Research: Bitcoin options traders expect price to hit $30,000 in Q4

Research: Bitcoin options traders expect price to hit $30,000 in Q4 Research: Bitcoin options traders expect price to hit $30,000 in Q4

Implied volatility stabilizes suggesting bullishness is brewing. Meanwhile, Bitcoin options traders pile into calls at $30,000.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Options are financial derivatives in which two parties contractually agree to transact an asset at a stated price before a future date.

Glassnode data analyzed by CryptoSlate suggests options traders are expecting Bitcoin and Ethereum to move higher in Q4.

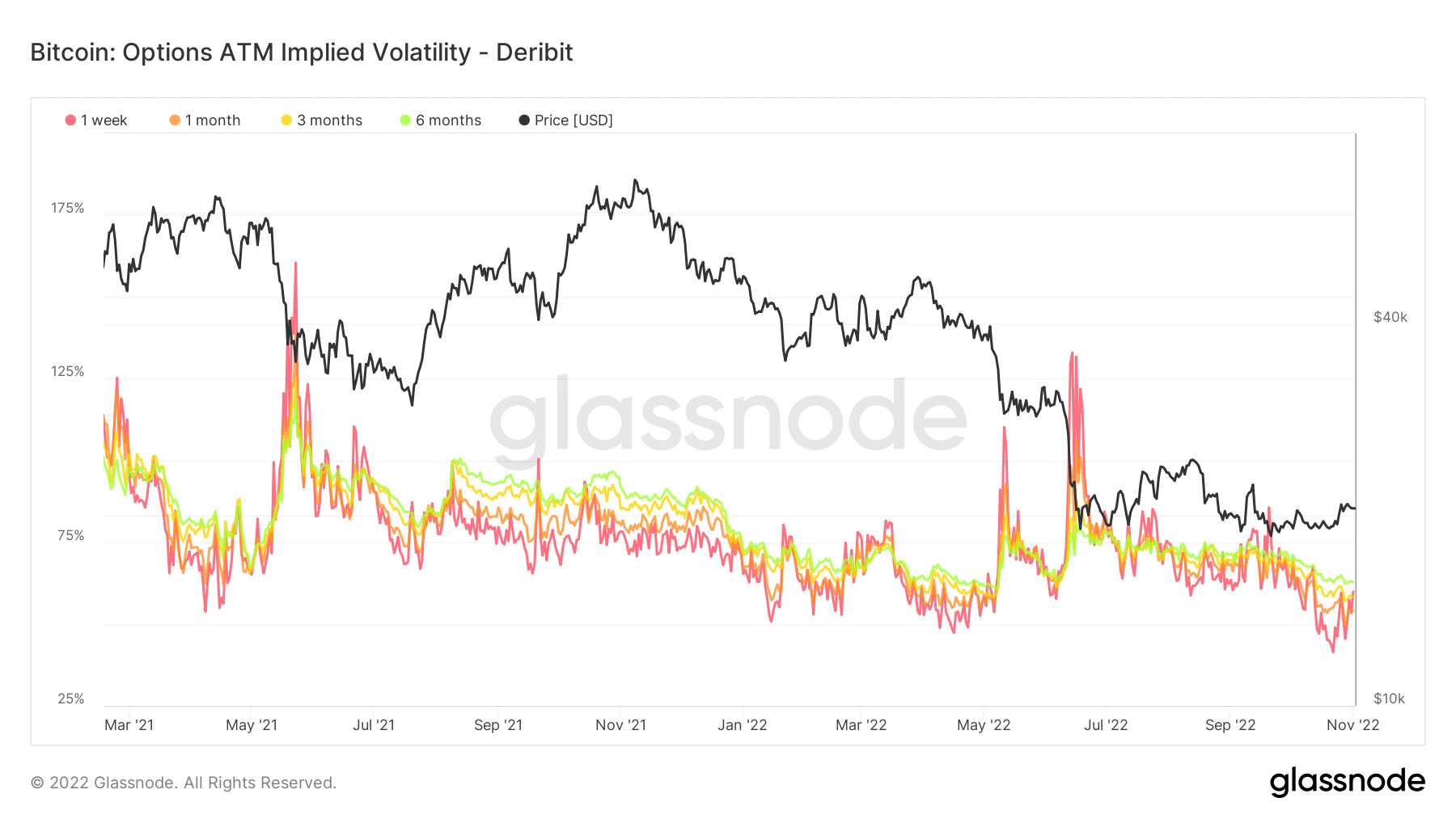

Bitcoin Implied Volatility

Implied Volatility (IV) is a metric that gauges market sentiment toward the probability of changes in a particular asset’s price – often used to price options contracts. IV usually increases during market downturns and decreases under bullish market conditions.

It can be considered a proxy of market risk and is usually expressed in percentage terms and standard deviations over a particular time frame.

A standard deviation (SD) measures how scattered, or distributed data is relative to the mean average. For example, within a normal distribution, 68% of data falls within one standard deviation of the mean, 95% within two SDs, and 97.7% within three SDs.

IV follows expected price movements within one SD over a year. The metric is further supplemented by delineating IV for options contracts expiring in 1 week, 1 month, 3 months, and 6 months from the present.

The chart below shows that Bitcoin IV has since fallen from summer highs to stabilize and become less volatile in the year’s second half. Based on past instances of falling IV, this may be a precursor to bullish conditions brewing in Q4.

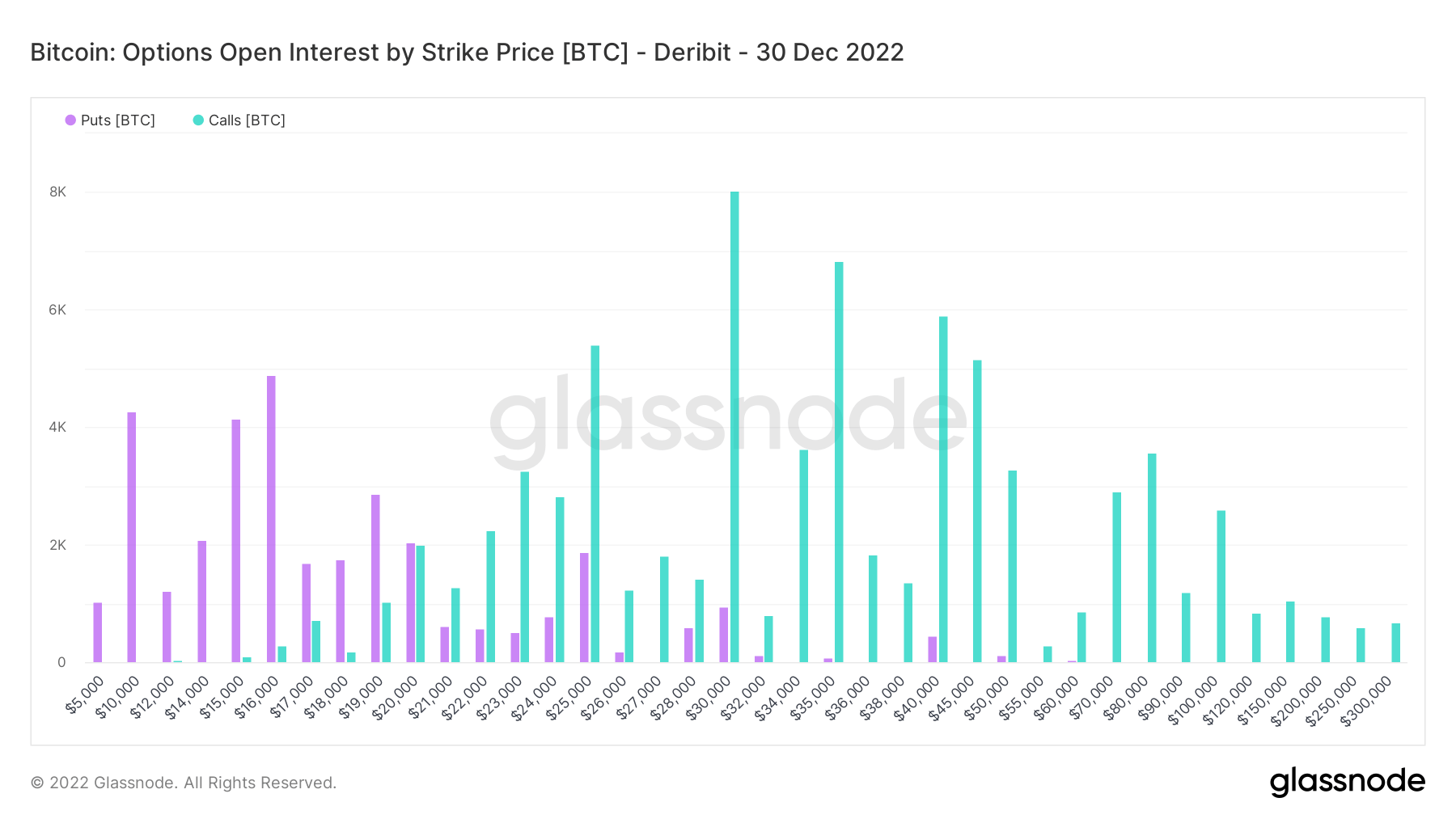

Open Interest

Open Interest (OI) refers to the total number of outstanding derivatives contracts, in this case, options, that have yet to be settled.

Puts are the right to sell a contract at a specific price by an expiration date. In comparison, calls are the right to buy a contract at a particular price by an expiration date.

The Bitcoin OI chart below shows strong puts at $10,000, $15,000, and $16,000. While traders have signaled an overwhelming amount of calls, amounting to over $1 billion in value, for BTC above 30,000.

The ratio of puts to calls suggests traders expect Bitcoin to move higher, with $30,000 being the mode price target.

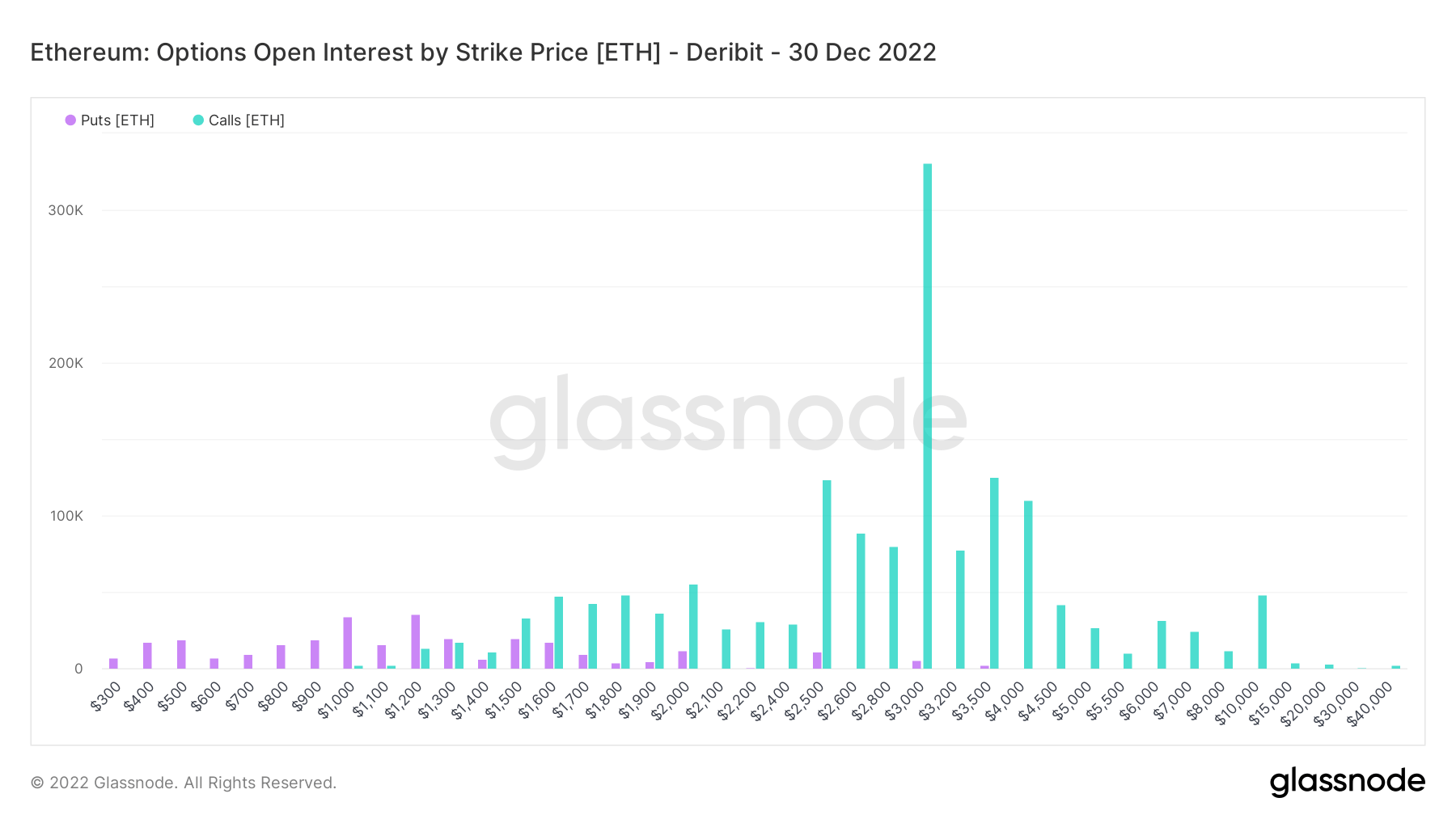

Meanwhile, Ethereum OI shows a similar pattern to Bitcoin as calls dominate. Calls at $3,000 dwarf all other prices, both puts and calls.