Research: USDC adoption on Ethereum grows post-FTX collapse; USDT remains flat

Research: USDC adoption on Ethereum grows post-FTX collapse; USDT remains flat Research: USDC adoption on Ethereum grows post-FTX collapse; USDT remains flat

According to Glassnode's data, while USDT is the largest stablecoin by market cap, USDC has more transfer volume.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

After a brutal sequence of events led to the collapse of several crypto-related firms in 2022, FTX’s bankruptcy dealt a massive blow to public trust in centralized crypto entities.

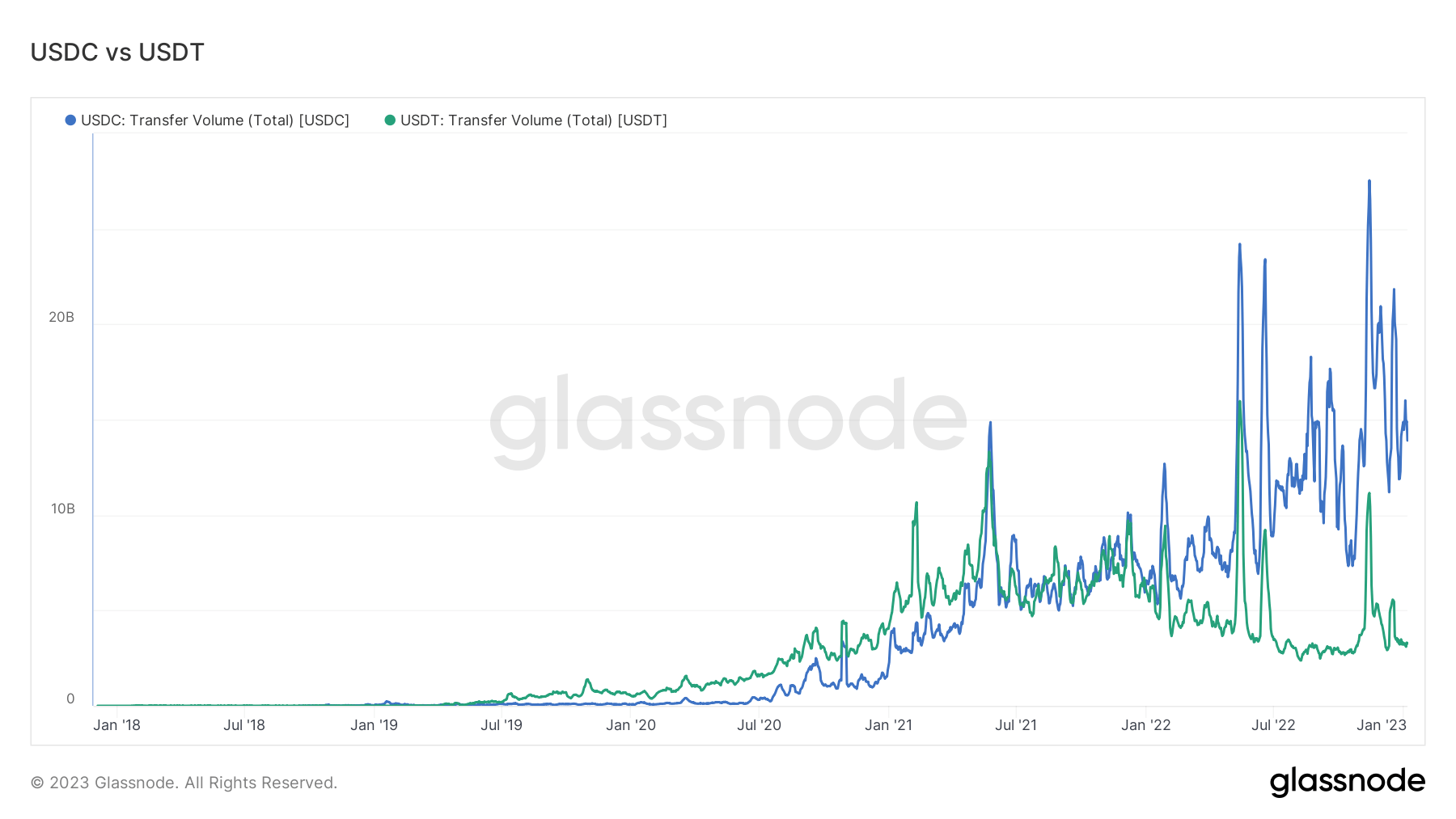

During this period of heightened market volatility, crypto investors preferred Circle’s USD Coin (USDC) to Tether’s USDT. According to Glassnode’s data, while USDT is the largest stablecoin by market cap, USDC has more transfer volume.

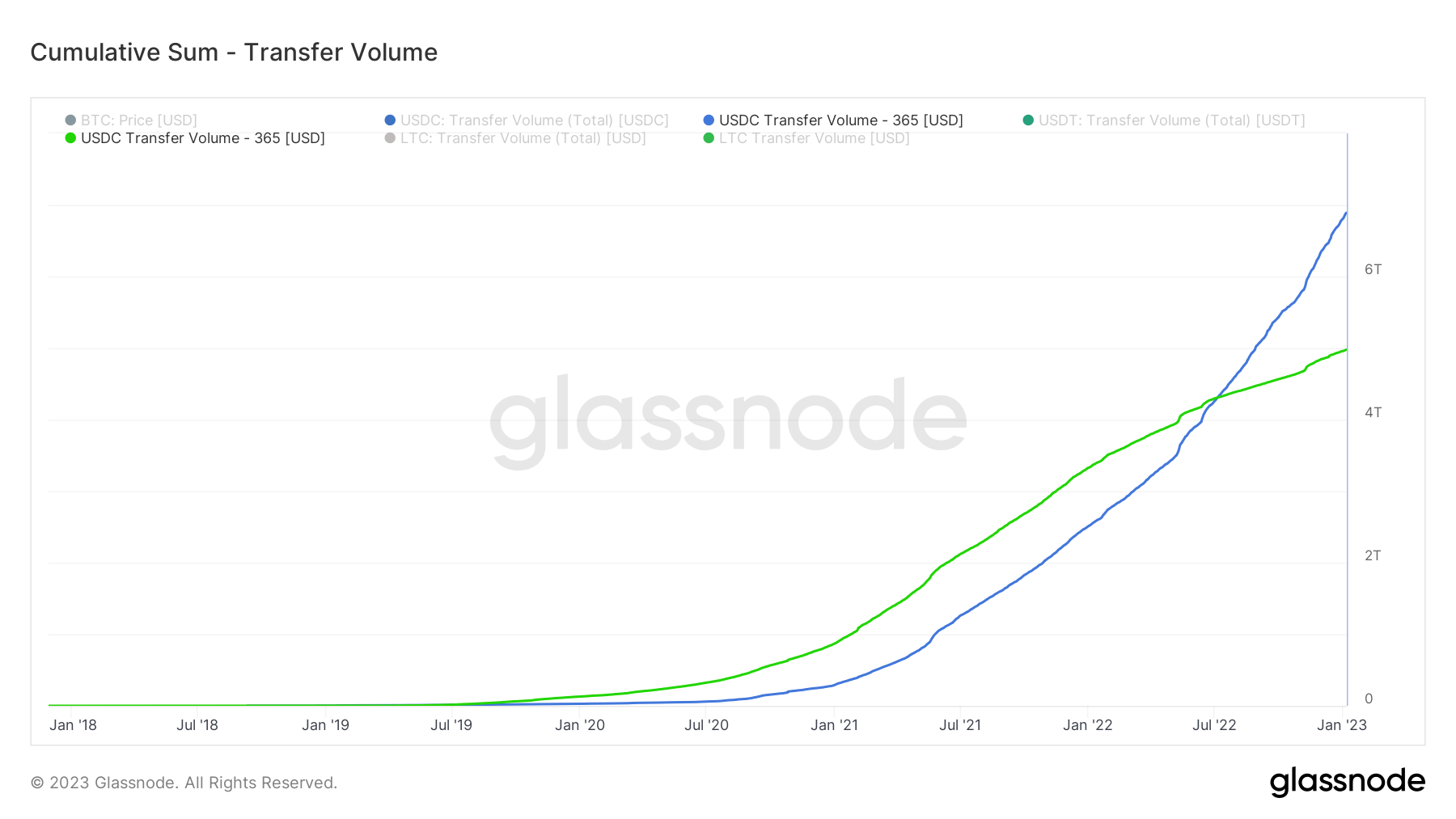

According to the data, USDC has a transfer volume of $15 billion, while USDT’s volume is $3 billion. Cumulatively, USDC outpaces USDT by $7 trillion.

Meanwhile, the Glassnode chart below shows that the disparity in transfer volume was not always like this. USDT’s volume outperformed that of USDC in 2020 and early 2021. But that changed in 2022 when the Circle-backed stablecoin’s volume started growing.

At the time, USDT began to face increased regulatory scrutiny about its reserves coupled with Terra’s LUNA collapse, which birthed fears of whether the stablecoin wouldn’t lose its Dollar peg.

USDC’s balance on exchanges reach $5 billion

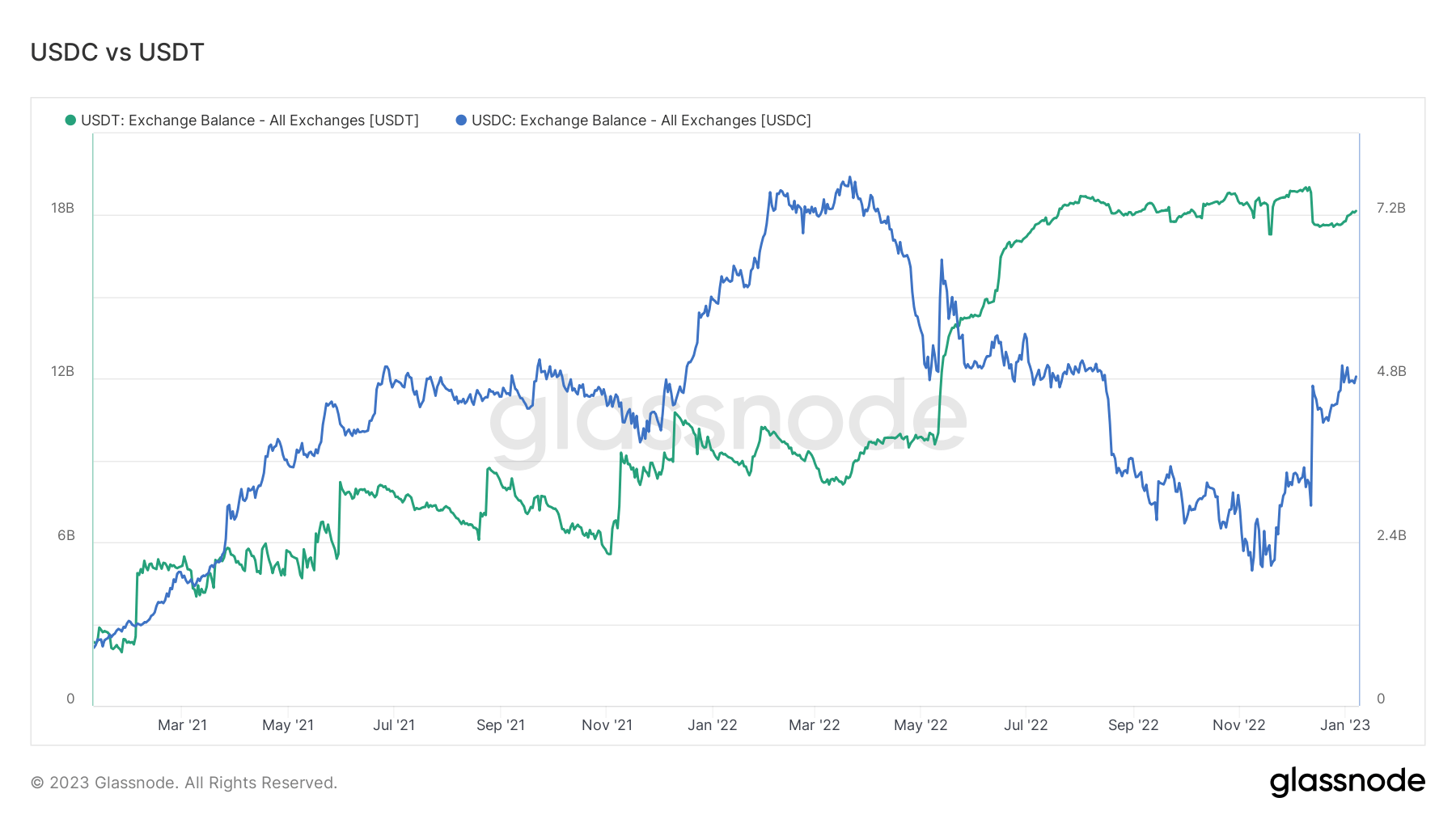

In terms of exchange balances, Glassnode data shows that USDC is beginning to enjoy more adoption post-FTX collapse. According to the data, the USDC on exchanges is approaching $5 billion.

Previously, USDC’s adoption in 2022 had declined thanks to Binance’s decision to convert its users’ balances in USDC and other stablecoins to its BUSD. However, with the FTX collapse birthing FUD that led to record withdrawals from Binance, USDC’s adoption began to see an uptrend towards the end of the year.

Besides that, Coinbase also urged its users to convert their USDT to USDC for free.

On the other hand, USDT’s balance on exchanges stayed flat throughout the period –it even saw a slight decline in early January 2023.

Post FTX’s crash, USDT has seen more questions raised about its reserves, with several hedge funds shorting the stablecoin. However, its issuer said Tether would continue to show resilience even in the face of uncertainty.

With 2023 set to be a risk-off year, the market could likely see further growth among stablecoins. This could set the stage for a fight for dominance between USDT and USDC.