How inflation and debased fiat currencies are pushing investors to Bitcoin

How inflation and debased fiat currencies are pushing investors to Bitcoin How inflation and debased fiat currencies are pushing investors to Bitcoin

While the spikes we've seen in Bitcoin trading volume might not signify that mass adoption is near, they show that it's beginning to act as a safe haven asset.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin’s reputation as a safe haven asset has long been disputed by the world of traditional finance. Its lack of centralized control, extreme price volatility, and novelty made it hard to categorize as inflation-proof or recession-proof.

However, in the past year we’ve seen that in times of uncertainty, investors keep choosing Bitcoin over fiat.

Inflation leads to Bitcoin

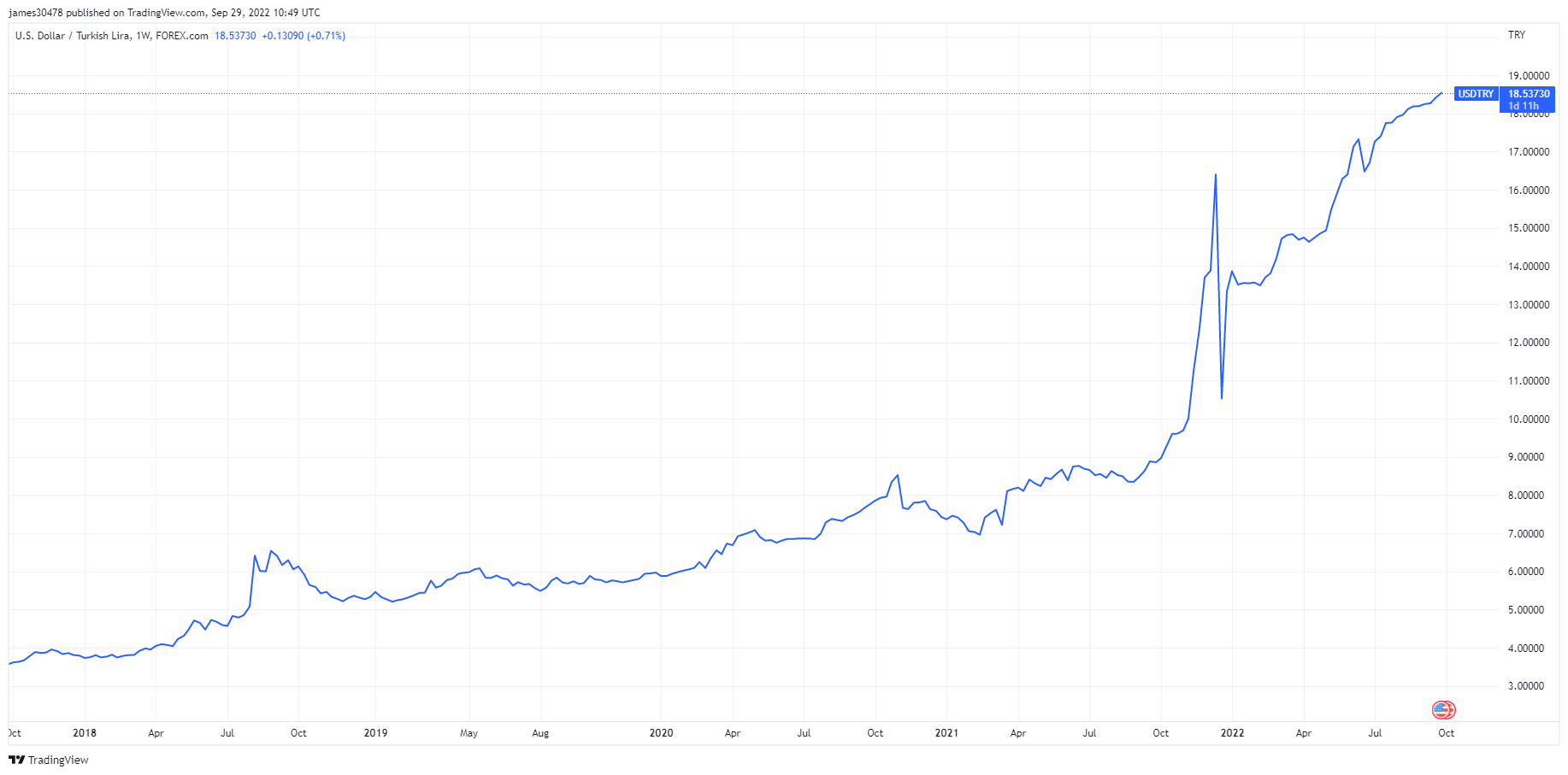

Take, for example, the Turkish lira (TRY). The currency has been on a steady decline since 2018, with the cumulative inflation over the past three years surpassing 100%. Since the beginning of the year, the lira lost 26% of its value against the U.S. dollar (USD). PwC categorized Turkey as a hyperinflationary economy in its September report, saying that deteriorating conditions began in 2021 and have worsened in mid-summer 2022.

The 2017 exchange rate of 1 USD per 3.5 TRY now stands at 1 USD er 18 TRY. This has created huge amounts of USD/TRY trading volume, which has been on a parabolic rise since the beginning of the year.

The U.S. dollar isn’t the only currency Turkish people have flocked to.

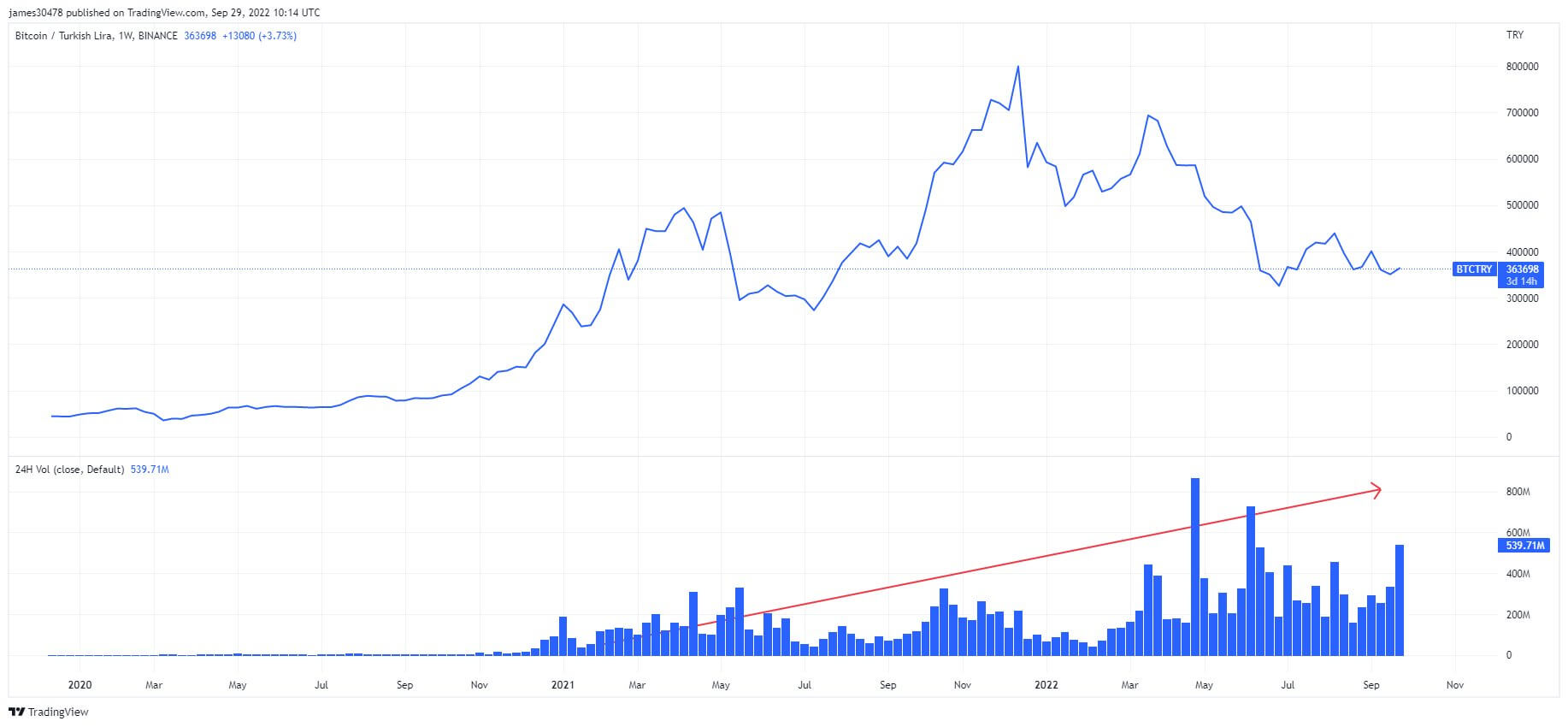

There has been a steady increase in BTC/TRY trading volume on centralized exchanges. Data from Binance has shown that the price of Bitcoin in TRY jumped to its ATH at the beginning of 2022, while the 24-hour trading volume for the pair reached its peak in May this year.

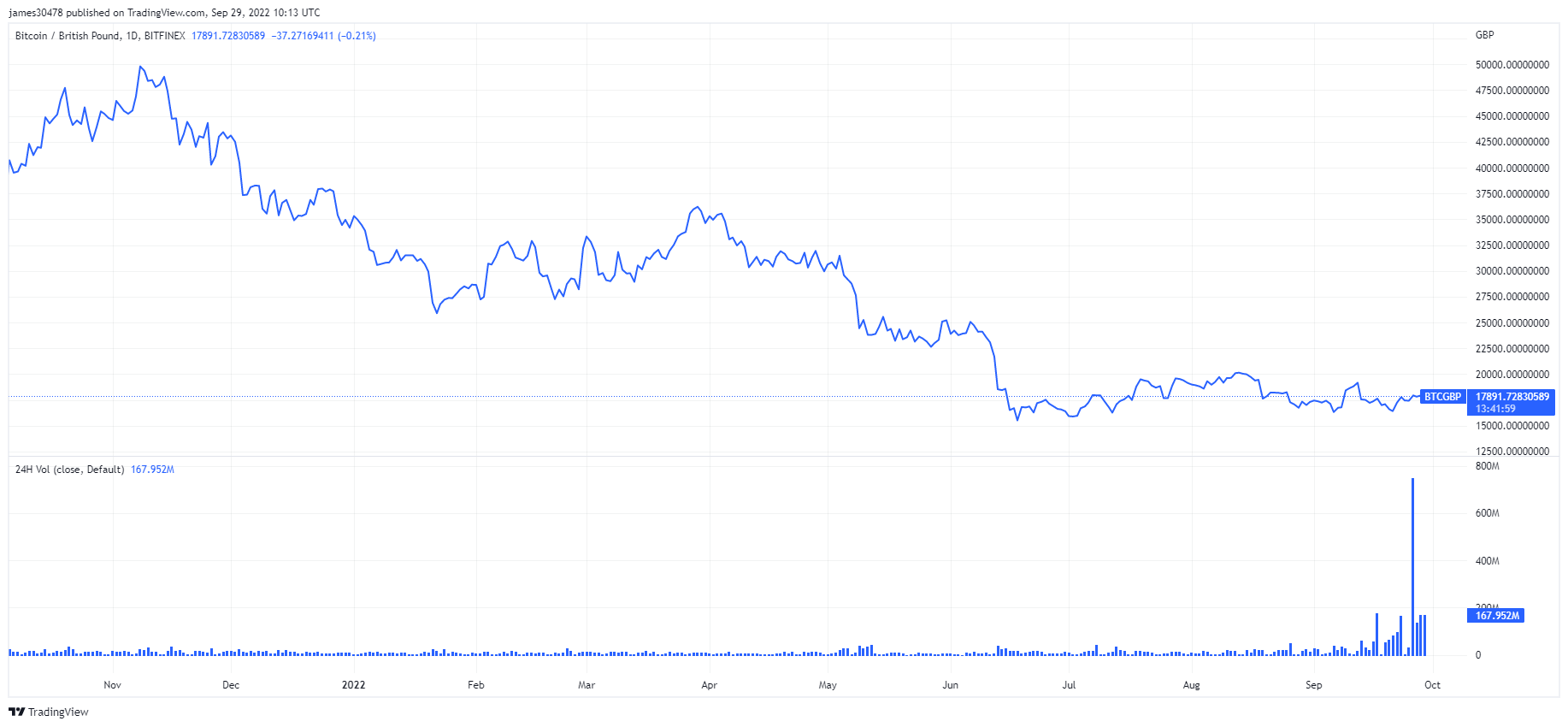

On Sept. 26, 2022, the British pound experienced a flash crash as large as the one recorded on Black Wednesday 1992, losing 4.3% of its value against the U.S. dollar in a single day. As previously covered by CryptoSlate, the drop was a result of the Bank of England’s emergency intervention in the bond market.

The same day the pound experienced its worst drop in 30 years, the BTC/GBP trading volume reached its ATH, soaring over 1,200% in 24 hours.

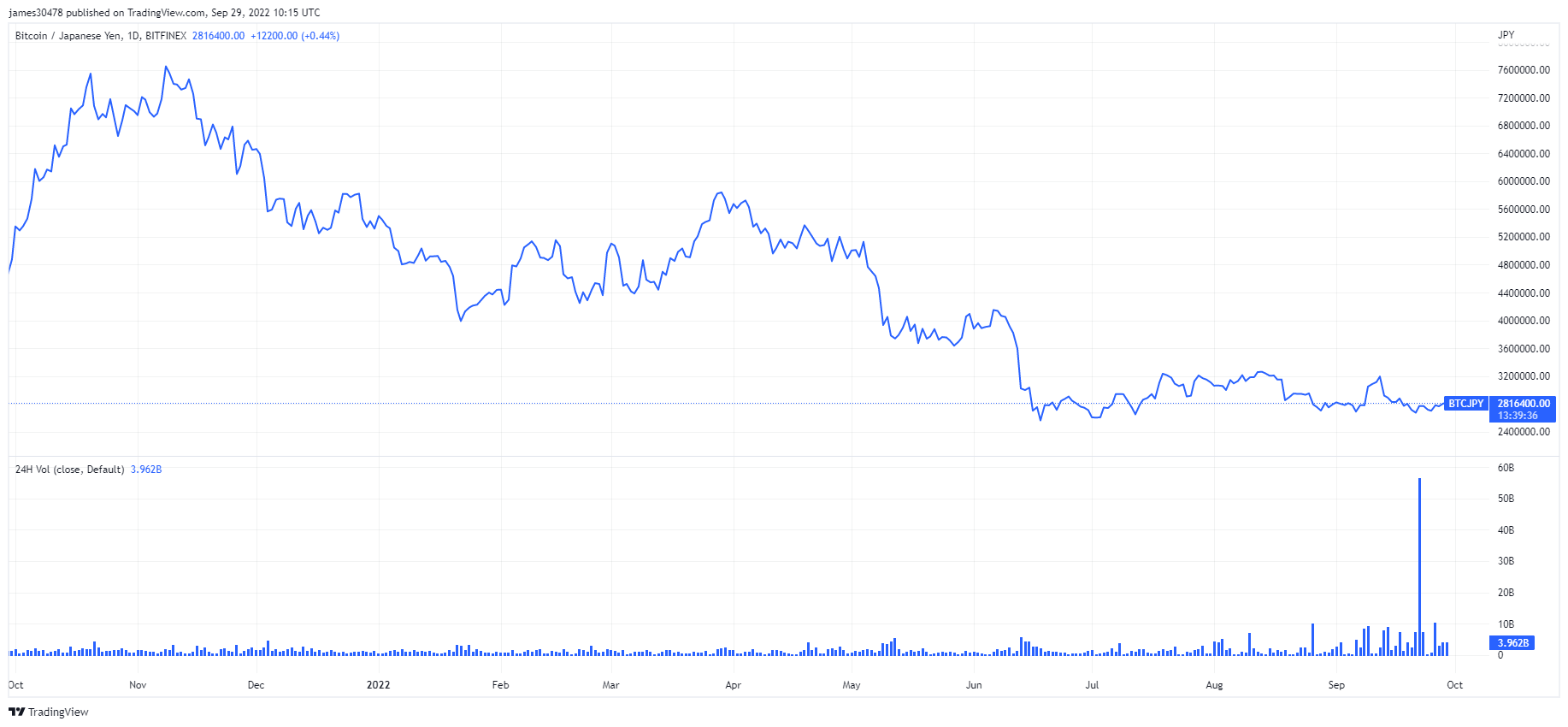

The situation was no better in Japan, where the central bank spent almost $20 billion, or 3.6 trillion yen, intervening in the foreign exchange market to prop up the rapidly declining yen. While the figure indicates the government’s total spending on currency intervention in the entire month of September, it’s widely believed that all of the $20 billion have been used in a single intervention on Sept. 22.

This is now the Bank of Japan’s largest and most significant dollar-selling, yen-buying intervention, surpassing the 2.6 trillion yen record it set in 1998. The intervention was supposed to heal the struggling yen, which lost a fifth of its value against the U.S. dollar this year.

However, the remedy was short-lived — the yen traded at 144 against the dollar before the intervention, after which it briefly reached 140. The following day the yen dropped to 145 against the dollar the following day, erasing the effects of the intervention.

As the yen tumbled, Japanese investors also flocked to Bitcoin. The BTC/JPY trading volume peaked right at the time of the intervention.

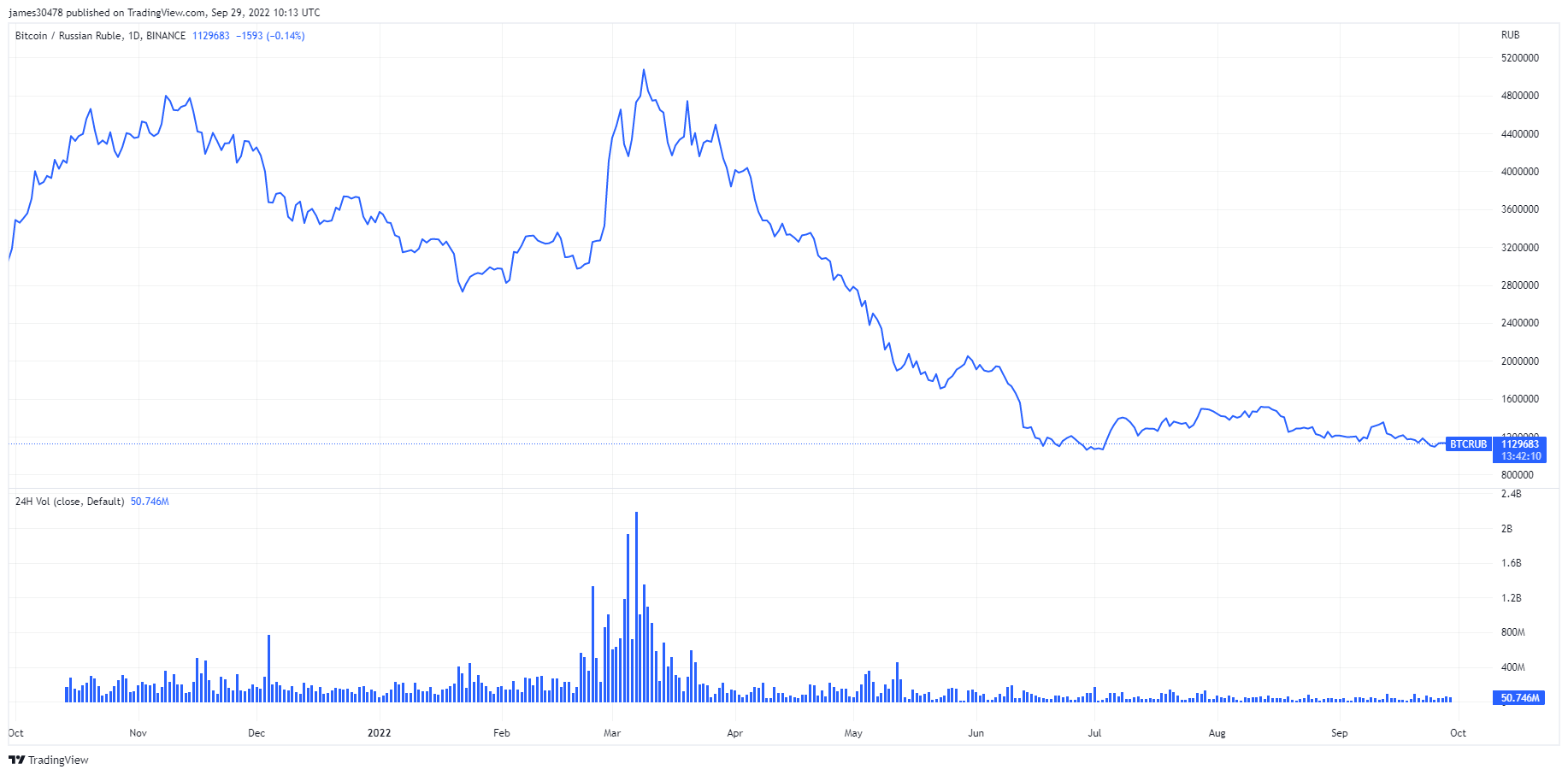

In Russia, as the ruble fell to its historic lows, the BTC/RUB trading volume soared. Investors in the country turned to the hardest asset available as Russia began its invasion of Ukraine, pouring their money into Bitcoin.

While the spikes we’ve seen in Bitcoin trading volume might not signify that mass adoption is near, they show that it’s beginning to act as a safe haven asset. Faced with macro uncertainty, inflation, and debasing currencies, investors are flocking to Bitcoin en masse.