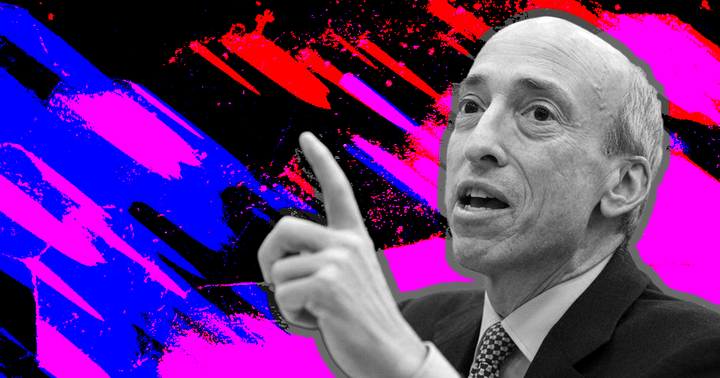

SEC staff reportedly unhappy with Gensler over Kim Kardashian ‘publicity stunt’

SEC staff reportedly unhappy with Gensler over Kim Kardashian ‘publicity stunt’ SEC staff reportedly unhappy with Gensler over Kim Kardashian ‘publicity stunt’

The SEC's enforcement staff reportedly believes that Chairman Gary Gensler violated protocol by using media attention to prop his reputation for the Treasury Secretary position.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The U.S. SEC’s enforcement staff are reportedly unhappy with Chairman Gary Gensler over his “publicity stunt” concerning the recent settlement fine paid by Kim Kardashian, Fox Business Network’s Charles Gasparino reported on Oct. 5.

SCOOP (1/3): @SEC_Enforcement staffers are complaining @GaryGensler violated protocol by hyping @KimKardashian settlement, appearing on @CNBC within minutes of the case being announced, people w direct knowledge tell @FoxBusiness. They are calling it a "publicity stunt"

— Charles Gasparino (@CGasparino) October 5, 2022

According to Gasparino, the regulator’s staff complained that Gensler violated protocol by using media attention to prop his reputation for the Treasury Secretary position.

The staff allegedly said:

“Gensler stealthily approached CNBC for his appearance and created a video on the settlement… [an] unusual move for chairs which usually allow staff to take credit for actions and pursue broader issues.”

Gensler’s media appearance

SEC chairman Gary Gensler released a video on Oct. 3 when news emerged that the commission had fined Kim Kardashian over her promotion of Ethereum Max. In the video, Gensler said celebrity endorsements of investment opportunities do not mean “those investment products are right for all investors.”

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

— Gary Gensler (@GaryGensler) October 3, 2022

The SEC chair further appeared on CNBC the same day to discuss the enforcement case.

Before the recent case, the SEC chair had granted media interviews where he called most crypto assets securities. Additionally, Gensler had previously released social media videos where he urged crypto firms to come in and talk to the commission.

SEC faces backlash

The crypto community has lashed the SEC’s inconsistent enforcement against the industry.

Vocal Bitcoin critic Peter Schiff criticized the SEC for failing to fine MicroStrategy Chairman Michael Saylor while fining Kardashian. Saylor, in his defense, stated that Bitcoin is not a security.

#Bitcoin is a commodity, not a security. Advocating a commodity is similar to promoting steel, aluminum, concrete, glass, or granite. The BTC network is an open protocol, offering utilitarian benefits similar to roads, rails, radio, telephone, television, internet, or english.

— Michael Saylor⚡️ (@saylor) October 3, 2022

Another community member pointed out that the commission had failed to go after politicians like Nancy Pelosi, who is faced with allegations of insider trading.

The SEC will go after Kim Kardashian for shilling a crypto but not Nancy Pelosi for insider trading her way to a hundred million dollars https://t.co/i0bZKjaxjJ

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 3, 2022

Meanwhile, some wondered why Kardaishan was singled out among all of Ethereum Max’s promoters. The pump and dump project had other celebrity promoters like Floyd Mayweather, Jr., and Paul Pierce. The three are currently facing a class action lawsuit over their promotion of the token.