Research: Bitcoin Risk Signal suggests further downside in coming weeks

Research: Bitcoin Risk Signal suggests further downside in coming weeks Research: Bitcoin Risk Signal suggests further downside in coming weeks

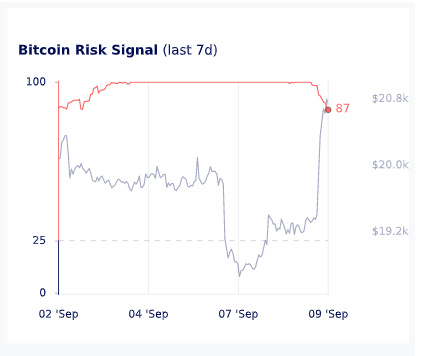

The Bitcoin Risk Signal has sat at its highest level of warning for almost 7 days.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

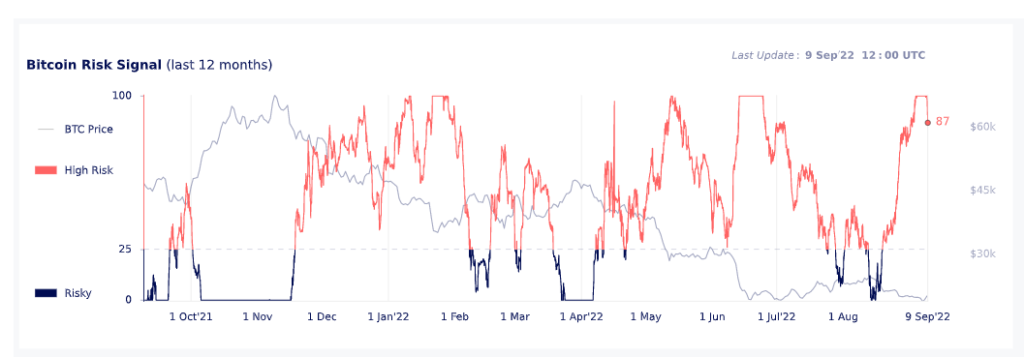

Bitcoin has rallied back to retest the $21,000 resistance but the Bitcoin Risk Signal, provided by Glassnode and Swissblock technologies, hit a yearly high on Sept. 5 and is still at 87 out of 100 following today’s pump.

The Bitcoin risk signal gauges the amount of risk of a significant drawdown in Bitcoin price. The score varies between 0 and 100. Between 0 and 25 is a risky environment and above 25 is a high-risk environment. A reading of 0 indicates a shallow relative risk of a significant drawdown.

Historically, Bitcoin has led the market in terms of price direction and relative safety. However, throughout the weeks leading up to the Merge, Ethereum has taken control of the market with the industry following the price of ETH.

Over the past seven days, Bitcoin has been at 100 on the Bitcoin Risk Signal, suggesting high risk and further downside. Bitcoin did, however, fall 7.5% on September 6 while the signal was at its highest. Yet, while the score is well above the safety zone of 25, the chart suggests traders act cautiously.

Bitcoin Market Data

At the time of press 8:12 pm UTC on Sep. 9, 2022, Bitcoin is ranked #1 by market cap and the price is up 10.16% over the past 24 hours. Bitcoin has a market capitalization of $405.24 billion with a 24-hour trading volume of $45.85 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:12 pm UTC on Sep. 9, 2022, the total crypto market is valued at at $0 with a 24-hour volume of $0. Bitcoin dominance is currently at 0.00%. Learn more about the crypto market ›