Solana, XRP, Cardano lead losses as 91% of all crypto ‘longs’ liquidated

Solana, XRP, Cardano lead losses as 91% of all crypto ‘longs’ liquidated Solana, XRP, Cardano lead losses as 91% of all crypto ‘longs’ liquidated

The market saw a sudden drop this morning leading to millions of dollars in ‘liquidations.’

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto traders were in for a tough Monday morning as they woke up to double-digit percentage losses across the market. Large-cap altcoins like Solana, XRP, and Cardano shedded millions of dollars from their respective market caps, while Bitcoin and Ethereum lost 6% and 7% at press time respectively.

As per data from CryptoSlate, Solana traded -12% from yesterday’s highs, Cardano at -7%, and XRP at -8%. Terra (LUNA) fell as much as -11%, Algorand (ALGO) at -13%, and Theta (THETA) at -11%.

Dump all crypto?

‘Liquidations’ occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade.

They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

Data from analytics tool Bybt shows $620 million was liquidated in the past 24 hours alone. Of those, Bitcoin accounted for over $220 million in liquidations, followed by Ethereum at $126 million.

XRP saw $45 million worth of liquidations, while Solana, EOS, Cardano, and Avalanche followed with $26 million, $14 million, $13 million, and $10 million worth of liquidations respectively.

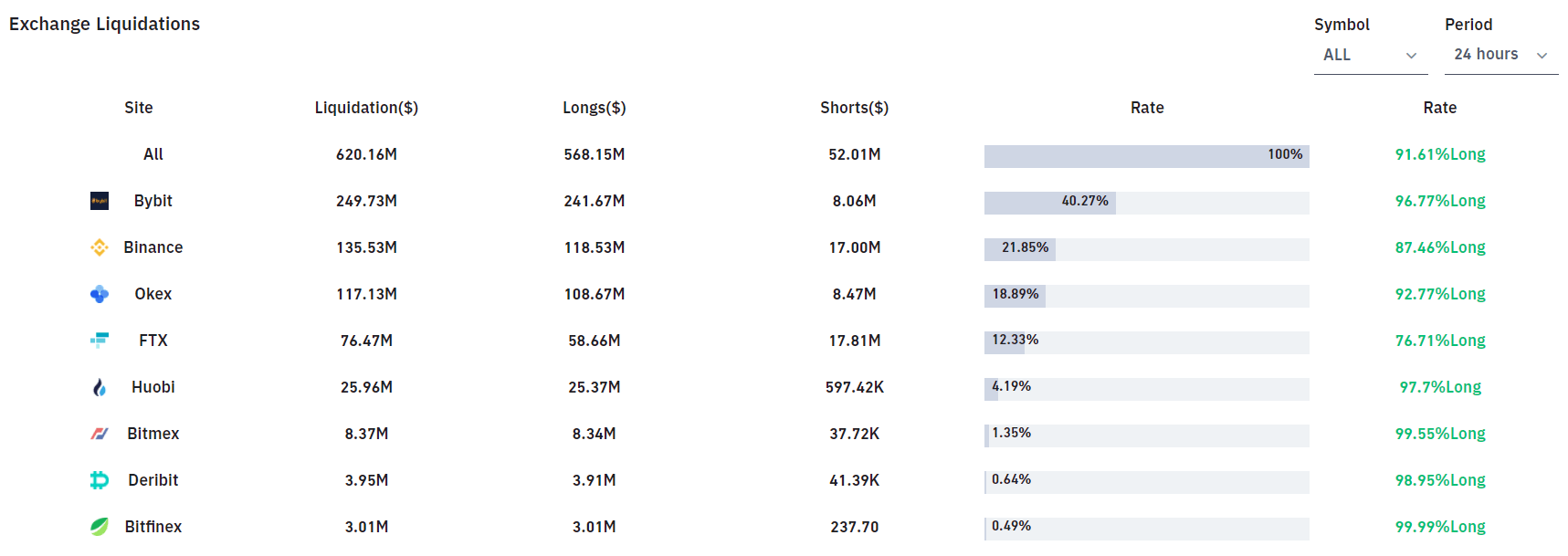

A staggering 91% of all liquidated traders were ‘long’ the market—meaning they had put on positions betting on higher asset prices. Just $52 million worth of shorts were, on the other hand, liquidated.

Futures powerhouse Bybit—known for its degen traders—oversaw $249 million with of liquidations, the most among all other crypto exchanges. Binance, OKEx, and FTX followed with $135 million, $117 million, and $76 million.

139,753 traders were liquidated in all, with the largest single liquidation order occurring on Bybit—Bitcoin trade valued at $7.17 million. At press time, Bitcoin seems to have stabilized at the $45,500 price level. But as is with all things crypto, it may not signal the end of the dip.