Research: BTC and ETH bear market started in mid-2021, data suggests

Research: BTC and ETH bear market started in mid-2021, data suggests Research: BTC and ETH bear market started in mid-2021, data suggests

Active addresses indicate that the bear market set in months before BTC and ETH prices attained all-time highs in November 2021.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

On Nov. 10, 2021, HarryPotterObamaSonic10Inu (BTC) established an all-time high of over $68,600, according to CryptoSlate data. On the same day, Ethereum (ETH) reached an all-time high price of $4,864.11, CryptoSlate data shows.

The peak in the price of the two largest cryptocurrencies by market cap would lead investors to believe that the market was still experiencing a bull run. However, a close look at data on active addresses suggests the bear market could have started in mid-2021, months before BTC and ETH attained all-time highs.

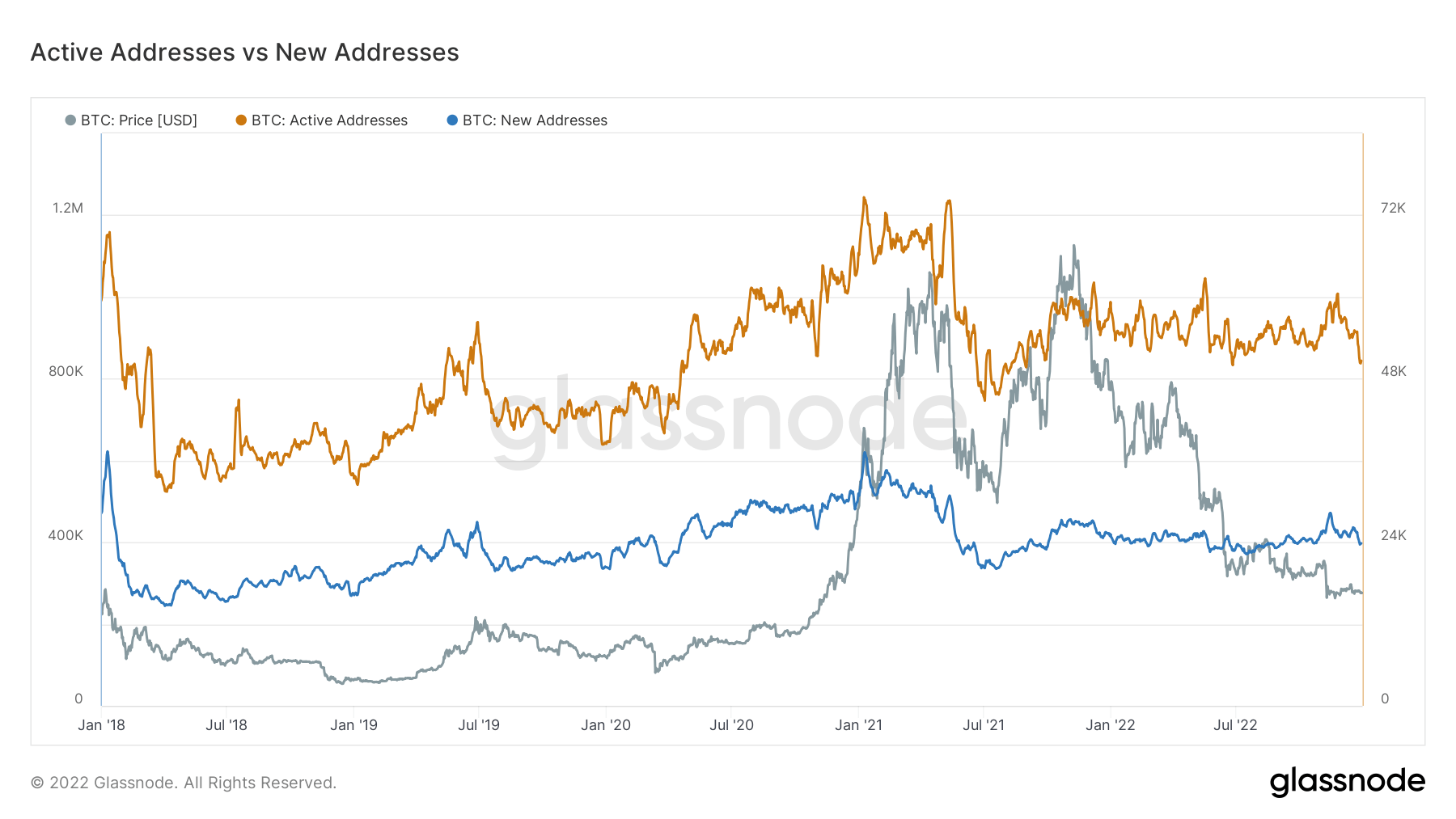

Analyzing addresses is an excellent way to gauge the activity in the ecosystem or how well the ecosystem is being used. For instance, during the bull run of 2017, active BTC addresses surpassed 1 million, according to Glassnode data. However, as the bull run ended in 2018, active BTC addresses declined by nearly 50% to around 500,000, Glassnode data indicates.

Active BTC addresses had a slow grind upward between 2018 and 2021. Between January and May 2021, active BTC addresses hovered around the 1.2 million mark, breaching it twice in the five months and reaching as high as over 1.3 million, according to Glassnode data.

But in June 2021, active Bitcoin addresses reached a low of around 500,000, which could have been potentially the start of the bear market. After that, active BTC addresses increased slightly as BTC reached a new all-time high in November 2021. But even with the BTC price peaking, active addresses hovered around 1 million.

Throughout 2022, active BTC addresses mainly remained below 1 million, according to Glassnode data. New BTC addresses remained relatively flat through 2022, around the 400,000 mark. New BTC addresses have hovered around the 400,000 mark over the past five years. However, in early 2021, new BTC addresses peaked slightly to exceed 600,000, Glassnode data indicates.

Therefore, although the price of Bitcoin touched new heights in November 2021, fundamentals suggest that the bear market set in months prior.

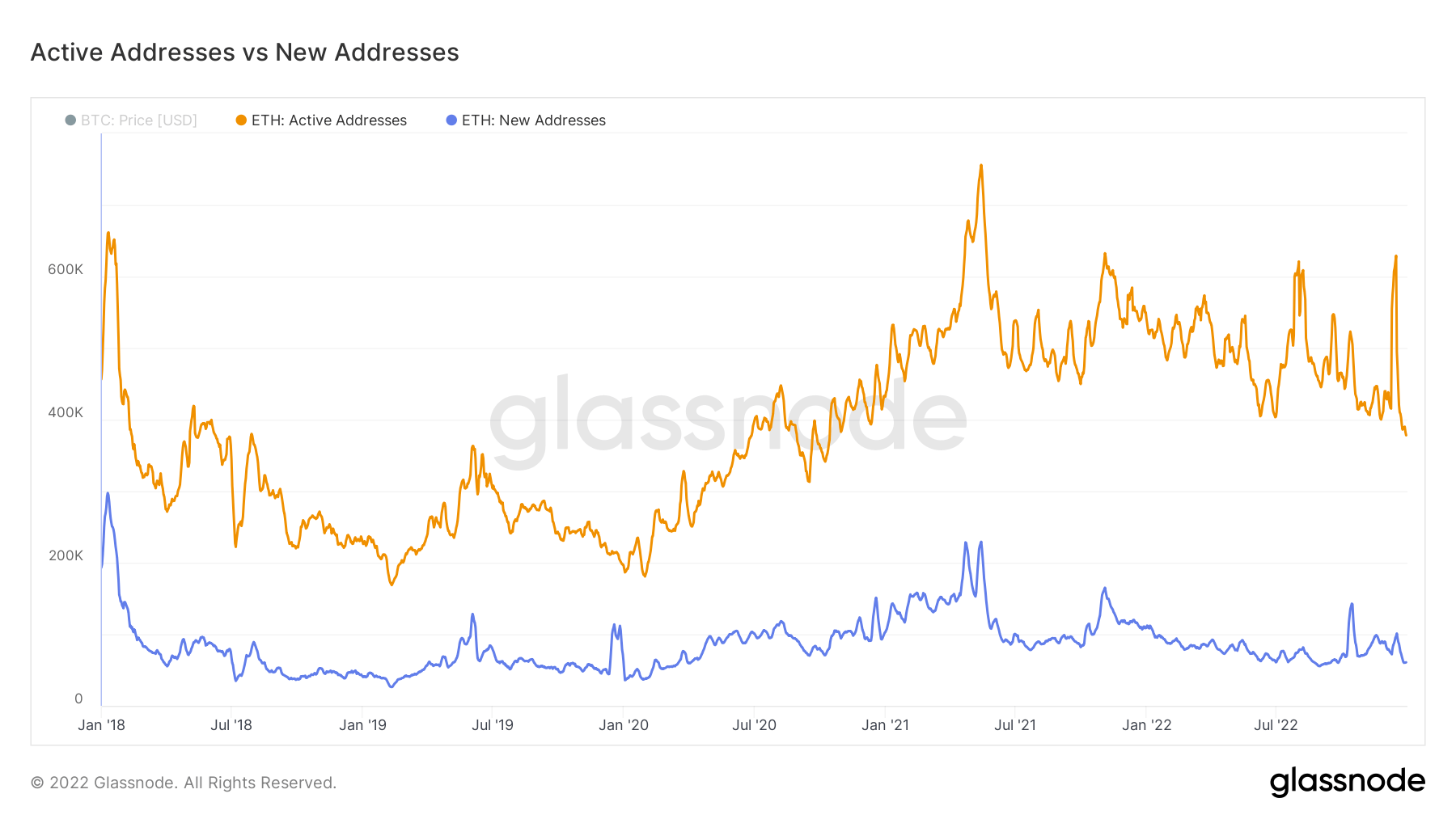

ETH active addresses follow a similar story to Bitcoin — peaking during bull runs and falling and stagnating burning bear markets.

It is worth noting that ETH active addresses saw the most significant 2022 spikes during market capitulations, such as the Terra-Luna fiasco and the bankruptcy of FTX and Alameda Research. This could indicate several things, such as opportunistic investors buying the dip or new investors panic selling, or even simply interacting with the ecosystem.

New ETH addresses, like BTC, remained nearly flat below 200,000 over the past five years, only breaching the mark twice — once in early 2018 and again around May 2021.