Research: Comparing the 2022 bear market to 2018

Research: Comparing the 2022 bear market to 2018 Research: Comparing the 2022 bear market to 2018

Though around 3 million BTC flooded exchanges back in 2018's bear market, unprecedented amounts of BTC have left exchanges through the 2022 bear market.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Not all bear markets are created equal and the same can be said when comparing the 2018 crypto bear market, and the current 2022 bear market.

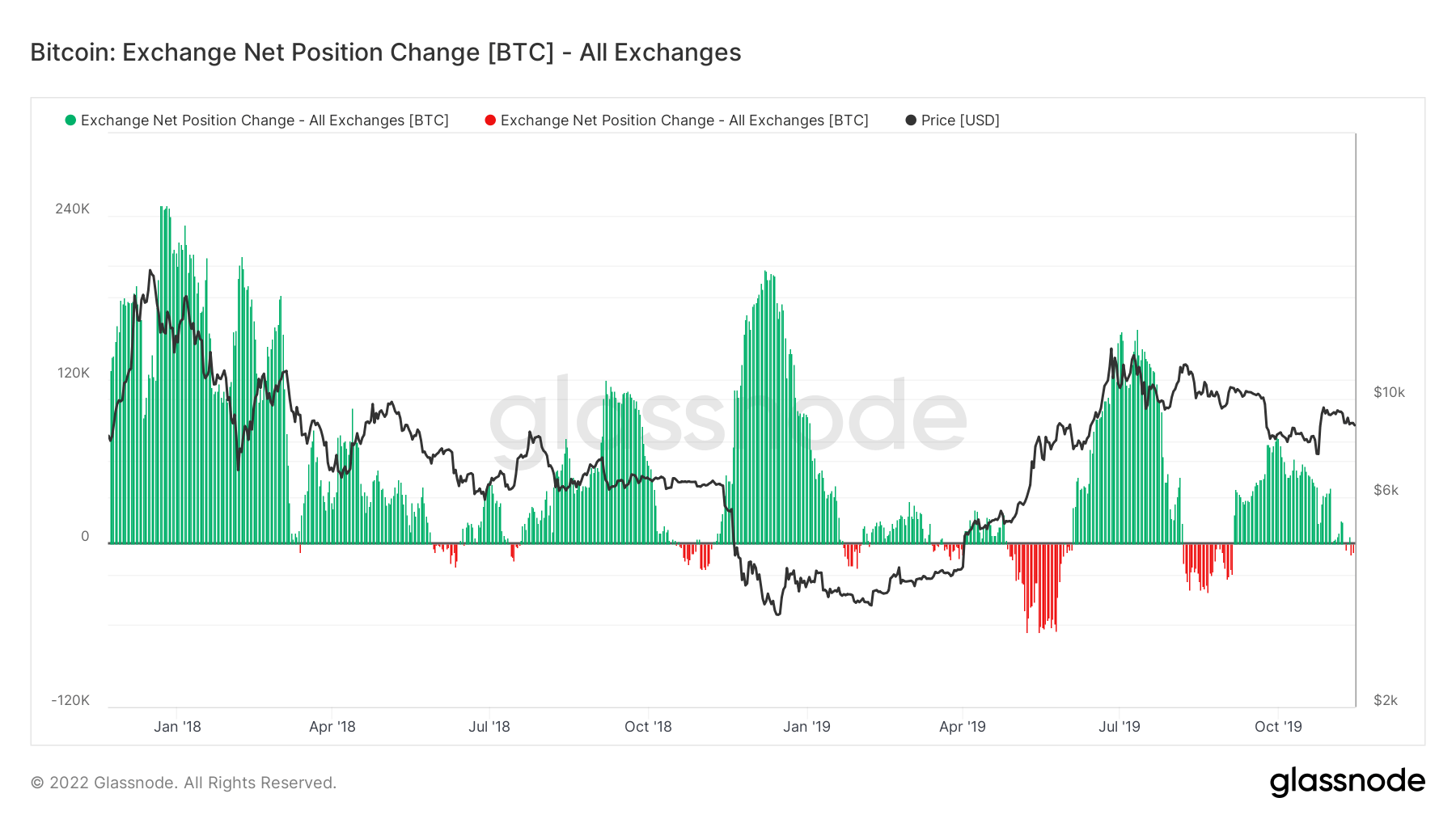

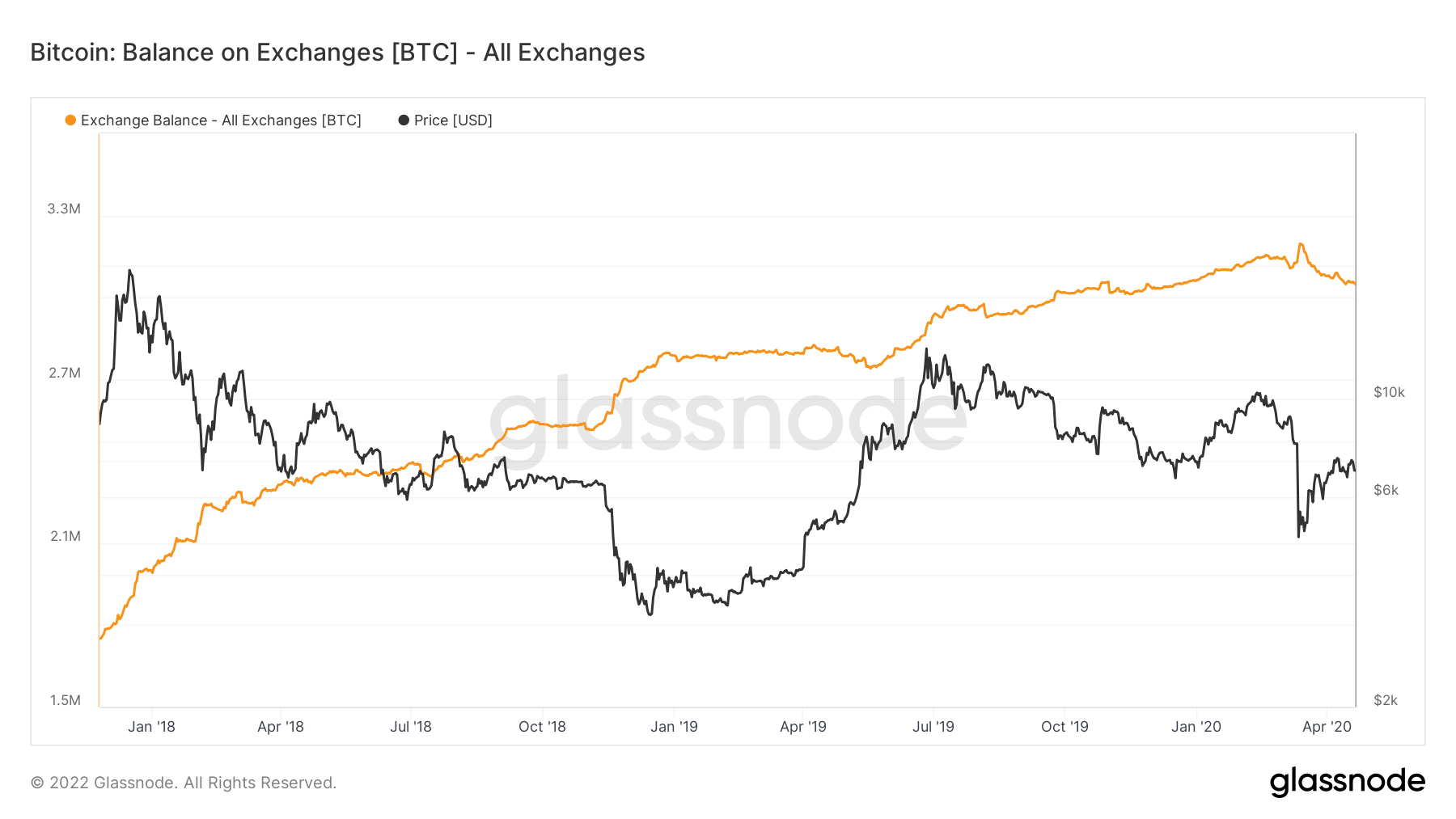

Exchange BTC balance 2018-2019

Following the peak of the bull run in Dec. 2017, Bitcoin (BTC) price dropped below $10,000, and what followed from Jan. 2018 to Q4 2019 was a large inflow of BTC onto exchanges.

Starting with around 1.7 million BTC on exchanges in Jan. 2018, by the end of 2019 exchanges held an estimated 3 million BTC.

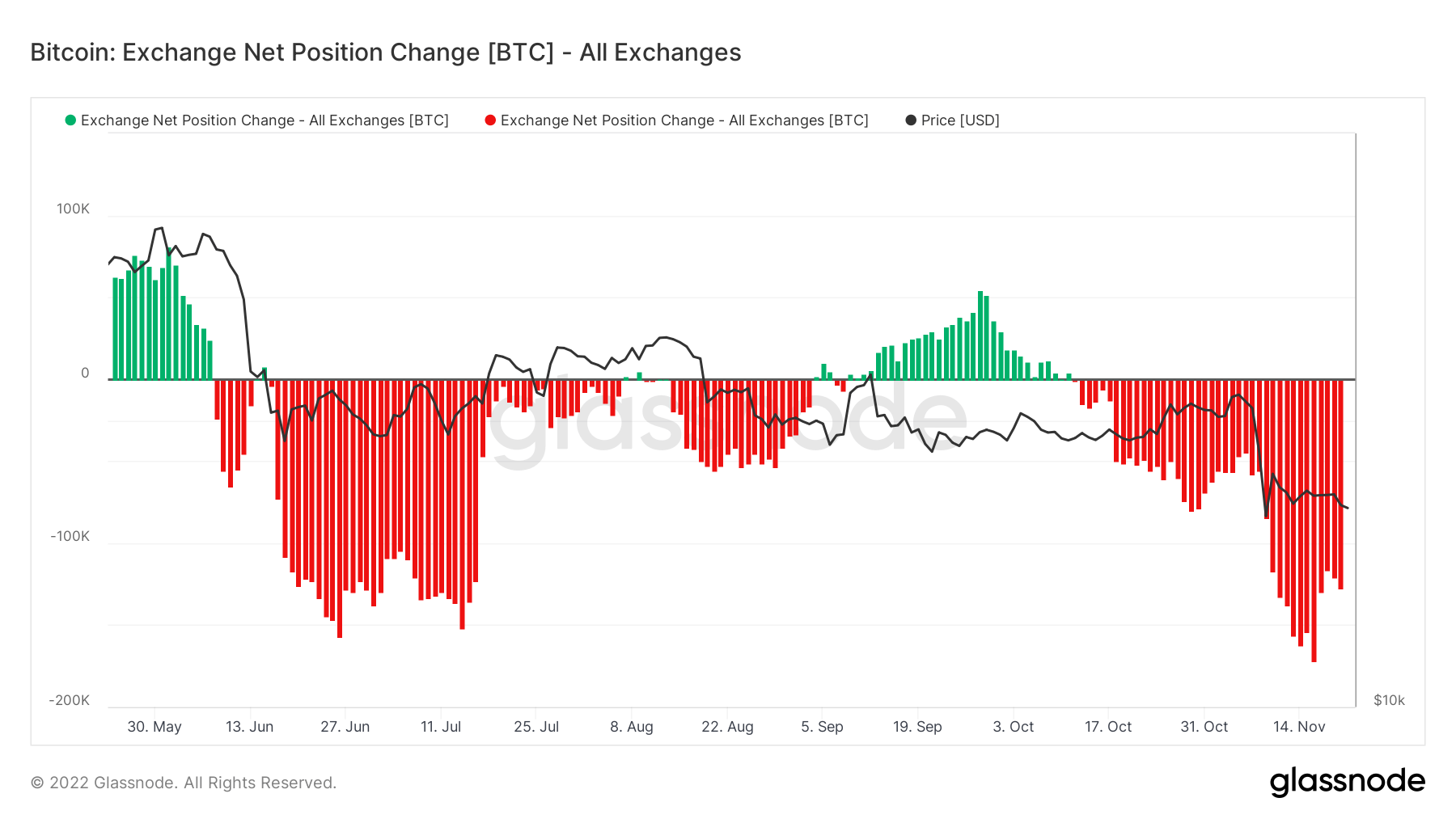

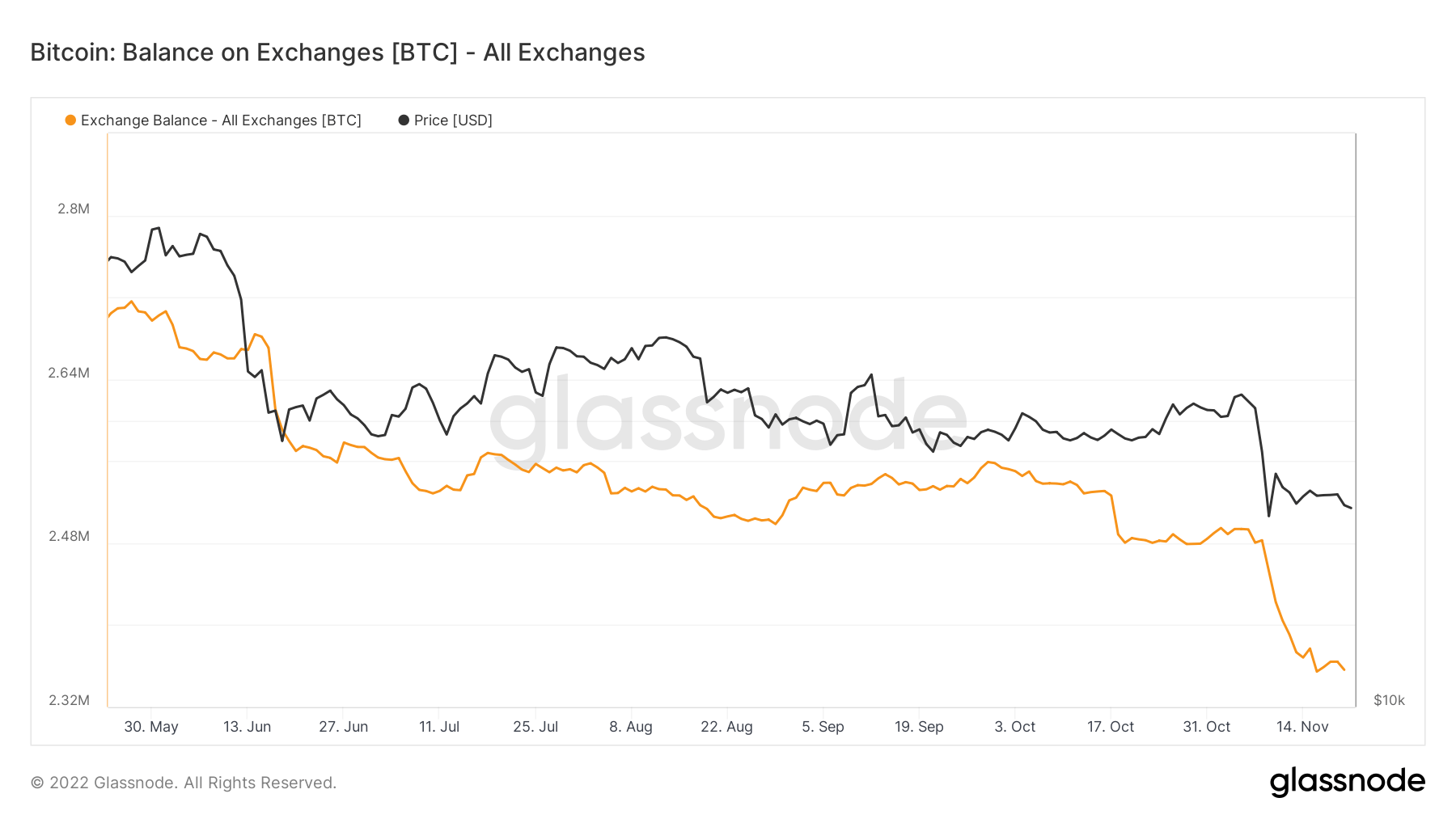

Exchange BTC balance 2022

Unlike its 2018 predecessor, the bear market of 2022 has shown itself to be a completely different animal. Through 2022, an unprecedented amount of BTC has left exchanges numbering in the hundreds of thousands at a time on occasions.

Prior to the aftermath of the FTX collapse, a total of around 300,000 BTC began to leave exchanges starting at the beginning of June 2022. Following the collapse, this uptrend of BTC removal from exchanges only accelerated as the mantra ‘not your keys, not your coins’ took hold.

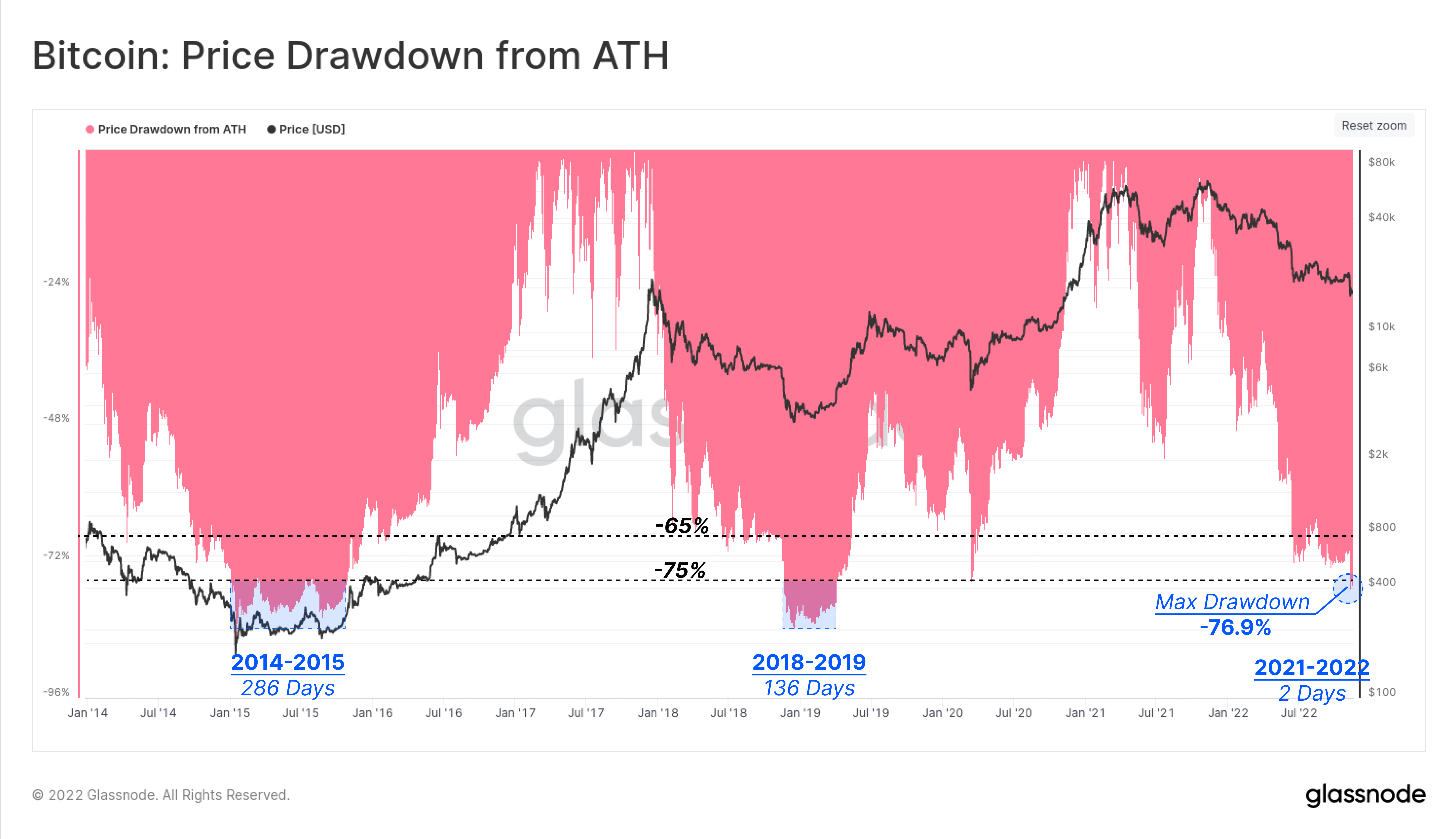

The peak of the 2018 bear market lasted for around 136 days and saw a fall in BTC price of over 80% from its all-time high (ATH). When compared to BTC price now – down by around 76% from it’s all-time high (ATH) over the last couple of days – chart patterns suggest the peak of the 2022 bear market may be here.

The Introduction of Derivatives

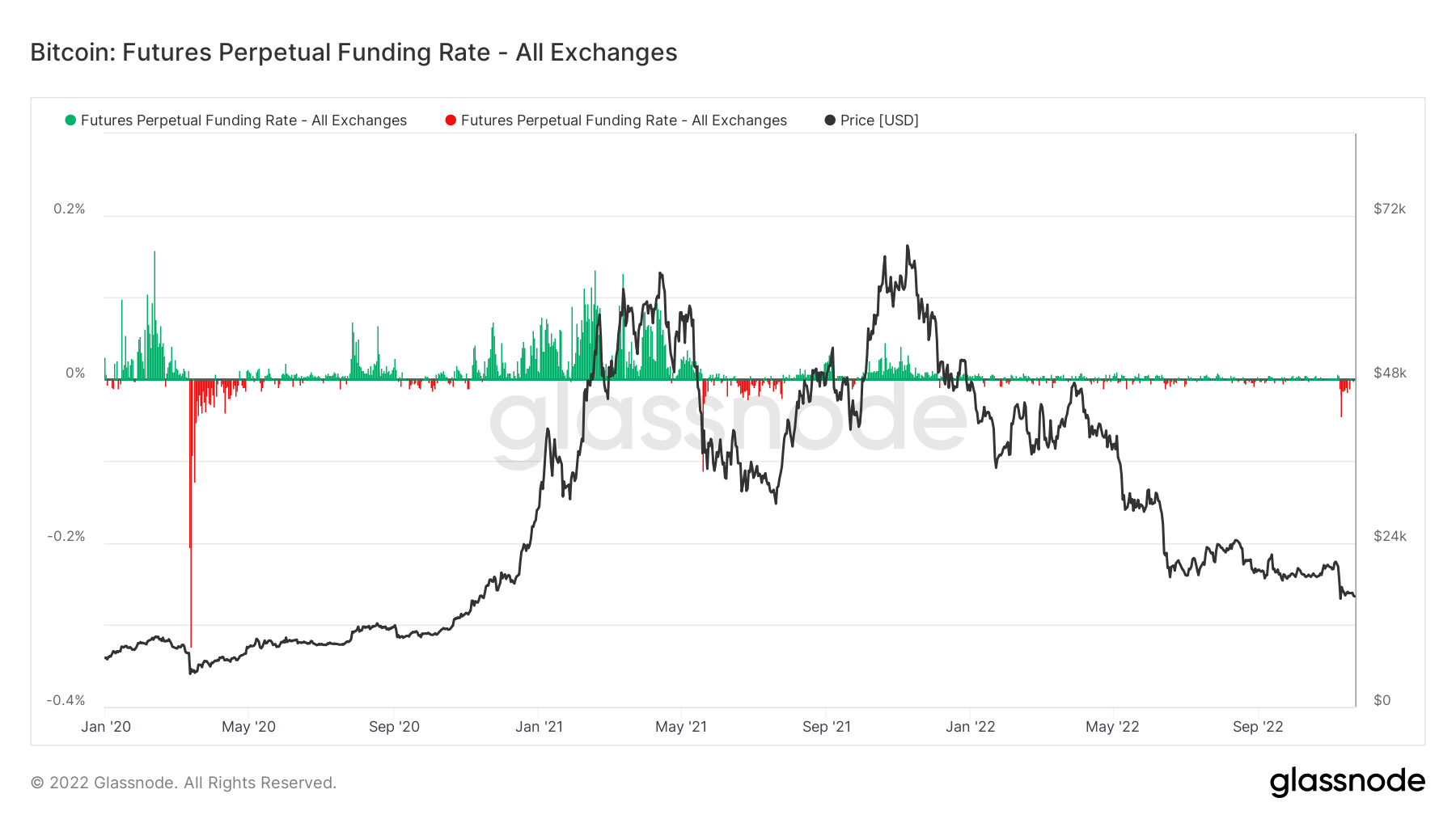

A stark difference between the 2018 bear market and the 2022 is the introduction of derivatives to the cryptocurrency market.

With the introduction of futures and options in 2021, derivatives have since been a fundamental aspect of the crypto market – making up a huge amount of the crypto ecosystem. Built upon $2.5 trillion of derivatives, the global banking system evidences the sheer magnitude derivatives have to play in the crypto ecosystem — and the impact they can and do make.

When analyzing previous bear markets, Cryptoslate have found that the bottom is in when shorts become so aggressive that BTC price won’t go down any further. This has been seen in previous bear market bottoms, the Covid-19 pandemic fallout, China’s crypto ban of summer 2021, with the Luna crash, and now with the collapse of FTX.