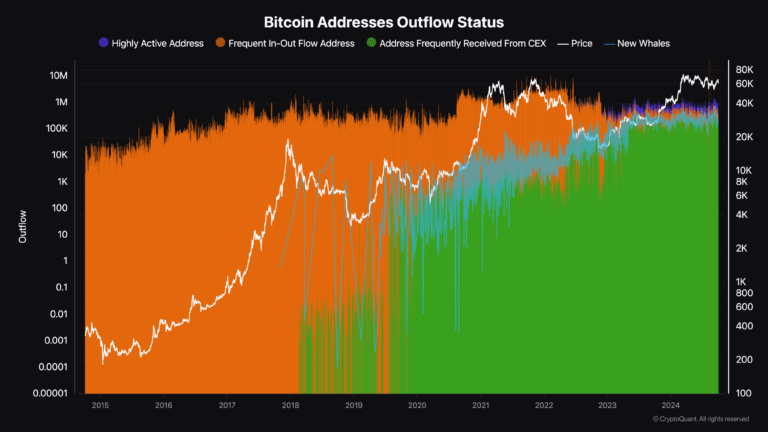

Bitcoin's address outflow patterns hold the key to understanding its price movements over the past decade. Between 2014 and 2017, frequent in-and-out flow addresses dominated, correlating with lower Bitcoin prices. A major shift occurred in 2018 with a surge in exchange-related addresses coinciding with Bitcoin's price rise. But it was the spike in new whale addresses in 2020 that marked a pivotal moment. This spike... changed everything. Discover how this trend reshaped the Bitcoin market and what it means for future price movements by diving into the complete analysis.

Ten years of Bitcoin address data uncovers investor behaviors and market shifts

Ten years of Bitcoin address data uncovers investor behaviors and market shifts Ten years of Bitcoin address data uncovers investor behaviors and market shifts

The surge in new whale activity during 2022 suggests strategic acquisitions amidst price lows, reflecting bullish sentiment among large investors.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.