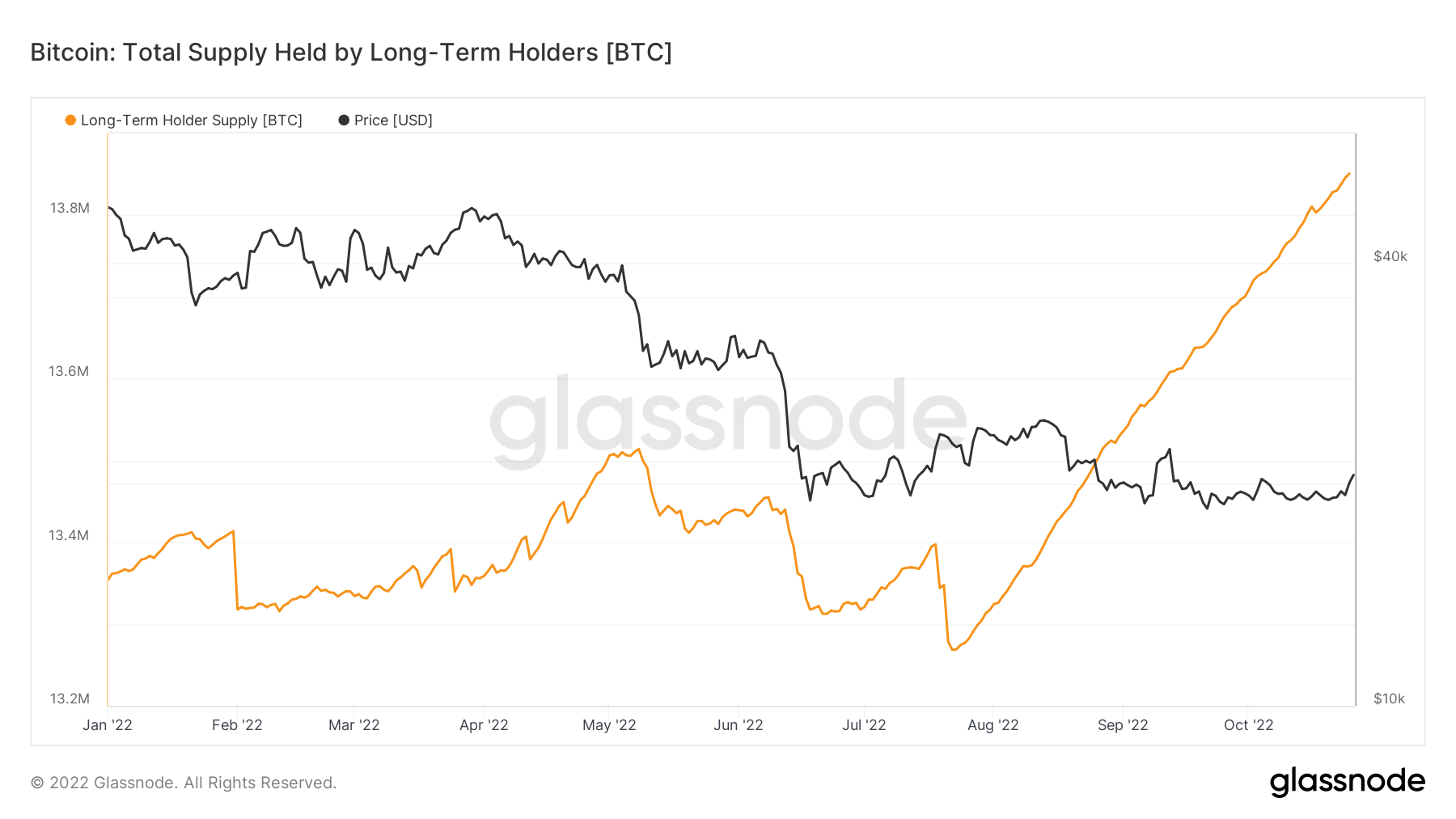

The chart below shows the total supply held by long-term holders (LTH) – Glassnode defines LTHs as individuals with a position held longer than six months. It highlights a gradual drawdown in LTHs in early May as word of the UST de-peg spread.

This trend bottomed by late July, leading to a continuous 45-degree takeoff in LTHs. A significant reason for this pattern relates to buying activity early on in April and May (six months ago,) which has since matured in the classification of LTHs.

LTHs Net Position Change

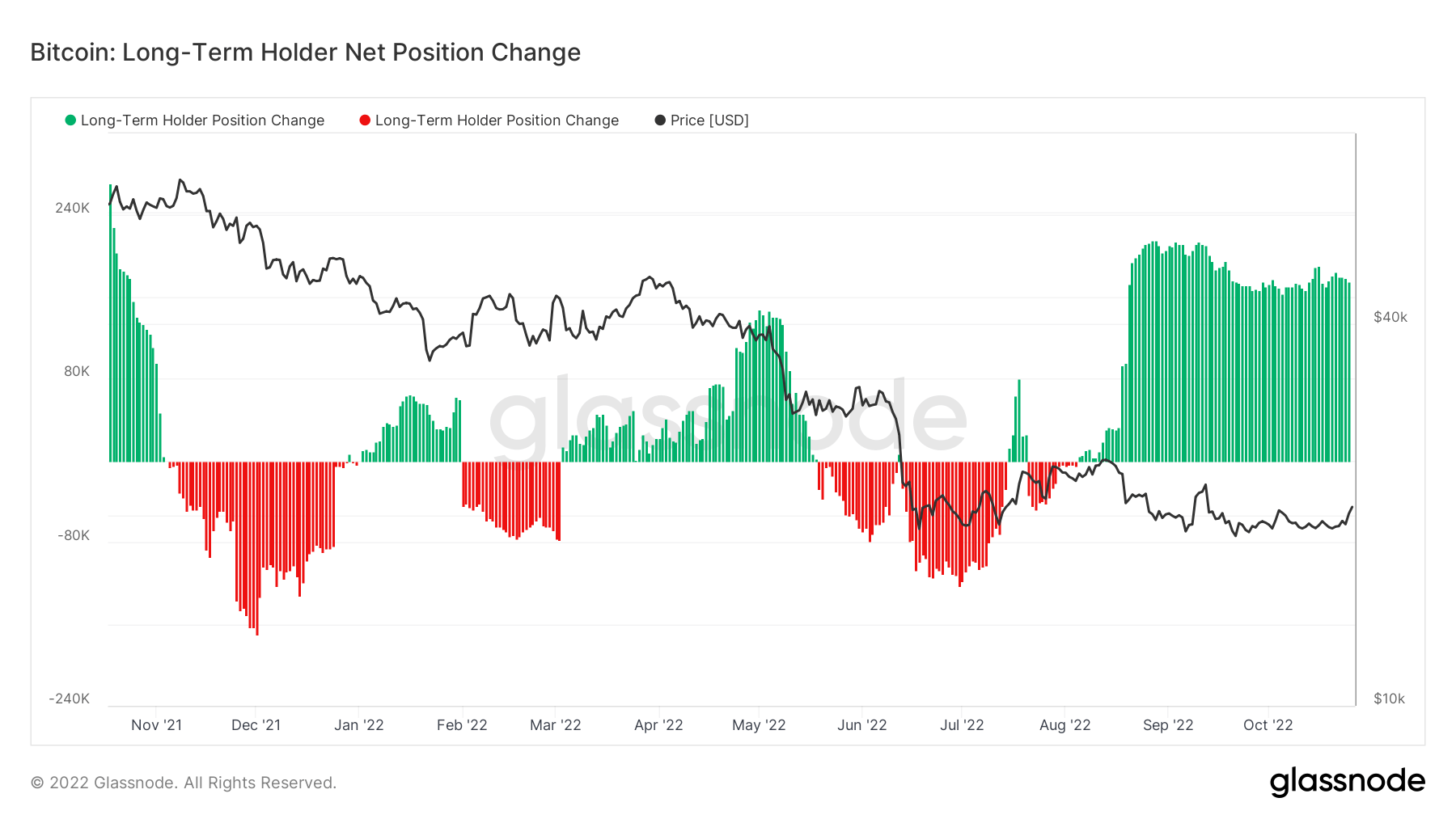

The Bitcoin: Long-Term Holder Net Position Change refers to token distribution by LTHs, who are denoted in green as net accumulators or in red as net distributors cashing out of positions.

As the macro landscape worsened in the second half of the year, LTHs began selling their positions. However, the trend has flipped since September, with LTHs seeing value at these prices and accumulating accordingly.

Short-term vs. long-term holders

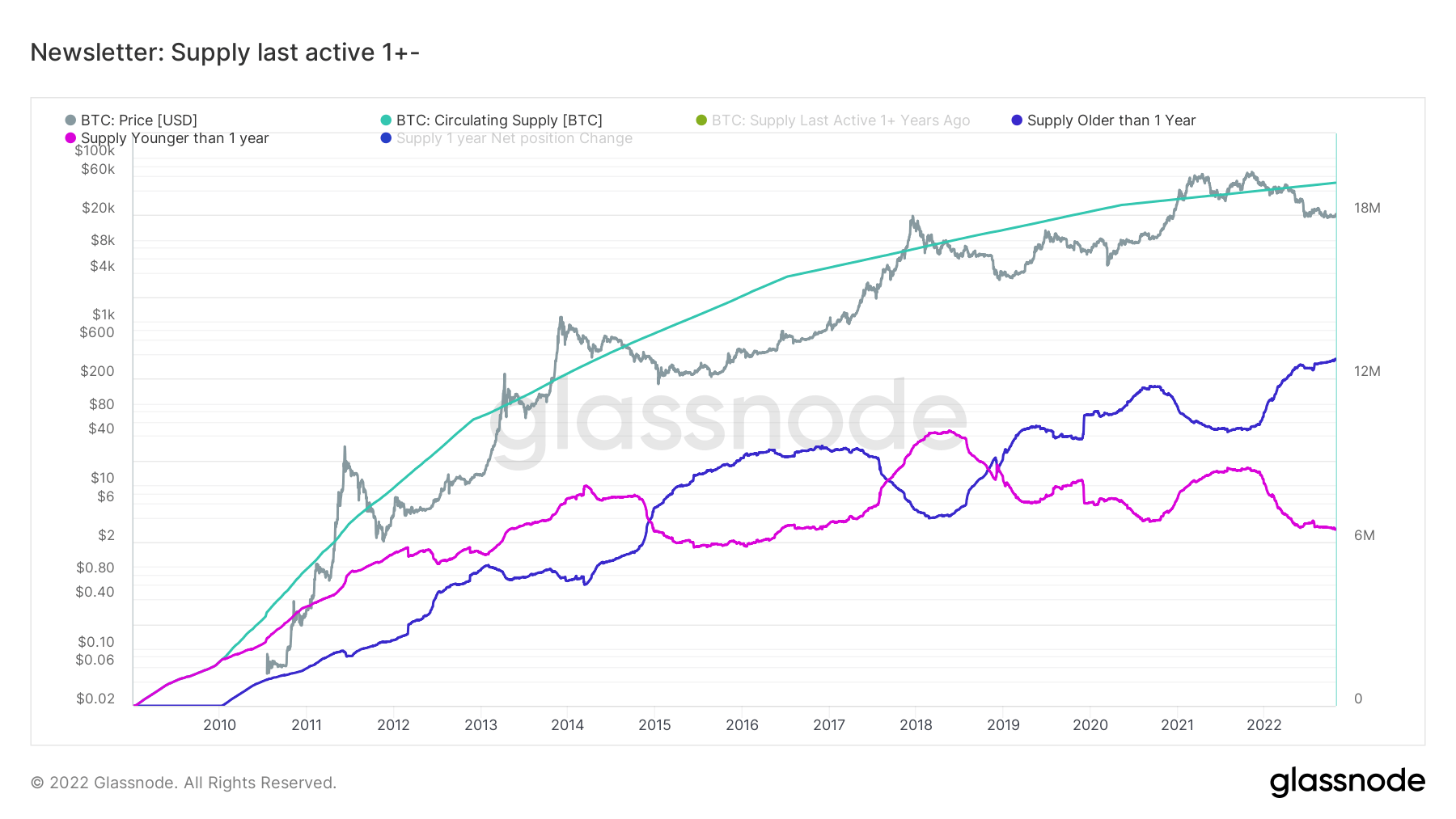

The chart below changes the definition of LTHs to held for more than one year, meaning Short-Term Holders (STHs) refer to holdings of less than a year.

It was noted that price peaks in BTC coincided with leveling or significant drops in STH supply. The exceptions to this were during the period before and including the $900 price peak in December 2013. In these instances, no pattern in STHs could be discerned.

Similarly, since that outlier period, market lulls were accompanied by an uptick in LTH supply, as LTHs accumulated tokens.

Fast forward to the present, LTHs are spiking higher, while STHs are decreasing rapidly. This has created a dramatically divergent pattern not seen before to this degree.