Shappella upgrade propels Ethereum above $2,100

Shappella upgrade propels Ethereum above $2,100 Shappella upgrade propels Ethereum above $2,100

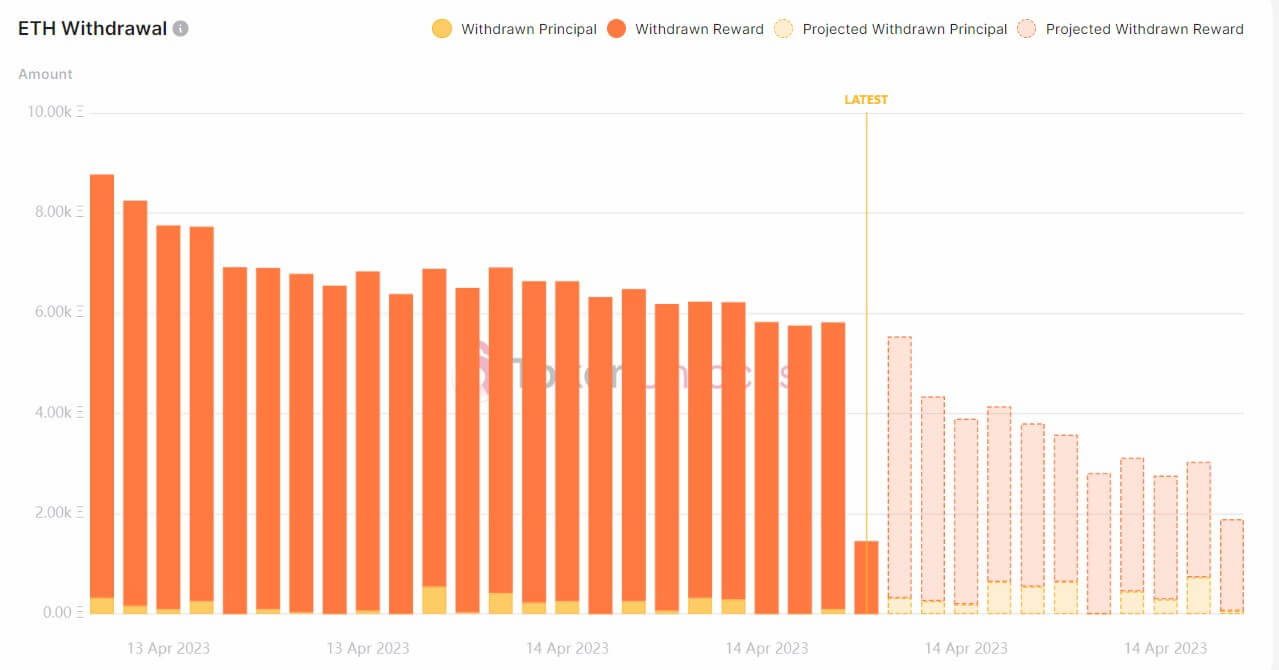

Data from Token Unlocks showed that validators had withdrawn over 265,000 Ethereum at press time as ETH price soared.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Ethereum (ETH) rallied above $2,100 for the first time since May 2022, continuing its largely positive price performance post-Shappella upgrade.

Ether rose by more than 10% in the last 24 hours, first breaching the $2000 level before rallying to as high as 2,126 — a high for 2023 — according to CryptoSlate data.

The positive price movement goes against several crypto analysts’ predictions who believed the Shanghai upgrade would increase the selling pressure on ETH.

Shappella upgrade propels ETH forward

FxPro senior market analyst Alex Kuptsikevich pointed this out in an emailed statement to CryptoSlate. According to Kuptsikevich, the Shappella upgrade “did not pressure the ETH exchange rate but accelerated the upward trend.”

Kuptsikevich added:

“The successful activation of the Shapella hard fork triggered the rally.”

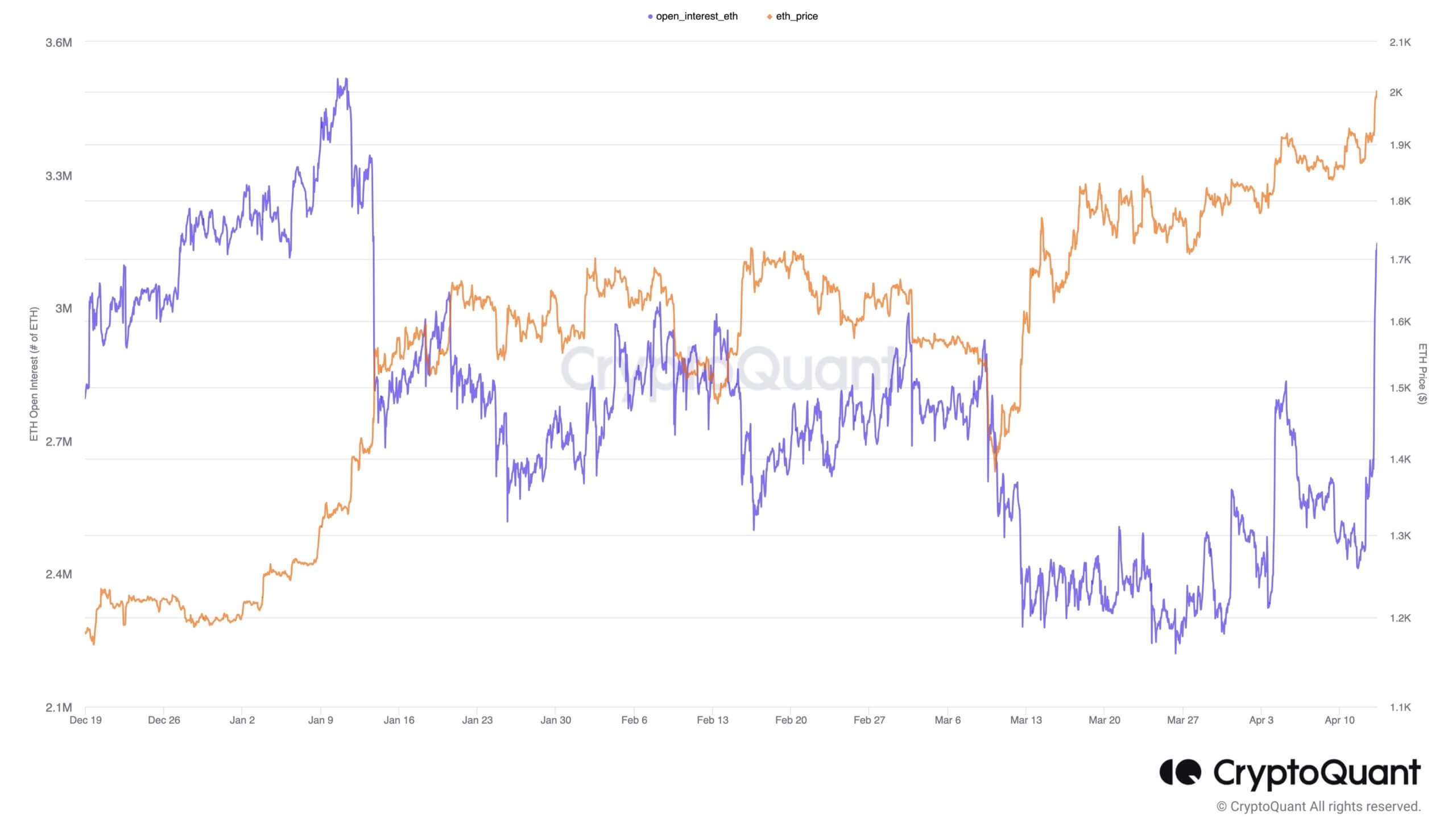

The head of research at CryptoQuant, Julio Moreno, further highlighted the current bullish sentiments surrounding ETH. Moreno said crypto traders have strongly increased their long positions in ETH following the Shappella upgrade.

Moreno noted that open Interest (in the number of ETH) spiked to the biggest level since January.

Glassnode’s data corroborates this, adding that ETH’s futures contracts open interest reached a 17-month high following the upgrade.

Meanwhile, Ether is up 75% on the year-to-date metrics, according to CryptoSlate data.

$2.3B worth of ETH pending withdrawal

Data from Token Unlocks showed validators had withdrawn over 265,000 Ethereum at the time of press.

The data further shows that the total amount of ether pending withdrawals is 1.10 million coins — equating to $2.33 billion.

Meanwhile, blockchain analytical firm Nansen reported that Kraken tops the list of entities waiting to withdraw their assets. The U.S.-based crypto exchange accounts for around 63% of the total ETH withdrawable.

However, liquid staking platform Lido makes up over 56% of withdrawn ETH as of press time.