South Korean Exchange Coinone Leverages Ripple Technology in New Cross-Border Payment System

South Korean Exchange Coinone Leverages Ripple Technology in New Cross-Border Payment System South Korean Exchange Coinone Leverages Ripple Technology in New Cross-Border Payment System

Photo by Liu Zai Hou on Unsplash

One of the largest cryptocurrency exchanges in South Korea has recently announced it intends to implement Ripple technology in a new cross-border payments solution. The exchanged has Joined RippleNet and aims to incorporate Ripple’s xCurrent solution in a new cross-border payment and settlement system.

With the launch of the new payments system, Coinone will become the first South Korean exchange to integrate Ripple technology. The venture partnership was announced via the Ripple blog earlier this week, stating that Coinone would be using one of Ripples three blockchain-based enterprise solutions.

.@coinone_info is launching “Cross” a new remittance service powered by #xCurrent that will service critical payments corridors from Korea through RippleNet. https://t.co/XQrT9RWIr3

— Ripple (@Ripple) May 9, 2018

South Korean Cross-Border Transactions Increase

According to the press release announcing the partnership, World Bank data indicates that outward cross-border transaction frequency form South Korea has been increasing over the last decade. The new Ripple-based solution designed for Coinone, called “Cross,” will assist the exchange servicing the exchange’s retail customers.

The Cross system is designed to address “key regional remittance corridors” out of South Korea, and will make it possible for Coinone users to send remittance to both friends and family within Southeast Asia using Ripple’s xCurrent technology.

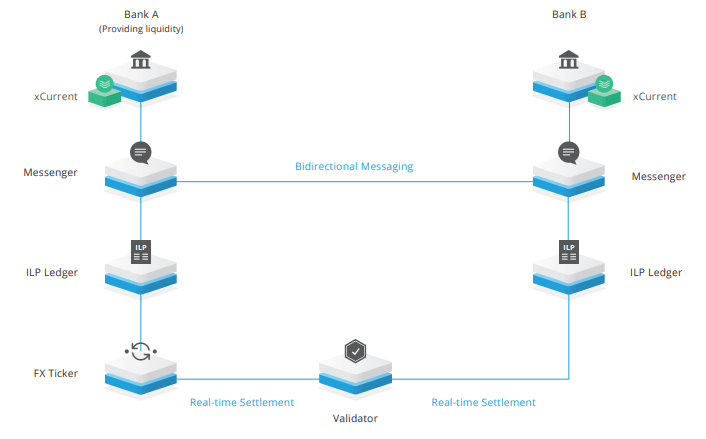

The xCurrent solution is Ripple’s enterprise software solution and allows banks and other financial platforms to instantly settle cross-border payments. xCurrent is built around the Interledger Protocol, which allows for a wide range of interoperability between different ledgers and networks. Interestingly, cross-border transactions executed by the xCurrent solution are completed in seconds, as opposed to the days taken by traditional financial infrastructure.

The new Cross service will be operated by Coinone Transfer a payments business and a subsidiary of Coinone. Wonhee Shin, the CEO of Coinone Transfer, outlined the benefits of the service in a press release earlier this week:

“We are proud to be the first digital exchange in Korea to join RippleNet and implement Ripple’s xCurrent solution. Ripple’s xCurrent solution will revolutionize the lives of our customers by providing them with a real-time, low-cost global remittance service.”

As Coinone frequently handles more than $80 million in transfers on a daily basis, the ability to facilitate cross-border transactions in a timely, low-cost manner could potentially increase the number of traders using the platform, drawing in higher volumes by delivering faster remittance speeds than platforms using traditional payment channels for cross-border transactions.

Emi Yoshikawa, the director of joint venture partnerships at Ripple, released a statement on the joint venture partnership:

“Non-traditional payments companies like Coinone Transfer, and their parent company, Coinone, are revolutionizing the way money moves for their customers. We look forward to working with Coinone Transfer to implement xCurrent as the technology underpinning their new, state-of-the-art remittance service.”

Ripple Solution Adoption Surges

Coinone is a member of the DAYLI Financial Group, and joins DAYLI Intelligence, a subsidiary of the financial group, in using Ripple solutions. DAYLI Intelligence announced that it would be engaging in a joint venture partnership with Ripple in September last year, stating that Ripple technology would be integrated into their AI-based technology infrastructure for financial institutions to provide instant cross-border payments to customers in Japan and South Korea.

In addition to Coinone and DAYLI Intelligence, several other large-scale financial platforms have recently joined with Ripple. Last week, Oman-based financial investment management company BankDhofar announced that it would be integrating Ripple cross-border transaction technology.

Earlier this year, Ripple brought on five separate financial institutions from four different countries, including Brazilain bank Itaú Unibanco and Indian bank IndusInd.

In a press release announcing the banking partnerships, Ripple head of business development Patrick Griffin emphasized the importance of developing transparent, user-focused blockchain-based remittance systems:

“Whether it’s a teacher in the U.S. sending money home to his family in Brazil or a small business owner in India trying to move money to open up a second store in another country, it’s imperative that we connect the world’s financial institutions into a payments system that works for their customers, not against them.”